Berkshire Hathaway 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

NFM was founded by Rose Blumkin (“Mrs. B”) in 1937 with $500. She worked until she was 103

(hmmm . . . not a bad idea). One piece of wisdom she imparted to the generations following her was,

“If you have the lowest price, customers will find you at the bottom of a river.” Our store serving

greater Kansas City, which is located in one of the area’ s more sparsely populated parts, has proved

Mrs. B’ s point. Though we have more than 25 acres of parking, the lot has at times overflowed.

“Victory,” President Kennedy told us after the Bay of Pigs disaster, “has a thousand fathers, but defeat

is an orphan.” At NFM, we knew we had a winner a month after the boffo opening in Kansas City,

when our new store attracted an unexpected paternity claim. A speaker there, referring to the Blumkin

family, asserted, “They had enough confidence and the policies of the Administration were working

such that they were able to provide work for 1,000 of our fellow citizens.” The proud papa at the

podium? President George W. Bush.

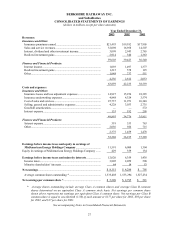

• In flight services, FlightSafety, our training operation, experienced a drop in “normal” operating

earnings from $183 million to $150 million. (The abnormals: In 2002 we had a $60 million pre-tax

gain from the sale of a partnership interest to Boeing, and in 2003 we recognized a $37 million loss

stemming from the premature obsolescence of simulators.) The corporate aviation business has slowed

significantly in the past few years, and this fact has hurt FlightSafety’ s results. The company

continues, however, to be far and away the leader in its field. Its simulators have an original cost of

$1.2 billion, which is more than triple the cost of those operated by our closest competitor.

NetJets, our fractional-ownership operation lost $41 million pre-tax in 2003. The company had a

modest operating profit in the U.S., but this was more than offset by a $32 million loss on aircraft

inventory and by continued losses in Europe.

NetJets continues to dominate the fractional-ownership field, and its lead is increasing: Prospects

overwhelmingly turn to us rather than to our three major competitors. Last year, among the four of us,

we accounted for 70% of net sales (measured by value).

An example of what sets NetJets apart from competitors is our Mayo Clinic Executive Travel

Response program, a free benefit enjoyed by all of our owners. On land or in the air, anywhere in the

world and at any hour of any day, our owners and their families have an immediate link to Mayo.

Should an emergency occur while they are traveling here or abroad, Mayo will instantly direct them to

an appropriate doctor or hospital. Any baseline data about the patient that Mayo possesses is

simultaneously made available to the treating physician. Many owners have already found this service

invaluable, including one who needed emergency brain surgery in Eastern Europe.

The $32 million inventory write-down we took in 2003 occurred because of falling prices for used

aircraft early in the year. Specifically, we bought back fractions from withdrawing owners at

prevailing prices, and these fell in value before we were able to remarket them. Prices are now stable.

The European loss is painful. But any company that forsakes Europe, as all of our competitors have

done, is destined for second-tier status. Many of our U.S. owners fly extensively in Europe and want

the safety and security assured by a NetJets plane and pilots. Despite a slow start, furthermore, we are

now adding European customers at a good pace. During the years 2001 through 2003, we had gains of

88%, 61% and 77% in European management-and-flying revenues. We have not, however, yet

succeeded in stemming the flow of red ink.

Rich Santulli, NetJets’ extraordinary CEO, and I expect our European loss to diminish in 2004 and also

anticipate that it will be more than offset by U.S. profits. Overwhelmingly, our owners love the

NetJets experience. Once a customer has tried us, going back to commercial aviation is like going

back to holding hands. NetJets will become a very big business over time and will be one in which we

are preeminent in both customer satisfaction and profits. Rich will see to that.