Berkshire Hathaway 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Management’s Discussion (Continued)

Insurance — Underwriting (Continued)

General Re (Continued)

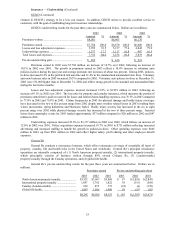

General Re’ s consolidated underwriting results in 2003 reflect significant improvements over the past two

years and are attributed to rate increases, better coverage terms and the absence of large property losses, partially

offset by increases in prior accident years’ loss estimates. Underwriting results in both 2002 and 2001 included

significant charges from increases in loss reserve estimates established for claims occurring in prior years.

Additionally, underwriting results for 2001 were severely impacted by losses from the September 11th terrorist

attack. General Re strives to generate long-term pre-tax underwriting gains in essentially all of its product lines.

Underwriting performance is not evaluated based upon market share and underwriters are instructed to reject

inadequately priced risks. Over the past three years, General Re has taken significant underwriting actions to better

align premium rates with coverage terms. Information with respect to each of General Re’ s underwriting units is

presented below.

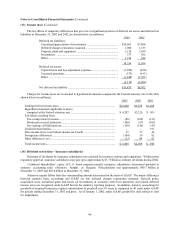

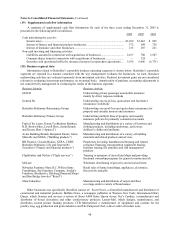

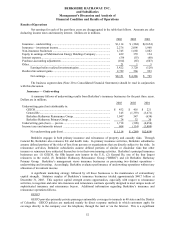

North American property/casualty

General Re’ s North American property/casualty operations underwrite predominantly excess reinsurance

across essentially all lines of property and casualty business. Excess reinsurance provides indemnification of losses

above a stated retention on either an individual claim basis or in the aggregate across all claims in a portfolio.

Reinsurance contracts are written on both a treaty (group of risks) and facultative (individual risk) basis.

Premiums earned in 2003 declined from 2002 premium levels by $416 million (10.5%). The decline in

premiums earned reflects a net reduction from cancellations/non-renewals in excess of new contracts (estimated at

$761 million), partially offset by rate increases across all lines of business (estimated at $345 million). Premiums

earned in 2002 were essentially unchanged compared to 2001 as rate increases (approximately $800 million) across

most lines of business were offset by reductions from cancellations in excess of new business. Premiums earned in

2001 included $400 million from one retroactive reinsurance contract and a large quota share agreement. No such

contracts were written in 2002 or 2003.

The North American property/casualty business produced a pre-tax underwriting gain of $67 million in

2003, compared with losses of $1,019 million and $2,843 million in 2002 and 2001, respectively. The 2003

underwriting gain consisted of $200 million in current accident year gains, partially offset by $133 million in prior

accident year losses. The favorable effects of re-pricing efforts and improved contract terms and conditions

implemented over the past three years contributed to the net gain. In addition, underwriting results for 2003 were

favorably impacted by the absence of major catastrophes and other large individual property losses ($20 million or

greater), a condition that is unusual and should not be expected to occur regularly in the future.

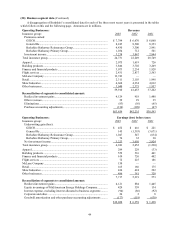

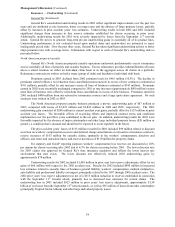

The prior accident years’ losses of $133 million recorded in 2003 included $99 million related to discount

accretion on workers’ compensation reserves and deferred charge amortization on retroactive reinsurance contracts,

reserve increases of $153 million for casualty claims, (primarily in the workers’ compensation, directors and

officers, and errors and omissions lines), and reserve decreases of $119 million for property claims.

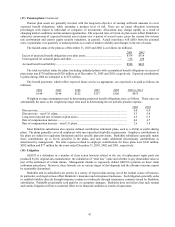

For statutory and GAAP reporting purposes workers’ compensation loss reserves are discounted at 1.0%

per annum for claims occurring after 2002 and at 4.5% for claims occurring before 2003. The lower discount rate

for 2003 claims was approved by General Re’ s state insurance regulators and reflects the lower interest rate

environment that now exists. The lower discount rate effectively reduced 2003 underwriting gains by

approximately $74 million.

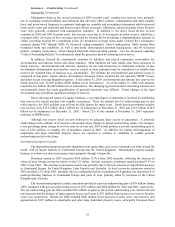

Underwriting results for 2002 included $1,085 million in prior year loss reserve adjustments, offset by net

gains of $66 million with respect to the 2002 accident year. Results for 2002 included $990 million in increased

loss estimates related to casualty lines of business (general liability, workers’ compensation, medical malpractice,

auto liability and professional liability coverages), principally related to the 1997 through 2000 accident years. The

2002 prior years’ loss reserve adjustment was net of a $115 million reduction in reserves established in connection

with the September 11th terrorist attack, primarily due to decreased loss estimates for certain claims. The

underwriting loss in 2001 included $923 million in prior years’ loss reserve adjustments, approximately $1.54

billion of net losses from the September 11th terrorist attack, as well as $87 million of losses from other catastrophes

(principally Tropical Storm Allison) and other large individual property losses.