Berkshire Hathaway 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

point. This markup fairly compensates Berkshire for putting its exceptional creditworthiness

to work, but it still delivers money to Clayton at an attractive price.

In 2003, Berkshire did $2 billion of such borrowing and re-lending, with Clayton using much

of this money to fund several large purchases of portfolios from lenders exiting the business.

A portion of our loans to Clayton also provided “catch-up” funding for paper it had generated

earlier in the year from its own operation and had found difficult to securitize.

You may wonder why we borrow money while sitting on a mountain of cash. It’ s because of

our “every tub on its own bottom” philosophy. We believe that any subsidiary lending money

should pay an appropriate rate for the funds needed to carry its receivables and should not be

subsidized by its parent. Otherwise, having a rich daddy can lead to sloppy decisions.

Meanwhile, the cash we accumulate at Berkshire is destined for business acquisitions or for

the purchase of securities that offer opportunities for significant profit. Clayton’ s loan

portfolio will likely grow to at least $5 billion in not too many years and, with sensible credit

standards in place, should deliver significant earnings.

For simplicity’ s sake, we include all of Clayton’ s earnings in this sector, though a sizable

portion is derived from areas other than consumer finance.

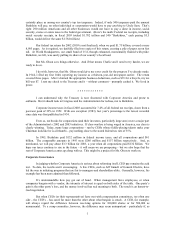

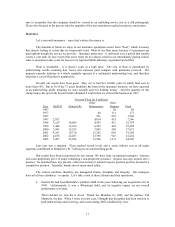

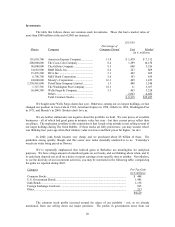

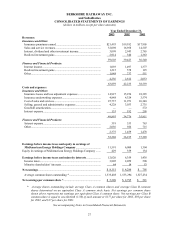

(in $ millions)

Pre-Tax Earnings Interest-bearing Liabilities

2003 2002 2003 2002

Trading – Ordinary Income ........................... $ 379 $ 553 $7,826 $13,762

Gen Re Securities ........................................... (99) (173) 8,041* 10,631*

Life and annuity operation.............................. 99 83 2,331 1,568

Value Capital.................................................. 31 61 18,238* 20,359*

Berkadia ......................................................... 101 115 525 2,175

Leasing operations.......................................... 34 34 482 503

Manufactured housing finance (Clayton) ....... 37** —2,032 —

Other............................................................... 84 102 618 630

Income before capital gains............................ 666 775

Trading – Capital Gains.................................. 1,215 578 N.A. N.A.

Total ............................................................... $1,881 $1,353

* Includes all liabilities

** From date of acquisition, August 7, 2003

Manufacturing, Service and Retailing Operations

Our activities in this category cover the waterfront. But let’ s look at a simplified balance sheet

and earnings statement consolidating the entire group.

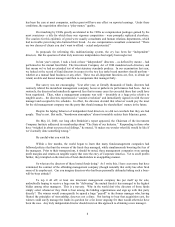

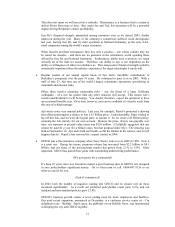

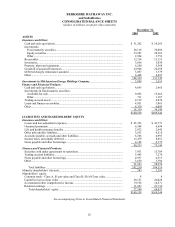

Balance Sheet 12/31/03 (in $ millions)

Assets Liabilities and Equity

Cash and equivalents ................................. $ 1,250 Notes payable ............................... $ 1,593

Accounts and notes receivable .................. 2,796 Other current liabilities................. 4,300

Inventory ................................................... 3,656 Total current liabilities ................. 5,893

Other current assets ................................... 262

Total current assets.................................... 7,964

Goodwill and other intangibles.................. 8,351 Deferred taxes............................... 105

Fixed assets ............................................... 5,898 Term debt and other liabilities...... 1,890

Other assets ............................................... 1,054 Equity ........................................... 15,379

$23,267 $23,267