Berkshire Hathaway 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

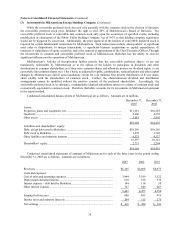

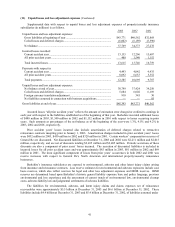

(7) Receivables

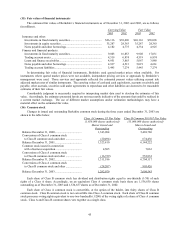

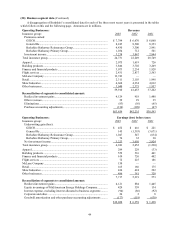

Receivables of insurance and other businesses are comprised of the following (in millions).

December 31, December 31,

2003 2002

Insurance premiums receivable.......................................................................... $ 5,183 $ 6,318

Reinsurance recoverables on unpaid losses ....................................................... 2,781 2,773

Trade and other receivables................................................................................ 4,791 4,437

Allowances for uncollectible accounts .............................................................. (441) (375)

$12,314 $13,153

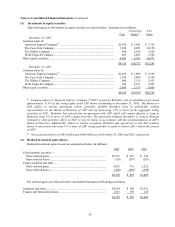

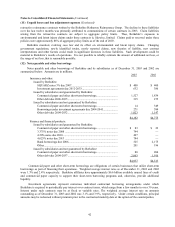

(8) Goodwill of acquired businesses

Effective January 1, 2002, Berkshire adopted Statement of Financial Accounting Standards (“SFAS”) No. 142

“Goodwill and Other Intangible Assets.” SFAS 142 changed the accounting for goodwill from a model that required

amortization of goodwill, supplemented by impairment tests, to an accounting model that is based solely upon

impairment tests. Thus, Berkshire’ s Consolidated Statements of Earnings for 2003 and 2002 include no periodic

amortization of goodwill. In 2001, goodwill amortization, net of tax, was $636 million (or $416 per equivalent Class A

share). Such amount included $78 million related to Berkshire’ s equity method investment in MidAmerican. A

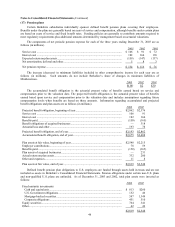

reconciliation of the change in the carrying value of goodwill for 2003 and 2002 is as follows (in millions).

2003 2002

Balance at beginning of year ..................................................................... $22,298 $21,510

Acquisitions of businesses......................................................................... 650 788

Balance at end of year ............................................................................... $22,948 $22,298

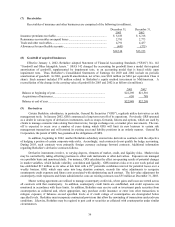

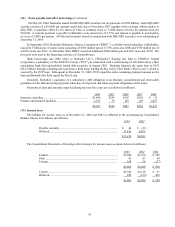

(9) Derivatives

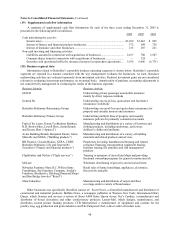

Certain Berkshire subsidiaries, in particular, General Re Securities (“GRS”), regularly utilize derivatives as risk

management tools. In January 2002, GRS commenced a long-term run-off of its operations. Previously GRS operated

as a dealer in various types of derivatives instruments, such as swaps, forwards, futures and options, which are used by

clients to manage economic risks arising from interest rate, foreign exchange rate, or market price movements. The run-

off is expected to occur over a number of years during which GRS will limit its new business to certain risk

management transactions and will unwind its existing asset and liability positions in an orderly manner. General Re

Corporation, the parent of GRS, has guaranteed the obligations of GRS.

In addition, beginning in 2002, another Berkshire subsidiary entered into derivatives contracts with the objective

of hedging a portion of certain corporate-wide risks. Accordingly, such contracts do not qualify for hedge accounting.

During 2003, such contracts were primarily foreign currency exchange forward contracts. Additional information

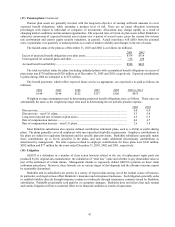

regarding Berkshire’ s derivative contracts follows.

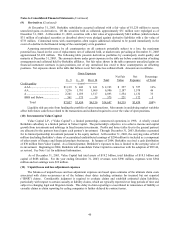

Derivative instruments involve, to varying degrees, elements of market, credit, and liquidity risks. Market risks

may be controlled by taking offsetting positions in either cash instruments or other derivatives. Exposures are managed

on a portfolio basis and monitored daily. For instance, GRS calculates the effect on operating results of potential changes

in market variables, which include volatility, correlation and liquidity. GRS monitors risks over a one week period and

has established $15 million as its value at risk limit with a 99th percentile confidence interval for potential losses over a

weekly horizon. GRS, which may enter into long duration contracts, records fair value adjustments to recognize

counterparty credit exposure and future costs associated with administering each contract. The fair value adjustment for

counterparty credit exposures and future administrative costs on existing contracts was $55 million at December 31, 2003.

Master netting agreements are utilized to manage counterparty credit risk, where gains and losses are netted across

all contracts with that counterparty. In addition, counterparty credit limits are established, and credit exposures are

monitored in accordance with these limits. In addition, Berkshire may receive cash or investment grade securities from

counterparties as collateral and, where appropriate, may purchase credit insurance or enter into other transactions to

mitigate exposure, if balances exceed specified levels or if credit ratings of counterparties are downgraded below

specified levels. Berkshire may incorporate contractual provisions that allow the unwinding of transactions under adverse

conditions. Likewise, Berkshire may be required to post cash or securities as collateral with counterparties under similar

circumstances.