Berkshire Hathaway 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

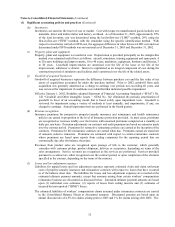

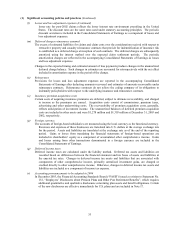

Notes to Consolidated Financial Statements (Continued)

(3) Investments in MidAmerican Energy Holdings Company (Continued)

While the convertible preferred stock does not vote generally with the common stock in the election of directors,

the convertible preferred stock gives Berkshire the right to elect 20% of MidAmerican’ s Board of Directors. The

convertible preferred stock is convertible into common stock only upon the occurrence of specified events, including

modification or elimination of the Public Utility Holding Company Act of 1935 so that holding company registration

would not be triggered by conversion. Additionally, the prior approval of the holders of convertible preferred stock is

required for certain fundamental transactions by MidAmerican. Such transactions include, among others: a) significant

asset sales or dispositions; b) merger transactions; c) significant business acquisitions or capital expenditures; d)

issuances or repurchases of equity securities; and e) the removal or appointment of the Chief Executive Officer. Through

the investments in common and convertible preferred stock of MidAmerican, Berkshire has the ability to exercise

significant influence on the operations of MidAmerican.

MidAmerican’ s Articles of Incorporation further provide that the convertible preferred shares: a) are not

mandatorily redeemable by MidAmerican or at the option of the holder; b) participate in dividends and other

distributions to common shareholders as if they were common shares and otherwise possess no dividend rights; c) are

convertible into common shares on a 1 for 1 basis, as adjusted for splits, combinations, reclassifications and other capital

changes by MidAmerican; and d) upon liquidation, except for a de minimus first priority distribution of $1 per share,

share ratably with the shareholders of common stock. Further, the aforementioned dividend and distribution

arrangements cannot be modified without the positive consent of the preferred shareholders. Accordingly, the

convertible preferred stock is, in substance, a substantially identical subordinate interest to a share of common stock and

economically equivalent to common stock. Therefore, Berkshire accounts for its investments in MidAmerican pursuant

to the equity method.

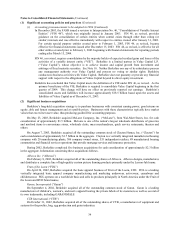

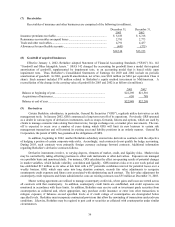

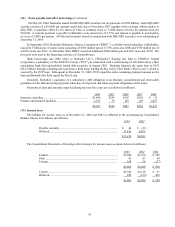

Condensed consolidated balance sheets of MidAmerican are as follows. Amounts are in millions.

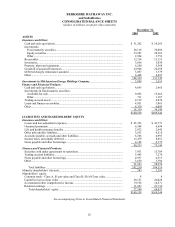

December 31, December 31,

2003 2002

Assets:

Properties, plant, and equipment, net ............................................................................. $11,181 $10,285

Goodwill......................................................................................................................... 4,306 4,258

Other assets .................................................................................................................... 3,681 3,892

$19,168 $18,435

Liabilities and shareholders’ equity:

Debt, except debt owed to Berkshire.............................................................................. $10,296 $10,286

Debt owed to Berkshire.................................................................................................. 1,578 1,728

Other liabilities and minority interests ........................................................................... 4,523 4,127

16,397 16,141

Shareholders’ equity....................................................................................................... 2,771 2,294

$19,168 $18,435

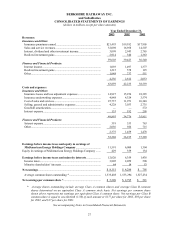

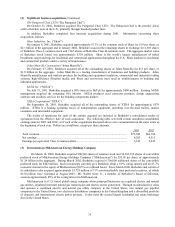

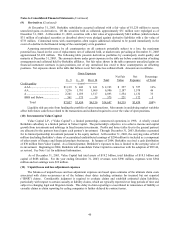

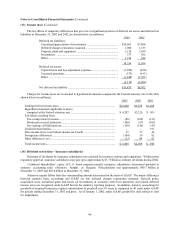

Condensed consolidated statements of earnings of MidAmerican for each of the three years in the period ending

December 31, 2003 are as follows. Amounts are in millions.

2003 2002 2001

Revenues ........................................................................................................... $6,145 $4,968 $4,973

Costs and expenses:

Cost of sales and operating expenses ................................................................ 3,944 3,189 3,522

Depreciation and amortization .......................................................................... 610 526 539

Interest expense – debt held by Berkshire......................................................... 184 118 50

Other interest expense ....................................................................................... 727 640 443

5,465 4,473 4,554

Earnings before taxes ........................................................................................ 680 495 419

Income taxes and minority interests.................................................................. 264 115 276

Net earnings ...................................................................................................... $ 416 $ 380 $ 143