Berkshire Hathaway 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

Equity Price Risk (Continued)

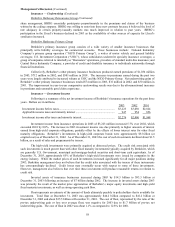

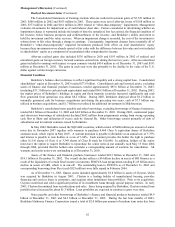

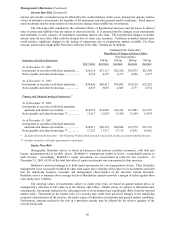

The table below summarizes Berkshire’ s equity price risks as of December 31, 2003 and 2002 and shows

the effects of a hypothetical 30% increase and a 30% decrease in market prices as of those dates. The selected

hypothetical change does not reflect what could be considered the best or worst case scenarios. Indeed, results

could be far worse due both to the nature of equity markets and the aforementioned concentrations existing in

Berkshire’ s equity investment portfolio. Dollars are in millions.

Estimated Hypothetical

Fair Value after Percentage

Hypothetical Hypothetical Increase (Decrease) in

Fair Value Price Change Change in Prices Shareholders’ Equity

As of December 31, 2003................. $35,287 30% increase $45,873 8.9

30% decrease 24,701 (8.9)

As of December 31, 2002................. $28,363 30% increase $36,872 8.6

30% decrease 19,854 (8.6)

Derivatives Risk

Berkshire’ s derivatives risks are concentrated in the operations of General Re Securities (“GRS”), a dealer

in various types of derivative instruments in conjunction with offering risk management products to its clients.

Effective January 2002, GRS commenced the run-off of its business. It is expected that the run-off will take several

years to complete. Since January 2002, approximately two-thirds of GRS’ s contracts have been terminated. GRS

manages its market risk from derivatives by estimating the effect on operating results of potential changes in market

variables over time, based on historical market volatility, correlation data and informed judgment. GRS’ s weekly

maximum aggregate market risk target was $15 million in 2003 and weekly losses exceeded that amount on two

occasions. In addition to these daily and weekly assessments of risk, GRS prepares periodic stress tests to assess its

exposure to extreme movements in various market risk factors. The estimated average expected weekly market risk,

as calculated using the methodology described over one week intervals was $5 million in 2003 and $4 million in

2002.

GRS evaluates and records a fair-value adjustment to recognize counterparty credit exposure and future

costs associated with administering each contract. The expected credit exposure for each trade is initially established

on the trade date and is estimated through the use of a proprietary credit exposure model that is based on historical

default probabilities, market volatilities and, if applicable, the legal right of setoff. These exposures are continually

monitored and adjusted due to changes in the credit quality of the counterparty, changes in interest and currency

rates or changes in other factors affecting credit exposure.

During 2003 and 2002, Berkshire entered into a significant number and amount of foreign currency

forward contracts. Generally, these contracts provide that Berkshire receive certain foreign currencies and pay U.S.

dollars at specified exchange rates and at specified future dates. Management entered into these contracts as an

overall economic hedge of Berkshire’ s net assets and business activities. The value of these contracts is subject to

change due primarily to changes in the spot exchange rates and to a lesser degree, interest rates and time value. The

duration of the contracts is generally less than twelve months. The aggregate notional value of such contracts at

December 31, 2003 was approximately $11 billion. Unrealized gains from these contracts totaled approximately

$630 million at December 31, 2003.

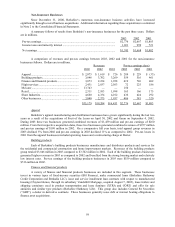

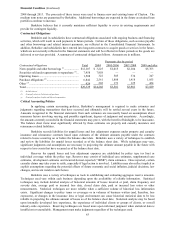

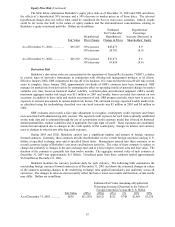

Berkshire monitors the currency positions daily for each currency. The following table summarizes the

outstanding foreign currency forward contracts as of December 31, 2003 and shows the estimated changes in values

of the contracts assuming changes in the underlying exchange rates applied immediately and uniformly across all

currencies. The changes in value do not necessarily reflect the best or worst case results and therefore, actual results

may differ. Dollars are in millions.

Estimated Fair Value Assuming a Hypothetical

Percentage Increase (Decrease) in the Value of

Foreign Currencies Versus the U.S. Dollar

Fair Value (20%) (10%) (1%) 1% 10% 20%

As of December 31, 2003............. $630 $(1,583) $(512) $512 $748 $1,865 $3,230