Berkshire Hathaway 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

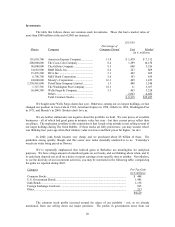

liquidation of long-term strips (the most volatile of government securities) and from certain strategies I

follow within our finance and financial products division. We retained most of our junk portfolio, selling

only a few issues. Calls and maturing bonds accounted for the rest of the gains in the junk category.

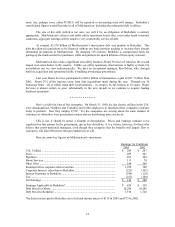

During 2002 we entered the foreign currency market for the first time in my life, and in 2003 we

enlarged our position, as I became increasingly bearish on the dollar. I should note that the cemetery for

seers has a huge section set aside for macro forecasters. We have in fact made few macro forecasts at

Berkshire, and we have seldom seen others make them with sustained success.

We have – and will continue to have – the bulk of Berkshire’ s net worth in U.S. assets. But in

recent years our country’ s trade deficit has been force-feeding huge amounts of claims on, and ownership

in, America to the rest of the world. For a time, foreign appetite for these assets readily absorbed the

supply. Late in 2002, however, the world started choking on this diet, and the dollar’ s value began to slide

against major currencies. Even so, prevailing exchange rates will not lead to a material letup in our trade

deficit. So whether foreign investors like it or not, they will continue to be flooded with dollars. The

consequences of this are anybody’ s guess. They could, however, be troublesome – and reach, in fact, well

beyond currency markets.

As an American, I hope there is a benign ending to this problem. I myself suggested one possible

solution – which, incidentally, leaves Charlie cold – in a November 10, 2003 article in Fortune Magazine.

Then again, perhaps the alarms I have raised will prove needless: Our country’ s dynamism and resiliency

have repeatedly made fools of naysayers. But Berkshire holds many billions of cash-equivalents

denominated in dollars. So I feel more comfortable owning foreign-exchange contracts that are at least a

partial offset to that position.

These contracts are subject to accounting rules that require changes in their value to be

contemporaneously included in capital gains or losses, even though the contracts have not been closed. We

show these changes each quarter in the Finance and Financial Products segment of our earnings statement.

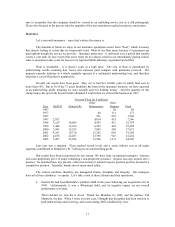

At yearend, our open foreign exchange contracts totaled about $12 billion at market values and were spread

among five currencies. Also, when we were purchasing junk bonds in 2002, we tried when possible to buy

issues denominated in Euros. Today, we own about $1 billion of these.

When we can’ t find anything exciting in which to invest, our “default” position is U.S. Treasuries,

both bills and repos. No matter how low the yields on these instruments go, we never “reach” for a little

more income by dropping our credit standards or by extending maturities. Charlie and I detest taking even

small risks unless we feel we are being adequately compensated for doing so. About as far as we will go

down that path is to occasionally eat cottage cheese a day after the expiration date on the carton.

* * * * * * * * * * * *

A 2003 book that investors can learn much from is Bull! by Maggie Mahar. Two other books I’ d

recommend are The Smartest Guys in the Room by Bethany McLean and Peter Elkind, and In an Uncertain

World by Bob Rubin. All three are well-reported and well-written. Additionally, Jason Zweig last year did

a first-class job in revising The Intelligent Investor, my favorite book on investing.

Designated Gifts Program

From 1981 through 2002, Berkshire administered a program whereby shareholders could direct

Berkshire to make gifts to their favorite charitable organizations. Over the years we disbursed $197 million

pursuant to this program. Churches were the most frequently named designees, and many thousands of

other organizations benefited as well. We were the only major public company that offered such a program

to shareholders, and Charlie and I were proud of it.

We reluctantly terminated the program in 2003 because of controversy over the abortion issue.

Over the years numerous organizations on both sides of this issue had been designated by our shareholders

to receive contributions. As a result, we regularly received some objections to the gifts designated for pro-

choice operations. A few of these came from people and organizations that proceeded to boycott products