Berkshire Hathaway 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

The key figure in this matter, however, was Governor George Pataki. His leadership and

tenacity are why Buffalo will have 2,500 new jobs when our expansion is fully rolled out.

Stan, Tony, and I – along with Buffalo – thank him for his help.

• Berkshire’ s smaller insurers had another terrific year. This group, run by Rod Eldred, John

Kizer, Tom Nerney, Don Towle and Don Wurster, increased its float by 41%, while

delivering an excellent underwriting profit. These men, though operating in unexciting ways,

produce truly exciting results.

* * * * * * * * * * * *

We should point out again that in any given year a company writing long-tail insurance (coverages

giving rise to claims that are often settled many years after the loss-causing event takes place) can report

almost any earnings that the CEO desires. Too often the industry has reported wildly inaccurate figures by

misstating liabilities. Most of the mistakes have been innocent. Sometimes, however, they have been

intentional, their object being to fool investors and regulators. Auditors and actuaries have usually failed to

prevent both varieties of misstatement.

I have failed on occasion too, particularly in not spotting Gen Re’ s unwitting underreserving a few

years back. Not only did that mean we reported inaccurate figures to you, but the error also resulted in our

paying very substantial taxes earlier than was necessary. Aaarrrggghh. I told you last year, however, that I

thought our current reserving was at appropriate levels. So far, that judgment is holding up.

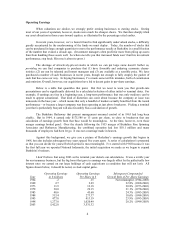

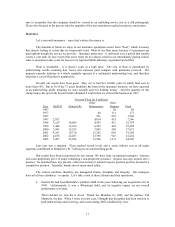

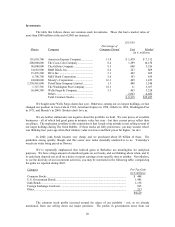

Here are Berkshire’ s pre-tax underwriting results by segment:

Gain (Loss) in $ millions

2003 2002

Gen Re...................................................................................................... $ 145 $(1,393)

Ajit’ s business excluding retroactive contracts ........................................ 1,434 980

Ajit’ s retroactive contracts* ..................................................................... (387) (433)

GEICO...................................................................................................... 452 416

Other Primary ........................................................................................... 74 32

Total ......................................................................................................... $1,718 $ (398)

*These contracts were explained on page 10 of the 2002 annual report, available on the Internet at

www.berkshirehathaway.com. In brief, this segment consists of a few jumbo policies that are likely to

produce underwriting losses (which are capped) but also provide unusually large amounts of float.

Regulated Utility Businesses

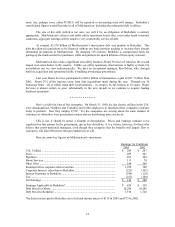

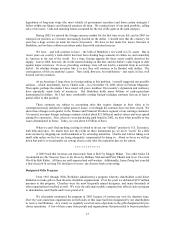

Through MidAmerican Energy Holdings, we own an 80.5% (fully diluted) interest in a wide

variety of utility operations. The largest are (1) Yorkshire Electricity and Northern Electric, whose 3.7

million electric customers make it the third largest distributor of electricity in the U.K.; (2) MidAmerican

Energy, which serves 689,000 electric customers in Iowa and; (3) Kern River and Northern Natural

pipelines, which carry 7.8% of the natural gas transported in the United States.

Berkshire has three partners, who own the remaining 19.5%: Dave Sokol and Greg Abel, the

brilliant managers of the business, and Walter Scott, a long-time friend of mine who introduced me to the

company. Because MidAmerican is subject to the Public Utility Holding Company Act (“PUHCA”),

Berkshire’ s voting interest is limited to 9.9%. Walter has the controlling vote.

Our limited voting interest forces us to account for MidAmerican in our financial statements in an

abbreviated manner. Instead of our fully including its assets, liabilities, revenues and expenses in our

statements, we record only a one-line entry in both our balance sheet and income account. It’ s likely that