Berkshire Hathaway 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

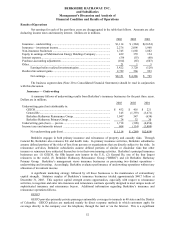

Insurance — Underwriting (Continued)

Berkshire Hathaway Reinsurance Group

The Berkshire Hathaway Reinsurance Group (“BHRG”) underwrites excess-of-loss and quota-share

reinsurance coverages for insurers and reinsurers around the world. BHRG is believed to be one of the leaders in

providing catastrophe excess-of-loss reinsurance and writing coverages for large or otherwise unusual discrete

commercial property risks on a direct and facultative reinsurance basis, referred to as individual risk business.

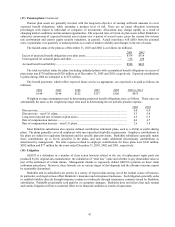

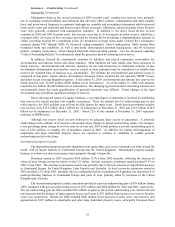

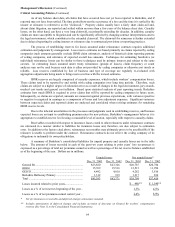

BHRG’ s underwriting results are summarized in the table below.

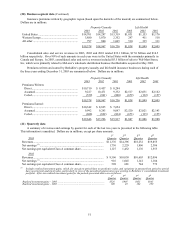

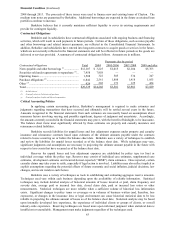

Premiums earned Pre-tax underwriting gain (loss)

2003 2002 2001 2003 2002 2001

Catastrophe and individual risk............................. $1,330 $1,283 $ 553 $1,108 $1,006 $ (150)

Retroactive reinsurance......................................... 526 407 1,993 (387) (433) (358)

Traditional multi-line ............................................ 2,574 1,610 445 326 (26) (126)

Total ...................................................................... $4,430 $3,300 $2,991 $1,047 $ 547 $ (634)

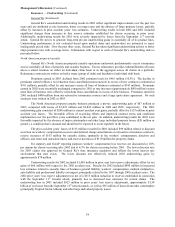

During the second half of 2001, opportunities for BHRG to write catastrophe and individual risk business

increased significantly, particularly subsequent to September 11th. Contracts written may provide exceptionally

large limits of indemnification, often several hundred million dollars and occasionally in excess of $1 billion, and

may cover catastrophe risks (such as hurricanes, earthquakes or other natural disasters) or other property risks (such

as aviation and aerospace, commercial multi-peril or terrorism). Catastrophe and individual business written totaled

about $1.2 billion in 2003 and $1.5 billion in 2002. The level of business written in future periods will vary,

perhaps materially, based upon market conditions and management’ s assessment of the adequacy of premium rates.

The catastrophe and individual risk business produced substantial underwriting gains in 2003 and 2002 due

to the lack of catastrophic or otherwise large loss events. The net underwriting loss in 2001 included about $410

million from the September 11th terrorist attack. Losses related to the September 11th terrorist attack were reduced

by about $85 million in 2002, as payments to settle claims under certain policies were below original estimates.

Although very large underwriting gains were achieved in 2003 and 2002, a single loss event could have easily

eliminated those gains. The pre-tax maximum probable loss from a single event at December 31, 2003 is estimated

to be approximately $6.7 billion resulting from potential risk of loss from a major earthquake in California.

BHRG, as a matter of general practice, does not cede catastrophe and individual risks to other reinsurers

due to the uncertainty of collecting recoverable losses ceded to financially weaker companies if a natural or

financial mega-catastrophe should occur. Underwriting results of this business will remain subject to extreme

volatility. Nevertheless, Berkshire’ s management remains willing to accept such volatility provided there is a

reasonable prospect of long-term underwriting profitability.

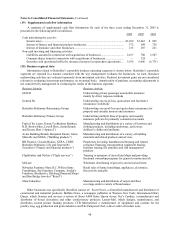

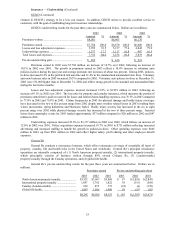

Retroactive reinsurance contracts indemnify ceding companies for losses arising under insurance or

reinsurance contracts written in the past, usually many years ago. While contract terms vary, losses under the

contracts are subject to a very large aggregate dollar limit, occasionally exceeding $1 billion under a single contract.

Generally, it is also anticipated, although not assured, that claims under retroactive contracts will be paid over long

time periods. These contracts do not produce an immediate underwriting loss for financial reporting purposes. The

excess of the estimated ultimate claims payable over the premiums received is established as a deferred charge

which is subsequently amortized over the expected claim settlement periods. Such amortization is included as a

component of losses incurred and essentially represents the net underwriting losses from this business in each of the

past three years. In addition, underwriting results in 2003 included a net gain of $41 million from the commutation

of contracts written in prior years in exchange for commutation payments of $710 million.

Retroactive reinsurance contracts are expected to generate significant underwriting losses over time due to

the amortization of deferred charges. This business is accepted due to the exceptionally large amounts of float

generated, which totaled about $7.7 billion at December 31, 2003. Unamortized deferred charges under BHRG

retroactive reinsurance contracts were $2.8 billion at December 31, 2003 and $3.2 billion as of December 31, 2002.

During the last two years, BHRG wrote a significant amount of business under traditional multi-line

contracts. Such contracts included several quota-share participations in, and contracts with, Lloyd’ s syndicates and a

quota-share contract written in 2002 with a major U.S. based insurer, which was cancelled in 2003. These contracts

and participations generated written premiums of about $1.6 billion in 2003 and $2.0 billion in 2002. In a quota-