Berkshire Hathaway 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12

That does not mean we will never have setbacks. Reinsurance is a business that is certain to

deliver blows from time to time. But, under Joe and Tad, this operation will be a powerful

engine driving Berkshire’ s future profitability.

Gen Re’ s financial strength, unmatched among reinsurers even as we started 2003, further

improved during the year. Many of the company’ s competitors suffered credit downgrades

last year, leaving Gen Re, and its sister operation at National Indemnity, as the only AAA-

rated companies among the world’ s major reinsurers.

When insurers purchase reinsurance, they buy only a promise – one whose validity may not

be tested for decades – and there are no promises in the reinsurance world equaling those

offered by Gen Re and National Indemnity. Furthermore, unlike most reinsurers, we retain

virtually all of the risks we assume. Therefore, our ability to pay is not dependent on the

ability or willingness of others to reimburse us. This independent financial strength could be

enormously important when the industry experiences the mega-catastrophe it surely will.

• Regular readers of our annual reports know of Ajit Jain’ s incredible contributions to

Berkshire’ s prosperity over the past 18 years. He continued to pour it on in 2003. With a

staff of only 23, Ajit runs one of the world’ s largest reinsurance operations, specializing in

mammoth and unusual risks.

Often, these involve assuming catastrophe risks – say, the threat of a large California

earthquake – of a size far greater than any other reinsurer will accept. This means Ajit’ s

results (and Berkshire’ s) will be lumpy. You should, therefore, expect his operation to have

an occasional horrible year. Over time, however, you can be confident of a terrific result from

this one-of-a-kind manager.

Ajit writes some very unusual policies. Last year, for example, PepsiCo promoted a drawing

that offered participants a chance to win a $1 billion prize. Understandably, Pepsi wished to

lay off this risk, and we were the logical party to assume it. So we wrote a $1 billion policy,

retaining the risk entirely for our own account. Because the prize, if won, was payable over

time, our exposure in present-value terms was $250 million. (I helpfully suggested that any

winner be paid $1 a year for a billion years, but that proposal didn’ t fly.) The drawing was

held on September 14. Ajit and I held our breath, as did the finalist in the contest, and we left

happier than he. PepsiCo has renewed for a repeat contest in 2004.

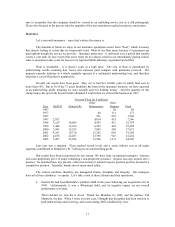

• GEICO was a fine insurance company when Tony Nicely took over as CEO in 1992. Now it

is a great one. During his tenure, premium volume has increased from $2.2 billion to $8.1

billion, and our share of the personal-auto market has grown from 2.1% to 5.0%. More

important, GEICO has paired these gains with outstanding underwriting performance.

(We now pause for a commercial)

It’ s been 67 years since Leo Goodwin created a great business idea at GEICO, one designed

to save policyholders significant money. Go to Geico.com or call 1-800-847-7536 to see

what we can do for you.

(End of commercial)

In 2003, both the number of inquiries coming into GEICO and its closure rate on these

increased significantly. As a result our preferred policyholder count grew 8.2%, and our

standard and non-standard policies grew 21.4%.

GEICO’ s business growth creates a never-ending need for more employees and facilities.

Our most recent expansion, announced in December, is a customer service center in – I’ m

delighted to say – Buffalo. Stan Lipsey, the publisher of our Buffalo News, was instrumental

in bringing the city and GEICO together.