Berkshire Hathaway 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

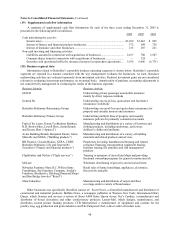

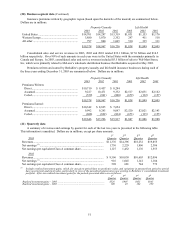

Notes to Consolidated Financial Statements (Continued)

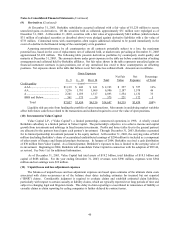

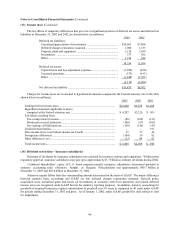

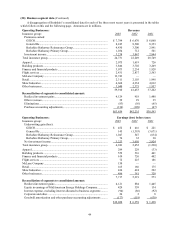

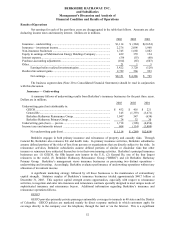

(20) Business segment data (Continued)

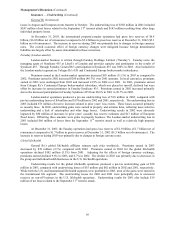

Depreciation

Capital expenditures * of tangible assets

Operating Businesses: 2003 2002 2001 2003 2002 2001

Insurance group:

GEICO............................................................................ $ 39 $ 31 $ 20 $ 34 $ 32 $ 70

General Re...................................................................... 13 18 19 26 17 20

Berkshire Hathaway Primary Group .............................. 3 4 3 3 3 2

Total insurance group........................................................ 55 53 42 63 52 92

Apparel.............................................................................. 71 51 851 37 13

Building products.............................................................. 170 158 152 174 152 124

Finance and financial products.......................................... 232 51 21 161 150 57

Flight services ................................................................... 150 241 408 136 127 108

McLane Company............................................................. 51 — — 59 — —

Retail ................................................................................. 106 113 76 51 40 37

Shaw Industries ................................................................. 120 196 71 91 91 88

Other businesses................................................................ 47 65 33 43 30 25

$1,002 $ 928 $ 811 $ 829 $ 679 $ 544

* Excludes capital expenditures which were part of business acquisitions.

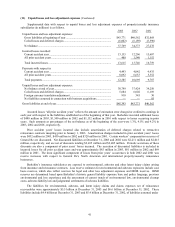

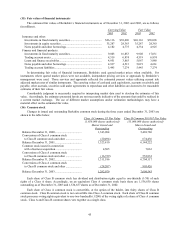

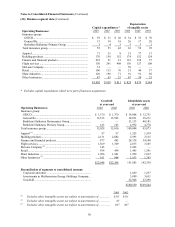

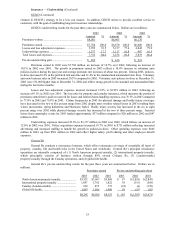

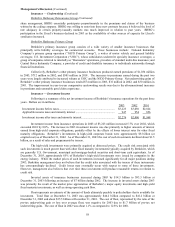

Goodwill Identifiable assets

at year-end at year-end

Operating Businesses: 2003 2002 2003 2002

Insurance group:

GEICO.................................................................................. $ 1,370 $ 1,370 $ 14,088 $ 12,751

General Re............................................................................ 13,515 13,503 38,831 38,271

Berkshire Hathaway Reinsurance Group.............................. — — 51,133 40,181

Berkshire Hathaway Primary Group..................................... 143 143 4,952 4,770

Total insurance group.............................................................. 15,028 15,016 109,004 95,973

Apparel (1) ................................................................................ 57 57 1,523 1,539

Building products .................................................................... 2,131 2,082 2,593 2,515

Finance and financial products ................................................ 877 495 28,338 34,148

Flight services.......................................................................... 1,369 1,369 2,875 3,105

McLane Company (2) ............................................................... 145 —2,243 —

Retail ....................................................................................... 434 434 1,495 1,341

Shaw Industries ....................................................................... 1,996 1,941 1,999 1,932

Other businesses (3) .................................................................. 911 904 1,813 1,785

$22,948 $22,298 151,883 142,338

Reconciliation of segments to consolidated amount:

Corporate and other ............................................................. 1,829 1,257

Investments in MidAmerican Energy Holdings Company .. 3,899 3,651

Goodwill .............................................................................. 22,948 22,298

$180,559 $169,544

2003 2002

(1) Excludes other intangible assets not subject to amortization of................ $311 $311

(2) Excludes other intangible assets not subject to amortization of................ 65 —

(3) Excludes other intangible assets not subject to amortization of................ 697 697