Berkshire Hathaway 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

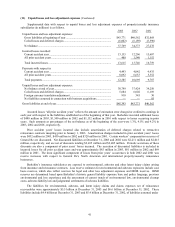

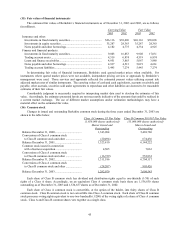

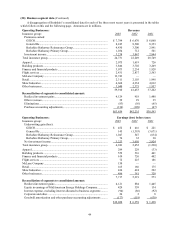

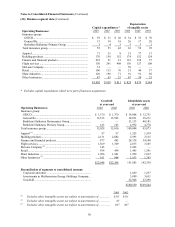

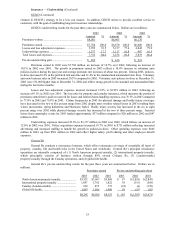

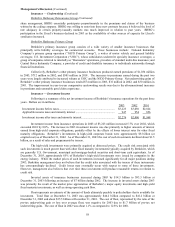

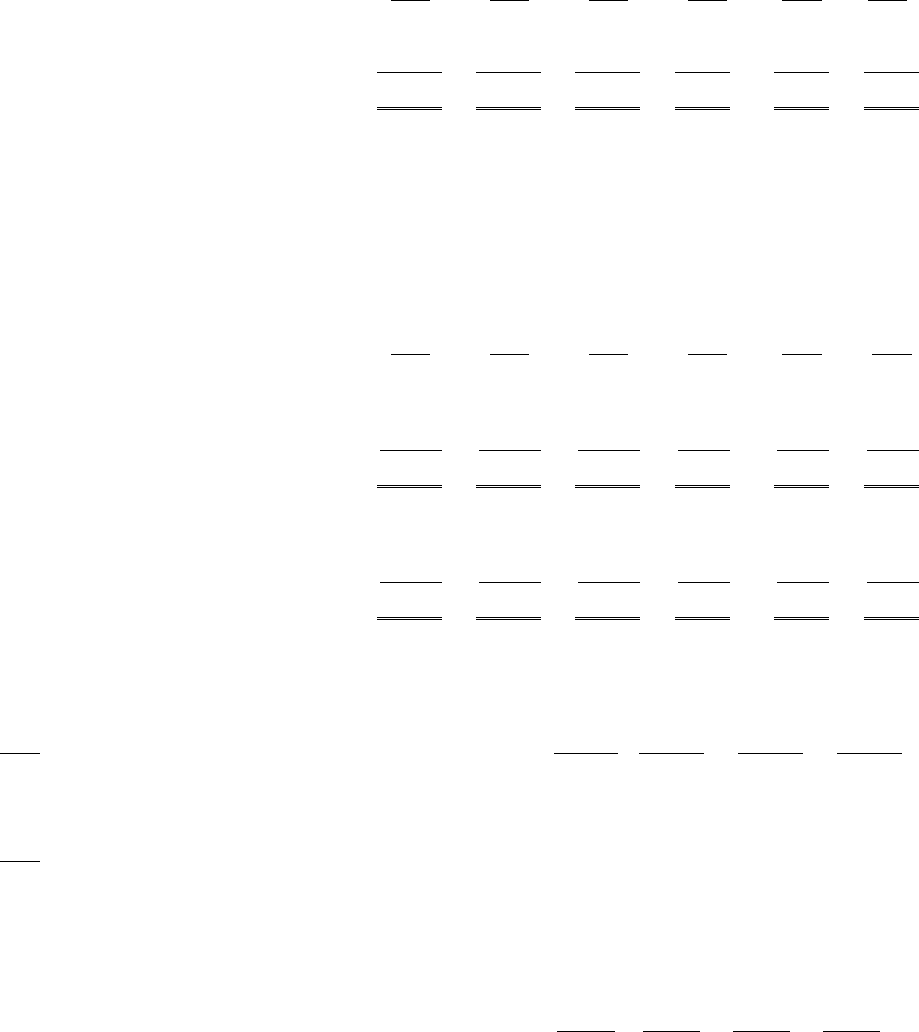

(20) Business segment data (Continued)

Insurance premiums written by geographic region (based upon the domicile of the insured) are summarized below.

Dollars are in millions.

Property/Casualty Life/Health

2003 2002 2001 2003 2002 2001

United States ....................................................... $14,701 $14,297 $13,319 $1,031 $1,153 $1,176

Western Europe................................................... 3,880 3,870 2,352 297 411 518

All other .............................................................. 797 800 1,065 510 335 311

$19,378 $18,967 $16,736 $1,838 $1,899 $2,005

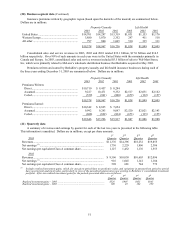

Consolidated sales and service revenues in 2003, 2002 and 2001 totaled $32.1 billion, $17.0 billion and $14.5

billion respectively. Over 90% of such amounts in each year were in the United States with the remainder primarily in

Canada and Europe. In 2003, consolidated sales and service revenues included $5.5 billion of sales to Wal-Mart Stores,

Inc. which were primarily related to McLane’ s wholesale distribution business that Berkshire acquired in May 2003.

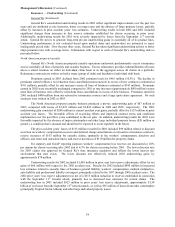

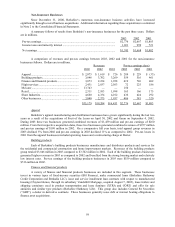

Premiums written and earned by Berkshire’ s property/casualty and life/health insurance businesses during each of

the three years ending December 31, 2003 are summarized below. Dollars are in millions.

Property/Casualty Life/Health

2003 2002 2001 2003 2002 2001

Premiums Written:

Direct................................................................ $10,710 $ 9,457 $ 8,294

Assumed........................................................... 9,227 10,471 9,332 $2,517 $2,031 $2,162

Ceded................................................................ (559) (961) (890) (679) (132) (157)

$19,378 $18,967 $16,736 $1,838 $1,899 $2,005

Premiums Earned:

Direct................................................................ $10,342 $ 8,825 $ 7,654

Assumed........................................................... 9,992 9,293 9,097 $2,520 $2,021 $2,143

Ceded................................................................ (688) (822) (834) (673) (135) (155)

$19,646 $17,296 $15,917 $1,847 $1,886 $1,988

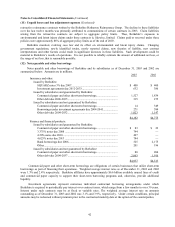

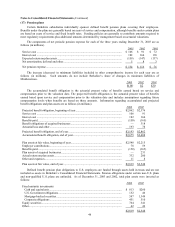

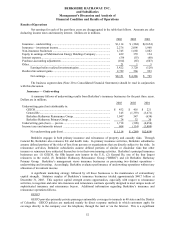

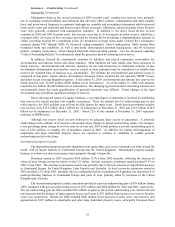

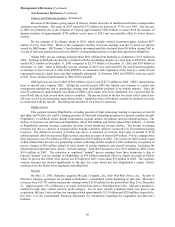

(21) Quarterly data

A summary of revenues and earnings by quarter for each of the last two years is presented in the following table.

This information is unaudited. Dollars are in millions, except per share amounts.

1st 2nd 3rd 4th

2003 Quarter Quarter Quarter Quarter

Revenues.................................................................................................. $11,376 $14,396 $18,232 $19,855

Net earnings (1) ......................................................................................... 1,730 2,229 1,806 2,386

Net earnings per equivalent Class A common share................................ 1,127 1,452 1,176 1,553

2002

Revenues.................................................................................................. $ 9,506 $10,030 $10,603 $12,096

Net earnings (1) ......................................................................................... 916 1,045 1,141 1,184

Net earnings per equivalent Class A common share................................ 598 681 744 772

(1) Includes realized investment gains, which, for any given period have no predictive value, and variations in amount from period to period

have no practical analytical value, particularly in view of the unrealized appreciation now existing in Berkshire’s consolidated investment

portfolio. After-tax realized investment gains for the periods presented above are as follows:

1st 2nd 3rd 4th

Quarter Quarter Quarter Quarter

Realized investment gains – 2003 ........................................................................ $526 $905 $453 $845

Realized investment gains – 2002 ........................................................................ 100 43 164 259