Berkshire Hathaway 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

Financial Condition (Continued)

2008 through 2013. The proceeds of these issues were used to finance new and existing loans of Clayton. The

medium term notes are guaranteed by Berkshire. Additional borrowings are expected in the future as retained loan

portfolios continue to increase.

Berkshire believes that it currently maintains sufficient liquidity to cover its existing requirements and

provide for contingent liquidity.

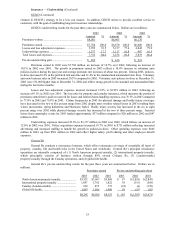

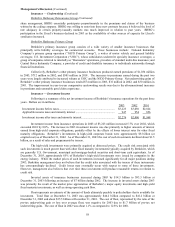

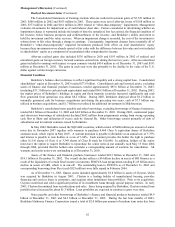

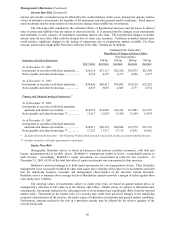

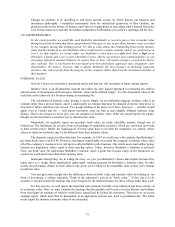

Contractual Obligations

Berkshire and its subsidiaries have contractual obligations associated with ongoing business and financing

activities, which will result in cash payments in future periods. Certain of those obligations, such as notes payable

and other borrowings and related interest payments, are reflected in the Consolidated Financial Statements. In

addition, Berkshire and subsidiaries have entered into long-term contracts to acquire goods or services in the future,

which are not currently reflected in the financial statements and will be reflected in future periods as the goods are

delivered or services provided. A summary of contractual obligations follows. Amounts are in millions.

Payments due by period

Contractual obligations Total 2004 2005-2006 2007-2008 2009 and after

Notes payable and other borrowings (1).................... $12,107 $ 3,225 $1,015 $2,104 $5,763

Securities sold under agreements to repurchase (1)... 7,958 7,958 — — —

Operating leases....................................................... 1,508 322 505 334 347

Purchase obligations (2) ............................................ 6,842 2,561 1,808 1,418 1,055

Other (3) .................................................................... 924 202 173 125 424

Total......................................................................... $29,339 $14,268 $3,501 $3,981 $7,589

(1) Includes interest

(2) Principally relates to NetJets aircraft purchases

(3) Principally employee benefits and deferred compensation

Critical Accounting Policies

In applying certain accounting policies, Berkshire’ s management is required to make estimates and

judgments regarding transactions that have occurred and ultimately will be settled several years in the future.

Amounts recognized in the financial statements from such estimates are necessarily based on assumptions about

numerous factors involving varying, and possibly significant, degrees of judgment and uncertainty. Accordingly,

the amounts currently recorded in the financial statements may prove, with the benefit of hindsight, to be inaccurate.

The balance sheet items most significantly affected by these estimates are property and casualty insurance and

reinsurance related liabilities.

Berkshire records liabilities for unpaid losses and loss adjustment expenses under property and casualty

insurance and reinsurance contracts based upon estimates of the ultimate amounts payable under the contracts

related to losses occurring on or before the balance sheet date. Berkshire uses a variety of techniques to establish

and review the liabilities for unpaid losses recorded as of the balance sheet date. While techniques may vary,

significant judgments and assumptions are necessary in projecting the ultimate amount payable in the future with

respect to loss events that have occurred as of the balance sheet date.

Reserves for unpaid losses and loss adjustment expenses are established by policy type (or line) or

individual coverage within the policy type. Reserves may consist of individual case estimates, supplemental case

estimates, development estimates and incurred-but-not-reported (“IBNR”) claim estimates. Once reported, certain

casualty claims may take years to settle, especially if legal action is involved. Liabilities may also reflect implicit or

explicit assumptions regarding the potential effects of future economic and social inflation, judicial decisions, law

changes, and recent trends in such factors.

Berkshire uses a variety of techniques as tools in establishing and evaluating aggregate reserve amounts.

Techniques used vary within each business depending upon the availability of reliable information. Statistical

techniques may include detailed analysis of historical amounts of losses incurred or paid, claim frequency and

severity data, average paid or incurred loss data, closed claim data, paid or incurred loss ratios or other

measurements. Statistical techniques are more reliable when a sufficient volume of historical loss information

exists. Significant changes to policy terms or coverages or in volumes of business written (and, therefore, loss

exposures), or changes in the insurance laws or legal environment can cause historical statistical data to be less

reliable in projecting the ultimate amount of losses as of the balance sheet date. Statistical analysis may be based

upon internally developed loss experience, the experience of individual clients or groups of clients, or overall

industry-wide experience. Reserving techniques are based more upon informed judgment when statistical data is

insufficient or unavailable. Management must make judgments regardless of the techniques used.