Berkshire Hathaway 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Insurance — Underwriting (Continued)

General Re (Continued)

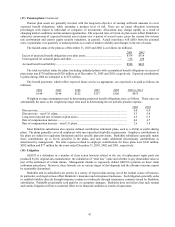

Management believes the revised estimates in 2003 on prior years’ casualty loss reserves were primarily

due to escalating medical inflation and utilization that adversely affect workers’ compensation and other casualty

lines; and an increased frequency in corporate bankruptcies, scandals and accounting restatements which increased

losses under errors and omissions and directors and officers coverages. Otherwise, reported casualty losses for prior

years were generally consistent with management estimates. In addition to the above listed factors, revised

estimates in 2002 and 2001 for prior years’ loss reserves were due to (1) an increase in claim severity, which has a

leveraged effect on excess of loss coverages provided by General Re by producing a disproportionate increase in

claims exceeding General Re’ s attachment point; (2) broadened coverage terms under General Re’ s reinsurance

contracts during 1997 through 2000; (3) increased ceding companies’ reserve inadequacies, likely arising from

broadened terms and conditions, as well as previously unrecognized premium inadequacies; and (4) increased

primary company insolvencies, which changed historical claim reporting patterns. See the discussion regarding

“Critical Accounting Policies” for information about the processes used in estimating loss reserves.

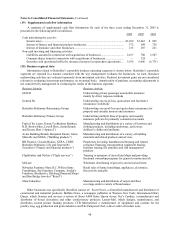

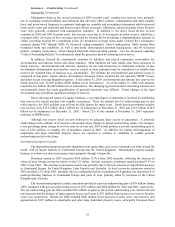

In addition, General Re continuously estimates its liabilities and related reinsurance recoverables for

environmental and asbestos claims and claim expenses. Most liabilities for such claims arise from exposures in

North America. Environmental and asbestos exposures do not lend themselves to traditional methods of loss

development determination and therefore reserves related to these exposures may be considered less reliable than

reserves for standard lines of business (e.g., automobile). The estimate for environmental and asbestos losses is

composed of four parts: known claims, development on known claims, incurred but not reported (“IBNR”) losses

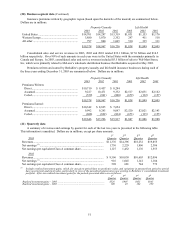

and direct excess coverage litigation expenses. At December 31, 2003, environmental and asbestos loss reserves for

North America were $1,050 million ($890 million net of reinsurance). As of December 31, 2002 such amounts

totaled $1,161 million ($1,008 million net of reinsurance). The changing legal environment concerning asbestos and

environmental claims has made quantification of potential exposures very difficult. Future changes to the legal

environment may precipitate significant changes in reserves.

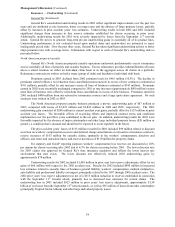

Due to the long-tail nature of casualty business, a very high degree of estimation is involved in establishing

loss reserves for current accident year casualty occurrences. Thus, the ultimate level of underwriting gain or loss

with respect to the 2003 accident year will not be fully known for many years. North American property/casualty

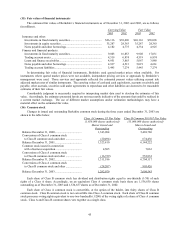

loss reserves were $15.5 billion ($14.3 billion net of reinsurance) at December 31, 2003 and $16.2 billion ($14.9

billion net of reinsurance) at December 31, 2002. About 52% of this amount at December 31, 2003 represents

estimates of IBNR losses.

Although loss reserve levels are now believed to be adequate, there can be no guarantees. A relatively

small change in the estimate of net reserves can produce large changes in annual underwriting results. For instance,

a one percentage point change in net loss reserves at year end 2003 would produce a pre-tax underwriting gain or

loss of $143 million, or roughly 4% of premiums earned in 2003. In addition, the timing and magnitude of

catastrophe and large individual property losses are expected to continue to contribute to volatile periodic

underwriting results in the future.

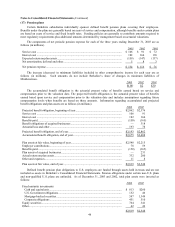

International property/casualty

The international property/casualty operations write quota-share and excess reinsurance on risks around the

world, with its largest markets in Continental Europe and the United Kingdom. International property/casualty

business is written on a direct reinsurance basis primarily through Cologne Re.

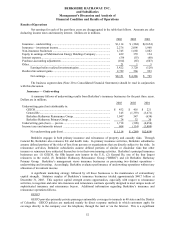

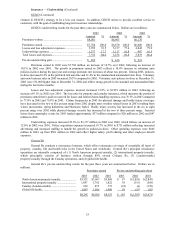

Premiums earned in 2003 increased $105 million (5.9%) from 2002 amounts, reflecting the increase in

values of most foreign currencies relative to the U.S. dollar. In local currencies, premiums earned declined 8.1% in

2003 versus 2002. The decrease in premiums earned was primarily due to the non-renewal of unprofitable business

in Continental Europe, the United Kingdom, Latin America and Australia. In local currencies, premiums earned in

2002 declined 2.1% from 2001, primarily due to a substantial decline in premiums in Argentina, the non-renewal of

under-performing business in Continental Europe and parts of Asia, partially offset by increases in the United

Kingdom and Australia.

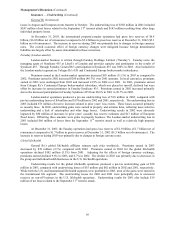

The international property/casualty operations produced a pre-tax underwriting gain of $38 million during

2003, compared with pre-tax underwriting losses of $315 million and $568 million for 2002 and 2001, respectively.

The net underwriting gain for 2003 included $69 million of gains in the current underwriting year, which reflected

rate increases and the absence of large property losses, and losses of $31 million from increases to reserves for prior

years’ loss occurrences. Results for 2002 included $240 million of net increases to prior years’ loss reserves, and

approximately $107 million in catastrophe and other large individual property losses, principally European flood