Berkshire Hathaway 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

Non-Insurance Businesses (Continued)

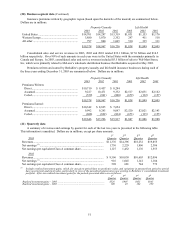

Retail

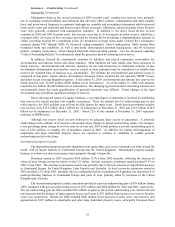

Berkshire’ s retailing businesses consist of four independently managed retailers of home furnishings

(Nebraska Furniture Mart and its subsidiaries (“NFM”), R.C. Willey Home Furnishings (“R.C. Willey”), Star

Furniture (“Star”) and Jordan’ s Furniture) and three independently managed retailers of fine jewelry (Borsheim’ s

Jewelry, Helzberg’ s Diamond Shops (“Helzberg”), and Ben Bridge Jeweler). Revenues of the retail businesses in

2003 increased $208 million (9.9%) as compared to 2002, and 2002 revenues increased 5.3% over 2001. The

increase in revenues in 2003 was primarily attributed to Nebraska Furniture Mart’ s new store in Kansas City,

Kansas, which opened in August 2003 and R.C. Willey’ s second Nevada location, which opened in May 2003.

Comparative pre-tax earnings of the retail group in 2003 were relatively unchanged from 2002. Higher earnings

associated with the new R.C. Willey store were offset by start-up and depreciation costs incurred in connection with

NFM’ s new store.

Shaw Industries

Shaw is a leading manufacturer and distributor of carpet and rugs for residential and commercial use.

Shaw also provides installation services and offers hardwood floor and other floor coverings. Berkshire acquired

87.3% of the common stock of Shaw in January 2001 and the remainder of the outstanding stock in January 2002.

Shaw’ s revenues in 2003 of $4,660 million increased by $326 million (7.5%) over 2002, and 2002 revenues

increased 8.0% over 2001. The increase in 2003 revenues reflects a 6.1% increase in carpet sales revenues as well

as increased sales of hard floor surfaces. Shaw’ s revenues in 2003 also include the results from Dixie Group, a

carpet and rug manufacturer acquired in November. In 2003, Shaw’ s pre-tax earnings totaled $436 million, an

increase of $12 million (2.8%) over 2002. Shaw’ s operating results in 2003 benefited from increased sales and

lower borrowing costs.

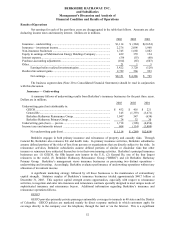

Other businesses

Revenues in 2003 from Berkshire’ s other businesses as compared to 2002 increased $665 million to $3,040

million and pre-tax earnings increased $105 million to $486 million. Berkshire’ s other non-insurance businesses

consist of the results of numerous smaller businesses. The increase in revenues and pre-tax earnings of other

businesses in 2003 was primarily due to the inclusion of the results of businesses acquired in 2002 from their

respective acquisition dates (Larson-Juhl—February 8, 2002, The Pampered Chef and CTB International—both

October 31, 2002).

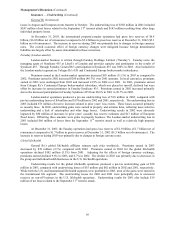

Equity in earnings of MidAmerican Energy Holdings Company

Earnings from MidAmerican represent Berkshire’ s share of MidAmerican’ s net earnings, as determined

under the equity method. Earnings from MidAmerican totaled $429 million in 2003, $359 million in 2002 and $134

million in 2001. MidAmerican’ s earnings increased in 2003 due to improved results in its utility businesses, the

effects of the acquisition during 2002 and the subsequent expansion during 2003 of two natural gas pipelines and

increased earnings from its real estate brokerage business due to acquisitions and increased transaction volume. See

Note 3 to the Consolidated Financial Statements for additional information regarding Berkshire’ s investments in

MidAmerican.

Purchase-Accounting Adjustments

Purchase-accounting adjustments reflect the after-tax effect on net earnings with respect to the amortization

of fair value adjustments to certain assets and liabilities recorded at various business acquisition dates. Prior to

2002, this amount also included goodwill amortization. Effective January 1, 2002, Berkshire ceased amortizing

goodwill of previously acquired businesses in accordance with the provisions of SFAS No. 142.

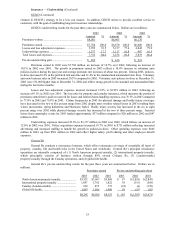

Realized Investment Gains

Realized investment gains and losses have been a recurring element in Berkshire’ s net earnings for many

years. Such amounts are recorded when investments are: (1) sold or disposed; (2) impaired; or (3) marked-to-

market with a corresponding gain or loss included in earnings. Such amounts also include realized and unrealized

gains or losses associated with certain derivatives contracts. Realized investment gains may fluctuate significantly

from period to period, resulting in a meaningful effect on reported net earnings. However, the amount of realized

gains in a given period has no practical analytical value, given the magnitude of unrealized gains existing in

Berkshire’ s consolidated investment portfolio.