Berkshire Hathaway 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

Management’s Discussion (Continued)

Critical Accounting Policies (Continued)

As of any balance sheet date, all claims that have occurred have not yet been reported to Berkshire, and if

reported may not have been settled. The time period between the occurrence of a loss and the time it is settled by the

insurer or reinsurer is referred to as the “claim-tail.” Property claims usually have a fairly short claim-tail and,

absent claim litigation, are reported and settled within no more than a few years of the balance sheet date. Casualty

losses, on the other hand, can have a very long claim-tail, occasionally extending for decades. In addition, casualty

claims are more susceptible to litigation and can be significantly affected by changing contract interpretations and to

the legal environment, which contributes to the extended claim-tail. The claim-tail for reinsurers is further extended

due to delayed reporting by ceding insurers or reinsurers due to contractual provisions or reporting practices.

The process of establishing reserves for losses assumed under reinsurance contracts requires additional

estimation and judgments by management. Loss reserve estimates are based primarily on claims reported by ceding

companies (such amounts generally exclude IBNR claim estimates), analysis of historical claim reporting patterns

of ceding companies, and estimates of expected overall loss amounts. Techniques for estimating facultative (or

individual) reinsurance losses can be similar to those techniques used by primary insurers and subject to the same

caveats. In estimating losses assumed under treaty reinsurance (groups of losses), claim frequency or count

analyses may not be used because such data is either not provided by ceding companies or otherwise not timely or

reliable. Loss reserves established by line of business and type of coverage are regularly re-evaluated with

appropriate adjustments being made to bring reserves in line with the revised estimates.

IBNR reserves are largely comprised of casualty exposures, which include workers’ compensation losses.

These claims tend to be reported by and settled with ceding companies over long time periods. Therefore, such

claims are subject to a higher degree of estimation error as a result of changes in the legal environment, jury awards,

medical cost trends and general cost inflation. Based upon statistical analysis of past reporting trends, Berkshire

estimates how much IBNR is required to cover claims that will be reported by ceding companies in future years.

Subsequently, as claims are reported, amounts are measured against previous expectations, with variances (positive

or negative) recognized in earnings as a component of losses and loss adjustment expenses. Significant variances

between expected claims and reported claims are analyzed and considered when revising estimates for remaining

IBNR reserve levels.

Due to the inherent uncertainties in the processes and judgments used in establishing reserves, and because

expected losses are an input in establishing premium rates for new policies, Berkshire’ s management believes it is

appropriate to establish reserve levels using a reasonable level of caution, especially with respect to casualty claims.

Receivables recorded with respect to insurance losses ceded to other reinsurers under reinsurance contracts

are estimated in a manner similar to liabilities for insurance losses and, therefore, are also subject to estimation

error. In addition to the factors cited above, reinsurance recoverables may ultimately prove to be uncollectible if the

reinsurer is unable to perform under the contract. Reinsurance contracts do not relieve the ceding company of its

obligations to indemnify its own policyholders.

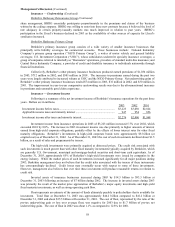

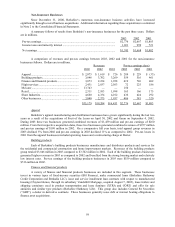

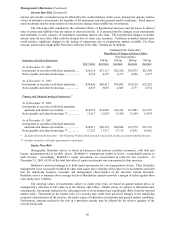

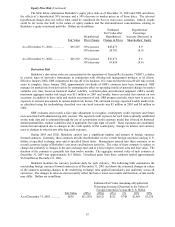

A summary of Berkshire’ s consolidated liabilities for unpaid property and casualty losses are in the table

below. The amount of losses recorded in each of the past two years relating to prior years’ loss occurrences is

expressed as a percentage of total net premiums earned as well as a percentage of the net reserve balance established

as of the beginning of the year. Dollars are in millions.

Unpaid losses Net unpaid losses*

Dec.31, 2003 Dec.31, 2002 Dec.31, 2003 Dec.31, 2002

General Re.................................................................. $23,820 $23,326 $20,787 $20,784

BHRG......................................................................... 15,769 15,516 12,513 11,990

GEICO........................................................................ 4,492 4,010 4,282 3,816

Berkshire Hathaway Primary ..................................... 1,312 919 1,217 834

Total ........................................................................... $45,393 $43,771 $38,799 $37,424

Losses incurred related to prior years......................... $ 480** $ 1,540**

Losses as a % of net reserves beginning of the year .. 1.3% 4.5%

Losses as a % of net premiums earned current year... 2.4% 8.9%

* Net of reinsurance recoverable and deferred charges reinsurance assumed.

** Includes amortization of deferred charges and includes accretion of discounts on General Re workers’ compensation

reserves (See Note 11 to the Consolidated Financial Statements).