Berkshire Hathaway 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

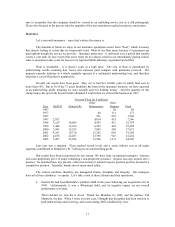

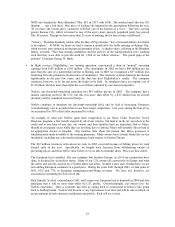

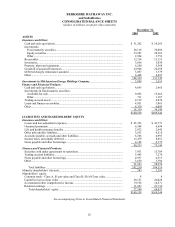

Investments

The table that follows shows our common stock investments. Those that had a market value of

more than $500 million at the end of 2003 are itemized.

12/31/03

Shares Company Percentage of

Company Owned Cost Market

(in $ millions)

151,610,700 American Express Company ................ 11.8 $ 1,470 $ 7,312

200,000,000 The Coca-Cola Company ..................... 8.2 1,299 10,150

96,000,000 The Gillette Company .......................... 9.5 600 3,526

14,610,900 H&R Block, Inc.................................... 8.2 227 809

15,476,500 HCA Inc. .............................................. 3.1 492 665

6,708,760 M&T Bank Corporation ....................... 5.6 103 659

24,000,000 Moody’ s Corporation ........................... 16.1 499 1,453

2,338,961,000 PetroChina Company Limited.............. 1.3 488 1,340

1,727,765 The Washington Post Company ........... 18.1 11 1,367

56,448,380 Wells Fargo & Company...................... 3.3 463 3,324

Others ................................................... 2,863 4,682

Total Common Stocks .......................... $ 8,515 $35,287

We bought some Wells Fargo shares last year. Otherwise, among our six largest holdings, we last

changed our position in Coca-Cola in 1994, American Express in 1998, Gillette in 1989, Washington Post

in 1973, and Moody’ s in 2000. Brokers don’ t love us.

We are neither enthusiastic nor negative about the portfolio we hold. We own pieces of excellent

businesses – all of which had good gains in intrinsic value last year – but their current prices reflect their

excellence. The unpleasant corollary to this conclusion is that I made a big mistake in not selling several of

our larger holdings during The Great Bubble. If these stocks are fully priced now, you may wonder what I

was thinking four years ago when their intrinsic value was lower and their prices far higher. So do I.

In 2002, junk bonds became very cheap, and we purchased about $8 billion of these. The

pendulum swung quickly though, and this sector now looks decidedly unattractive to us. Yesterday’ s

weeds are today being priced as flowers.

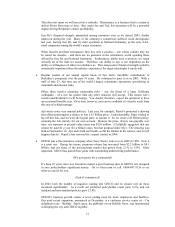

We’ ve repeatedly emphasized that realized gains at Berkshire are meaningless for analytical

purposes. We have a huge amount of unrealized gains on our books, and our thinking about when, and if,

to cash them depends not at all on a desire to report earnings at one specific time or another. Nevertheless,

to see the diversity of our investment activities, you may be interested in the following table, categorizing

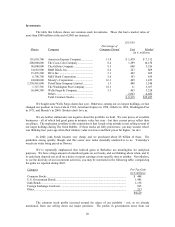

the gains we reported during 2003:

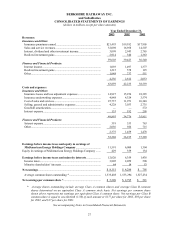

Category Pre-Tax Gain

(in $ million)

Common Stocks .............................................................................................................. $ 448

U.S. Government Bonds.................................................................................................. 1,485

Junk Bonds......................................................................................................................1,138

Foreign Exchange Contracts ........................................................................................... 825

Other................................................................................................................................ 233

$4,129

The common stock profits occurred around the edges of our portfolio – not, as we already

mentioned, from our selling down our major positions. The profits in governments arose from our