Berkshire Hathaway 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

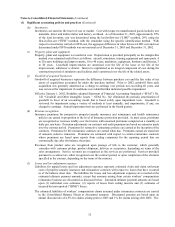

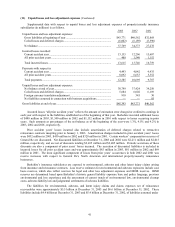

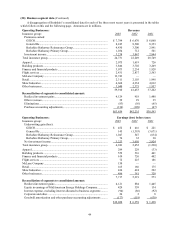

(11) Unpaid losses and loss adjustment expenses (Continued)

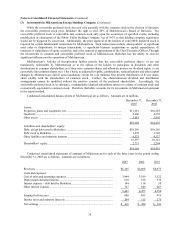

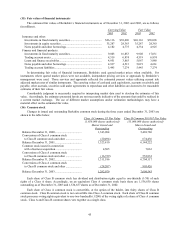

Supplemental data with respect to unpaid losses and loss adjustment expenses of property/casualty insurance

subsidiaries (in millions) is as follows. 2003 2002 2001

Unpaid losses and loss adjustment expenses:

Gross liabilities at beginning of year ................................................................ $43,771 $40,562 $32,868

Ceded losses and deferred charges.................................................................... (6,002) (6,189) (5,590)

Net balance........................................................................................................ 37,769 34,373 27,278

Incurred losses recorded:

Current accident year ........................................................................................ 13,135 12,206 15,607

All prior accident years ..................................................................................... 480 1,540 1,152

Total incurred losses ......................................................................................... 13,615 13,746 16,759

Payments with respect to:

Current accident year ........................................................................................ 4,493 4,042 4,435

All prior accident years ..................................................................................... 8,092 6,653 5,352

Total payments .................................................................................................. 12,585 10,695 9,787

Unpaid losses and loss adjustment expenses:

Net balance at end of year................................................................................. 38,799 37,424 34,250

Ceded losses and deferred charges.................................................................... 5,684 6,002 6,189

Foreign currency translation adjustment........................................................... 910 345 30

Net liabilities assumed in connection with business acquisitions..................... — — 93

Gross liabilities at end of year.............................................................................. $45,393 $43,771 $40,562

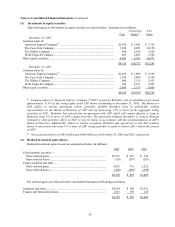

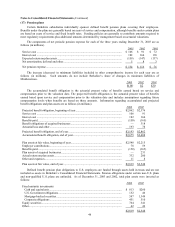

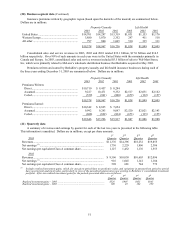

Incurred losses “all prior accident years” reflects the amount of estimation error charged or credited to earnings in

each year with respect to the liabilities established as of the beginning of that year. Berkshire recorded additional losses

of $480 million in 2003, $1,540 million in 2002 and $1,152 million in 2001 with respect to losses occurring in prior

years. Such amounts as percentages of the net balance as of the beginning of the year were 1.3%, 4.5% and 4.2% in

2003, 2002 and 2001, respectively.

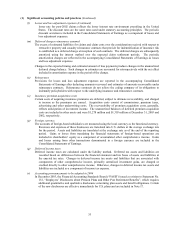

Prior accident years’ losses incurred also include amortization of deferred charges related to retroactive

reinsurance contracts incepting prior to January 1, 2003. Amortization charges included in prior accident years’ losses

were $432 million in 2003, $430 million in 2002 and $328 million in 2001. Certain workers’ compensation reserves of

General Re are discounted. Net discounted liabilities at December 31, 2003 and 2002 were $2,211 million and $2,015

million, respectively, and are net of discounts totaling $2,435 million and $2,405 million. Periodic accretions of these

discounts are also a component of prior years’ losses incurred. The accretion of discounted liabilities is included in

incurred losses for all prior accident years and was approximately $85 million in 2003, $81 million in 2002 and $69

million in 2001. The most significant component of losses from prior years’ occurrences in both 2002 and 2001 was

reserve increases with respect to General Re’ s North American and international property/casualty reinsurance

businesses.

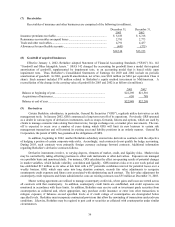

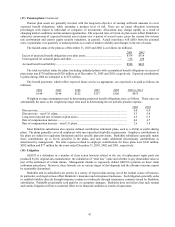

Berkshire’ s insurance subsidiaries are exposed to environmental, asbestos and other latent injury claims arising

from insurance and reinsurance contracts. Loss reserve estimates for environmental and asbestos exposures include case

basis reserves, which also reflect reserves for legal and other loss adjustment expenses and IBNR reserves. IBNR

reserves are determined based upon Berkshire’ s historic general liability exposure base and policy language, previous

environmental and loss experience and the assessment of current trends of environmental law, environmental cleanup

costs, asbestos liability law and judgmental settlements of asbestos liabilities.

The liabilities for environmental, asbestos, and latent injury claims and claims expenses net of reinsurance

recoverables were approximately $5.5 billion at December 31, 2003 and $6.6 billion at December 31, 2002. These

liabilities include $4.4 billion at December 31, 2003 and $5.4 billion at December 31, 2002, of liabilities assumed under