Berkshire Hathaway 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

(2) Significant business acquisitions (Continued)

The Pampered Chef, LTD (“The Pampered Chef”)

On October 31, 2002, Berkshire acquired The Pampered Chef, LTD. The Pampered Chef is the premier direct

seller of kitchen tools in the U.S., primarily through branded product lines.

In addition, Berkshire completed four business acquisitions during 2001. Information concerning these

acquisitions follows.

Shaw Industries, Inc. (“Shaw”)

On January 8, 2001, Berkshire acquired approximately 87.3% of the common stock of Shaw for $19 per share, or

$2.1 billion in the aggregate and in January 2002, Berkshire acquired the remaining shares in exchange for 4,505 shares

of Berkshire Class A common stock and 7,063 shares of Berkshire Class B common stock. The aggregate market value

of Berkshire stock issued was approximately $324 million. Shaw is the world’ s largest manufacturer of tufted

broadloom carpet and rugs for residential and commercial applications throughout the U.S. Shaw markets its residential

and commercial products under a variety of brand names.

Johns Manville Corporation (“Johns Manville”)

On February 27, 2001, Berkshire acquired all of the outstanding shares of Johns Manville for $13 per share, or

$1.8 billion in the aggregate. Johns Manville is a leading manufacturer of insulation and building products. Johns

Manville manufactures and markets products for building and equipment insulation, commercial and industrial roofing

systems, high-efficiency filtration media, and fibers and non-woven mats used as reinforcements in building and

industrial applications.

MiTek Inc. (“MiTek”)

On July 31, 2001, Berkshire acquired a 90% interest in MiTek for approximately $400 million. Existing MiTek

management acquired the remaining 10% interest. MiTek produces steel connector products, design engineering

software and ancillary services for the building components market.

XTRA Corporation (“XTRA”)

On September 20, 2001, Berkshire acquired all of the outstanding shares of XTRA for approximately $578

million. XTRA is a leading operating lessor of transportation equipment, including over-the-road trailers, marine

containers and intermodal equipment.

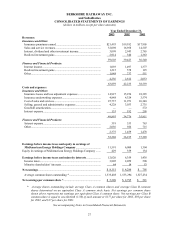

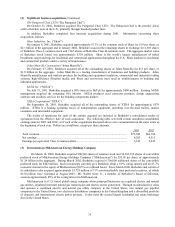

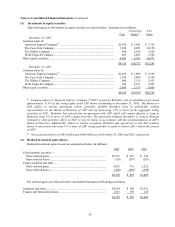

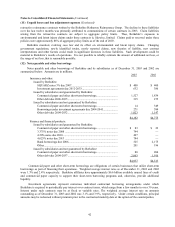

The results of operations for each of the entities acquired are included in Berkshire’ s consolidated results of

operations from the effective date of each acquisition. The following table sets forth certain unaudited consolidated

earnings data for 2003 and 2002, as if each of the acquisitions discussed above were consummated on the same terms at

the beginning of each year. Dollars are in millions, except per share amounts.

2003 2002

Total revenues ............................................................................................................................ $72,945 $66,194

Net earnings ............................................................................................................................... 8,203 4,512

Earnings per equivalent Class A common share........................................................................ 5,343 2,942

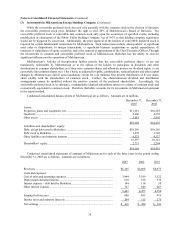

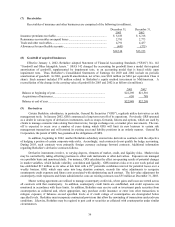

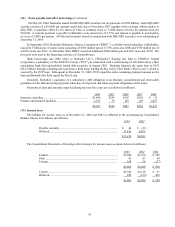

(3) Investments in MidAmerican Energy Holdings Company

On March 14, 2000, Berkshire acquired 900,942 shares of common stock and 34,563,395 shares of convertible

preferred stock of MidAmerican Energy Holdings Company (“MidAmerican”) for $35.05 per share, or approximately

$1.24 billion in the aggregate. During March 2002, Berkshire acquired 6,700,000 additional shares of the convertible

preferred stock for $402 million. Such investments currently give Berkshire about a 9.9% voting interest and an 83.7%

economic interest in the equity of MidAmerican (80.5% on a diluted basis). Since March 2000, Berkshire and certain of

its subsidiaries also acquired approximately $1,728 million of 11% non-transferable trust preferred securities, of which

$150 million were redeemed in August 2003. Mr. Walter Scott, Jr., a member of Berkshire’ s Board of Directors,

controls approximately 88% of the voting interest in MidAmerican.

MidAmerican is a U.S. based global energy company whose principal businesses are regulated electric and natural

gas utilities, regulated interstate natural gas transmission and electric power generation. Through its subsidiaries it owns

and operates a combined electric and natural gas utility company in the United States, two natural gas pipeline

companies in the United States, two electricity distribution companies in the United Kingdom and a diversified portfolio

of domestic and international electric power projects. It also owns the second largest residential real estate brokerage

firm in the United States.