Berkshire Hathaway 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

BERKSHIRE HATHAWAY INC.

To the Shareholders of Berkshire Hathaway Inc.:

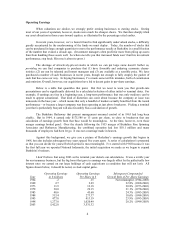

Our gain in net worth during 2003 was $13.6 billion, which increased the per-share book value of

both our Class A and Class B stock by 21%. Over the last 39 years (that is, since present management took

over) per-share book value has grown from $19 to $50,498, a rate of 22.2% compounded annually.*

It’ s per-share intrinsic value that counts, however, not book value. Here, the news is good:

Between 1964 and 2003, Berkshire morphed from a struggling northern textile business whose intrinsic

value was less than book into a widely diversified enterprise worth far more than book. Our 39-year gain

in intrinsic value has therefore somewhat exceeded our 22.2% gain in book. (For a better understanding of

intrinsic value and the economic principles that guide Charlie Munger, my partner and Berkshire’ s vice-

chairman, and me in running Berkshire, please read our Owner’ s Manual, beginning on page 69.)

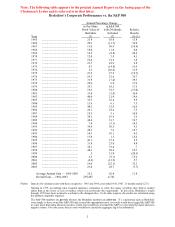

Despite their shortcomings, book value calculations are useful at Berkshire as a slightly

understated gauge for measuring the long-term rate of increase in our intrinsic value. The calculation is

less relevant, however, than it once was in rating any single year’ s performance versus the S&P 500 index

(a comparison we display on the facing page). Our equity holdings, including convertible preferreds, have

fallen considerably as a percentage of our net worth, from an average of 114% in the 1980s, for example, to

an average of 50% in 2000-03. Therefore, yearly movements in the stock market now affect a much

smaller portion of our net worth than was once the case.

Nonetheless, Berkshire’ s long-term performance versus the S&P remains all-important. Our

shareholders can buy the S&P through an index fund at very low cost. Unless we achieve gains in per-

share intrinsic value in the future that outdo the S&P’ s performance, Charlie and I will be adding nothing to

what you can accomplish on your own.

If we fail, we will have no excuses. Charlie and I operate in an ideal environment. To begin with,

we are supported by an incredible group of men and women who run our operating units. If there were a

Corporate Cooperstown, its roster would surely include many of our CEOs. Any shortfall in Berkshire’ s

results will not be caused by our managers.

Additionally, we enjoy a rare sort of managerial freedom. Most companies are saddled with

institutional constraints. A company’ s history, for example, may commit it to an industry that now offers

limited opportunity. A more common problem is a shareholder constituency that pressures its manager to

dance to Wall Street’ s tune. Many CEOs resist, but others give in and adopt operating and capital-

allocation policies far different from those they would choose if left to themselves.

At Berkshire, neither history nor the demands of owners impede intelligent decision-making.

When Charlie and I make mistakes, they are – in tennis parlance – unforced errors.

*All figures used in this report apply to Berkshire’ s A shares, the successor to the only stock that

the company had outstanding before 1996. The B shares have an economic interest equal to 1/30th that of

the A.