Berkshire Hathaway 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

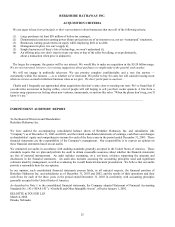

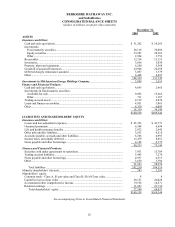

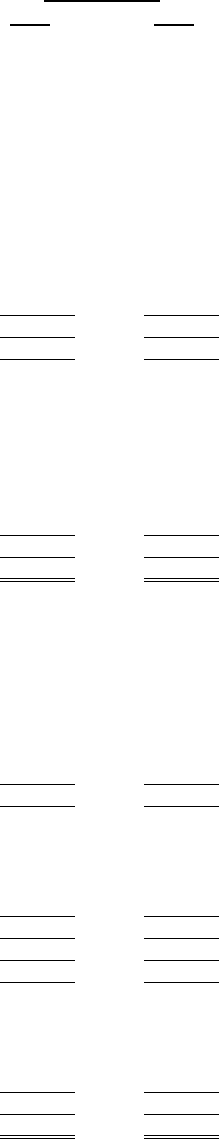

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions except per share amounts)

December 31,

2003 2002

ASSETS

Insurance and Other:

Cash and cash e

q

uivalents.............................................................................................. $ 31,262 $ 10,283

Investments:

Fixed maturit

y

securities............................................................................................. 26,116 38,096

E

q

uit

y

securities ......................................................................................................... 35,287 28,363

Othe

r

........................................................................................................................... 2,924 3,752

Receivables .................................................................................................................... 12,314 13,153

Inventories...................................................................................................................... 3,656 3,030

Pro

p

ert

y

,

p

lant and e

q

ui

p

men

t

........................................................................................ 6,260 5,368

Goodwill of ac

q

uired businesses.................................................................................... 22,948 22,298

Deferred char

g

es reinsurance assumed .......................................................................... 3,087 3,379

Othe

r

............................................................................................................................... 4,468 4,023

148,322 131,745

Investments in MidAmerican Ener

gy

Holdin

g

s Com

p

an

y

............................................. 3,899 3,651

F

inance and Financial Products:

Cash and cash e

q

uivalents.............................................................................................. 4,695 2,465

Investments in fixed maturit

y

securities:

Available-for-sale ....................................................................................................... 9,092 15,666

Othe

r

........................................................................................................................... 711 1,187

Tradin

g

account assets ................................................................................................... 4,519 6,874

Loans and finance receivables........................................................................................ 4,951 3,863

Othe

r

............................................................................................................................... 4,370 4,093

28,338 34,148

$180,559 $169,544

LIABILITIES AND SHAREHOLDERS’ E

Q

UITY

Insurance and Other:

Losses and loss ad

j

ustment ex

p

enses ............................................................................. $ 45,393 $ 43,771

Unearned

p

remiums ....................................................................................................... 6,308 6,694

Life and health insurance benefits.................................................................................. 2,872 2,642

Other

p

olic

y

holder liabilities.......................................................................................... 3,635 4,218

Accounts

p

a

y

able, accruals and other liabilities............................................................. 6,386 4,995

Income taxes,

p

rinci

p

all

y

deferred ................................................................................. 11,479 8,051

N

otes

p

a

y

able and other borrowin

g

s .............................................................................. 4,182 4,775

80,255 75,146

F

inance and Financial Products:

Securities sold under a

g

reements to re

p

urchase............................................................. 7,931 13,789

Tradin

g

account liabilities.............................................................................................. 5,445 7,274

N

otes

p

a

y

able and other borrowin

g

s .............................................................................. 4,937 4,513

Othe

r

............................................................................................................................... 3,650 3,394

21,963 28,970

Total liabilities.............................................................................................................. 102,218 104,116

Minorit

y

shareholders’ interests........................................................................................ 745 1,391

Shareholders’ e

q

uit

y

:

Common stock - Class A, $5

p

ar value and Class B, $0.1667

p

ar value........................ 88

Ca

p

ital in excess of

p

ar value......................................................................................... 26,151 26,028

Accumulated other com

p

rehensive income.................................................................... 19,556 14,271

Retained earnin

g

s ........................................................................................................... 31,881 23,730

Total shareholders’ e

q

uit

y

........................................................................................ 77,596 64,037

$180,559 $169,544

See accompanying Notes to Consolidated Financial Statements