Berkshire Hathaway 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

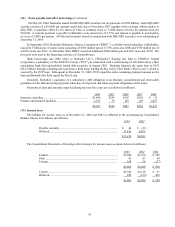

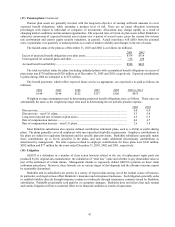

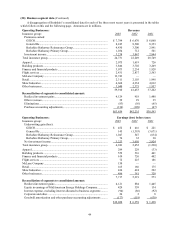

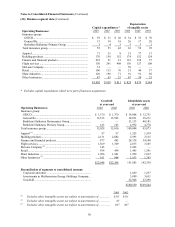

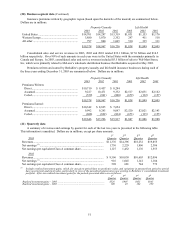

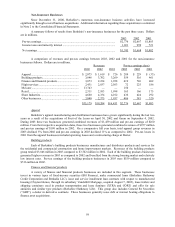

(20) Business segment data (Continued)

A disaggregation of Berkshire’ s consolidated data for each of the three most recent years is presented in the tables

which follow on this and the following page. Amounts are in millions.

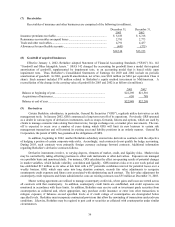

Operating Businesses: Revenues

Insurance group: 2003 2002 2001

Premiums earned:

GEICO.................................................................................................... $ 7,784 $ 6,670 $ 6,060

General Re.............................................................................................. 8,245 8,500 8,353

Berkshire Hathaway Reinsurance Group................................................ 4,430 3,300 2,991

Berkshire Hathaway Primary Group....................................................... 1,034 712 501

Investment income..................................................................................... 3,238 3,067 2,844

Total insurance group................................................................................... 24,731 22,249 20,749

Apparel......................................................................................................... 2,075 1,619 726

Building products ......................................................................................... 3,846 3,702 3,269

Finance and financial products..................................................................... 3,073 2,234 1,928

Flight services .............................................................................................. 2,431 2,837 2,563

McLane Company........................................................................................ 13,743 — —

Retail ............................................................................................................ 2,311 2,103 1,998

Shaw Industries ............................................................................................ 4,660 4,334 4,012

Other businesses........................................................................................... 3,040 2,375 1,957

59,910 41,453 37,202

Reconciliation of segments to consolidated amount:

Realized investment gains ......................................................................... 4,129 918 1,488

Other revenues........................................................................................... 39 29 35

Eliminations............................................................................................... (83) (56) (65)

Purchase-accounting adjustments.............................................................. (136) (109) (67)

$63,859 $42,235 $38,593

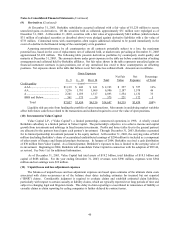

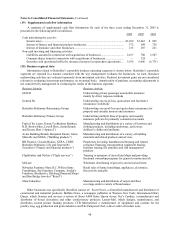

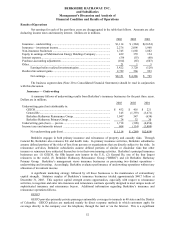

Operating Businesses: Earnings (loss) before taxes

Insurance group: 2003 2002 2001

Underwriting gain (loss):

GEICO.................................................................................................... $ 452 $ 416 $ 221

General Re.............................................................................................. 145 (1,393) (3,671)

Berkshire Hathaway Reinsurance Group................................................ 1,047 547 (634)

Berkshire Hathaway Primary Group....................................................... 74 32 30

Net investment income.............................................................................. 3,223 3,050 2,824

Total insurance group................................................................................... 4,941 2,652 (1,230)

Apparel......................................................................................................... 289 229 (33)

Building products ......................................................................................... 559 516 461

Finance and financial products..................................................................... 619 726 402

Flight services .............................................................................................. 72 225 186

McLane Company........................................................................................ 150 — —

Retail ............................................................................................................ 165 166 175

Shaw Industries ............................................................................................ 436 424 292

Other businesses........................................................................................... 486 381 320

7,717 5,319 573

Reconciliation of segments to consolidated amount:

Realized investment gains ......................................................................... 4,121 884 1,445

Equity in earnings of MidAmerican Energy Holdings Company.............. 429 359 134

Interest expense, excluding interest allocated to business segments ......... (94) (86) (92)

Corporate and other................................................................................... 24 2 8

Goodwill amortization and other purchase-accounting adjustments ......... (177) (119) (630)

$12,020 $ 6,359 $ 1,438