Berkshire Hathaway 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

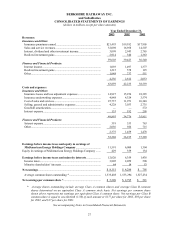

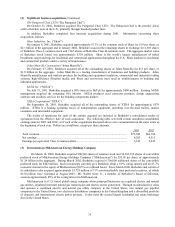

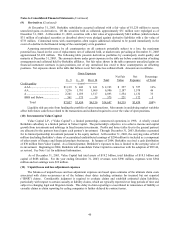

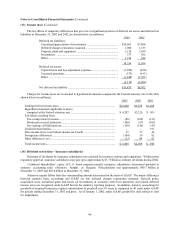

(4) Investments in fixed maturity securities

Investments in securities with fixed maturities as of December 31, 2003 and 2002 are shown below (in millions).

A

mortized Unrealized Unrealized

F

ai

r

Cos

t

Gains Losses Value

December 31, 2003

Insurance and other:

Obligations of U.S. Treasury, U.S. government

corporations and agencies ............................................... $ 2,019 $ 95 $ (5) $ 2,109

Obligations of states, municipalities

and political subdivisions ................................................ 4,659 241 —4,900

Obligations of foreign governments ...................................... 4,986 80 (26) 5,040

Corporate bonds and redeemable preferred stock.................. 8,677 2,472 (23) 11,126

Mortgage-backed securities ................................................... 2,802 145 (6) 2,941

$23,143 $3,033 $ (60) $26,116

Finance and financial products, available-for-sale:

Obligations of U.S. Treasury, U.S. government

corporations and agencies ............................................... $ 3,733 $ 320 $ — $ 4,053

Corporate bonds ..................................................................... 704 79 —783

Mortgage-backed securities ................................................... 4,076 180 — 4,256

$ 8,513 $ 579 $ — $ 9,092

Mortgage-backed securities, held-to-maturity....................... $ 563 $ 105 $ — $ 668

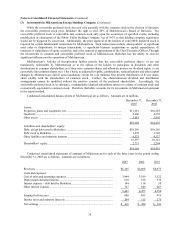

A

mortized Unrealized Unrealized

F

ai

r

December 31

,

2002 Cos

t

Gains Losses Value

Insurance and other:

Obligations of U.S. Treasury, U.S. government

corporations and agencies ............................................... $ 9,091 $ 966 $ — $10,057

Obligations of states, municipalities

and political subdivisions ................................................ 6,346 280 (1) 6,625

Obligations of foreign governments ...................................... 3,813 92 (2) 3,903

Corporate bonds and redeemable preferred stocks ................ 10,120 1,041 (118) 11,043

Mortgage-backed securities ................................................... 6,155 321 (8) 6,468

$35,525 $2,700 $ (129) $38,096

Finance and financial products, available-for-sale:

Obligations of U.S. Treasury, U.S. government

corporations and agencies ............................................... $ 3,543 $ 331 $ — $ 3,874

Corporate bonds ..................................................................... 1,261 40 (10) 1,291

Mortgage-backed securities ................................................... 10,202 299 — 10,501

$15,006 $ 670 $ (10) $15,666

Mortgage-backed securities, held-to-maturity....................... $ 1,019 $ 178 $ — $ 1,197

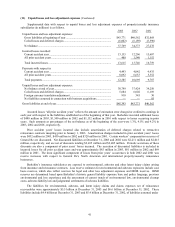

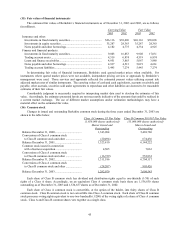

Shown below are the amortized cost and estimated fair values of securities with fixed maturities at

December 31, 2003, by contractual maturity dates. Actual maturities will differ from contractual maturities because

issuers of certain of the securities retain early call or prepayment rights. Amounts are in millions.

Amortized Fair

Cost Value

Due in 2004 ................................................................................................................. $ 4,105 $ 4,217

Due 2005 – 2008 ......................................................................................................... 7,914 8,656

Due 2009 – 2013 ......................................................................................................... 8,590 10,018

Due after 2014............................................................................................................. 4,169 5,120

24,778 28,011

Mortgage-backed securities......................................................................................... 7,441 7,865

$32,219 $35,876