Berkshire Hathaway 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

We will continue the capital allocation practices we have used in the past. If stocks become

significantly cheaper than entire businesses, we will buy them aggressively. If selected bonds become

attractive, as they did in 2002, we will again load up on these securities. Under any market or economic

conditions, we will be happy to buy businesses that meet our standards. And, for those that do, the bigger

the better. Our capital is underutilized now, but that will happen periodically. It’ s a painful condition to be

in – but not as painful as doing something stupid. (I speak from experience.)

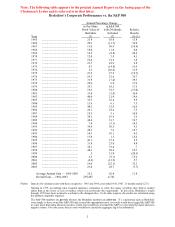

Overall, we are certain Berkshire’ s performance in the future will fall far short of what it has been

in the past. Nonetheless, Charlie and I remain hopeful that we can deliver results that are modestly above

average. That’ s what we’ re being paid for.

Acquisitions

As regular readers know, our acquisitions have often come about in strange ways. None, however,

had a more unusual genesis than our purchase last year of Clayton Homes.

The unlikely source was a group of finance students from the University of Tennessee, and their

teacher, Dr. Al Auxier. For the past five years, Al has brought his class to Omaha, where the group tours

Nebraska Furniture Mart and Borsheim’ s, eats at Gorat’ s and then comes to Kiewit Plaza for a session with

me. Usually about 40 students participate.

After two hours of give-and-take, the group traditionally presents me with a thank-you gift. (The

doors stay locked until they do.) In past years it’ s been items such as a football signed by Phil Fulmer and

a basketball from Tennessee’ s famous women’ s team.

This past February, the group opted for a book – which, luckily for me, was the recently-published

autobiography of Jim Clayton, founder of Clayton Homes. I already knew the company to be the class act

of the manufactured housing industry, knowledge I acquired after earlier making the mistake of buying

some distressed junk debt of Oakwood Homes, one of the industry’ s largest companies. At the time of that

purchase, I did not understand how atrocious consumer-financing practices had become throughout most of

the manufactured housing industry. But I learned: Oakwood rather promptly went bankrupt.

Manufactured housing, it should be emphasized, can deliver very good value to home purchasers.

Indeed, for decades, the industry has accounted for more than 15% of the homes built in the U.S. During

those years, moreover, both the quality and variety of manufactured houses consistently improved.

Progress in design and construction was not matched, however, by progress in distribution and

financing. Instead, as the years went by, the industry’ s business model increasingly centered on the ability

of both the retailer and manufacturer to unload terrible loans on naive lenders. When “securitization” then

became popular in the 1990s, further distancing the supplier of funds from the lending transaction, the

industry’ s conduct went from bad to worse. Much of its volume a few years back came from buyers who

shouldn’ t have bought, financed by lenders who shouldn’ t have lent. The consequence has been huge

numbers of repossessions and pitifully low recoveries on the units repossessed.

Oakwood participated fully in the insanity. But Clayton, though it could not isolate itself from

industry practices, behaved considerably better than its major competitors.

Upon receiving Jim Clayton’ s book, I told the students how much I admired his record and they

took that message back to Knoxville, home of both the University of Tennessee and Clayton Homes. Al

then suggested that I call Kevin Clayton, Jim’ s son and the CEO, to express my views directly. As I talked

with Kevin, it became clear that he was both able and a straight-shooter.

Soon thereafter, I made an offer for the business based solely on Jim’ s book, my evaluation of

Kevin, the public financials of Clayton and what I had learned from the Oakwood experience. Clayton’ s

board was receptive, since it understood that the large-scale financing Clayton would need in the future

might be hard to get. Lenders had fled the industry and securitizations, when possible at all, carried far