Berkshire Hathaway 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Notes to Consolidated Financial Statements (Continued)

(13) Income taxes (Continued)

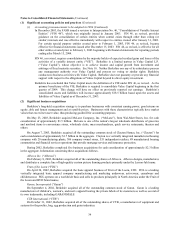

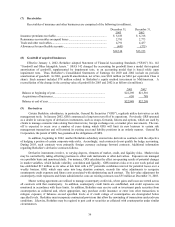

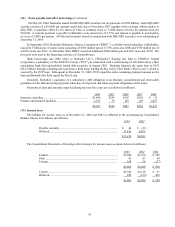

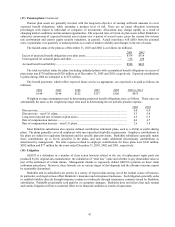

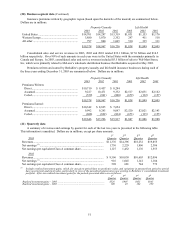

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and deferred tax

liabilities at December 31, 2003 and 2002 are shown below (in millions). 2003 2002

Deferred tax liabilities:

Unrealized appreciation of investments ............................................ $10,663 $7,884

Deferred charges reinsurance assumed ............................................. 1,080 1,183

Property, plant and equipment .......................................................... 1,124 1,059

Investments ....................................................................................... 337 282

Other ................................................................................................. 1,350 648

14,554 11,056

Deferred tax assets:

Unpaid losses and loss adjustment expenses..................................... (1,299) (870)

Unearned premiums .......................................................................... (372) (413)

Other ................................................................................................. (1,448) (1,701)

(3,119) (2,984)

Net deferred tax liability ...................................................................... $11,435 $8,072

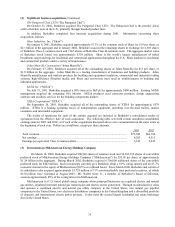

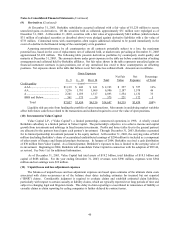

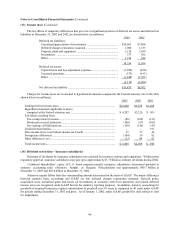

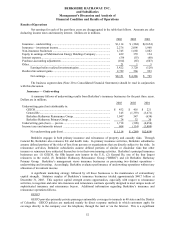

Charges for income taxes are reconciled to hypothetical amounts computed at the Federal statutory rate in the table

shown below (in millions). 2003 2002 2001

Earnings before income taxes .............................................................................. $12,020 $6,359 $1,438

Hypothetical amounts applicable to above

computed at the Federal statutory rate .............................................................. $ 4,207 $2,226 $ 503

Tax effects resulting from:

Tax-exempt interest income.............................................................................. (88) (109) (123)

Dividends received deduction........................................................................... (100) (97) (101)

Net earnings of MidAmerican........................................................................... (150) (126) (47)

Goodwill amortization ......................................................................................... — — 191

State income taxes, less Federal income tax benefit ............................................ 53 57 44

Foreign rate differences ....................................................................................... (104) 59 82

Other differences, net........................................................................................... (13) 49 41

Total income taxes............................................................................................... $ 3,805 $2,059 $ 590

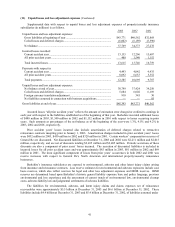

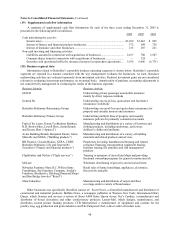

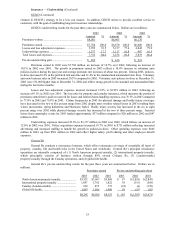

(14) Dividend restrictions – Insurance subsidiaries

Payments of dividends by insurance subsidiaries are restricted by insurance statutes and regulations. Without prior

regulatory approval, insurance subsidiaries may pay up to approximately $3.7 billion as ordinary dividends during 2004.

Combined shareholders’ equity of U.S. based property/casualty insurance subsidiaries determined pursuant to

statutory accounting rules (Statutory Surplus as Regards Policyholders) was approximately $40.7 billion at

December 31, 2003 and $28.4 billion at December 31, 2002.

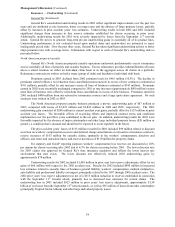

Statutory surplus differs from the corresponding amount determined on the basis of GAAP. The major differences

between statutory basis accounting and GAAP are that deferred charges reinsurance assumed, deferred policy

acquisition costs, unrealized gains and losses on investments in securities with fixed maturities and related deferred

income taxes are recognized under GAAP but not for statutory reporting purposes. In addition, statutory accounting for

goodwill of acquired businesses requires amortization of goodwill over 10 years as compared to 40 years under GAAP

for periods ending December 31, 2001 and prior. As of January 1, 2002, under GAAP, goodwill is only subject to tests

for impairment.