Berkshire Hathaway 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

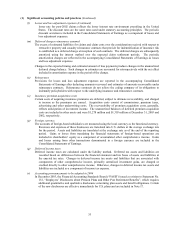

(12) Notes payable and other borrowings (Continued)

On May 28, 2002, Berkshire issued 40,000 SQUARZ securities for net proceeds of $398 million. Each SQUARZ

security consists of a $10,000 par amount senior note due in November 2007 together with a warrant, which expires in

May 2007, to purchase either 0.1116 shares of Class A common stock or 3.3480 shares of Class B common stock for

$10,000. A warrant premium is payable to Berkshire at an annual rate of 3.75% and interest is payable to note holders

at a rate of 3.00% per annum. All debt and warrants issued in conjunction with SQUARZ securities were outstanding at

December 31, 2003.

In September 2003, Berkshire Hathaway Finance Corporation (“BHFC”), a wholly-owned subsidiary of Berkshire,

issued $1.5 billion par of senior notes consisting of $750 million par of 3.375% notes due 2008 and $750 million par of

4.625% notes due 2013. In December 2003, BHFC issued an additional $500 million par of 4.20% notes due 2010. The

proceeds were used in the financing activities of Clayton Homes.

Bank borrowings due 2006 relate to Berkadia LLC’ s (“Berkadia”) floating rate loan to FINOVA Capital

Corporation, a subsidiary of The FINOVA Group (“FNV”) in connection with a restructuring of all of that entity’ s then

outstanding bank debt and publicly traded debt securities in August 2001. Berkadia financed the entire loan to FNV

($5.6 billion) through a floating rate loan from a third party lending facility led by Fleet Bank (“Fleet Loan”), which is

secured by the FNV loan. Subsequent to December 31, 2003, FNV repaid the entire remaining principal amount on the

loan and Berkadia has fully repaid the Fleet Loan.

Generally, Berkshire’ s guarantee of a subsidiary’ s debt obligation is an absolute, unconditional and irrevocable

guarantee for the full and prompt payment when due of all present and future payment obligations of the issuer.

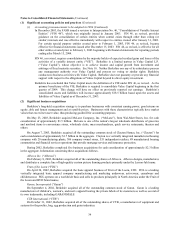

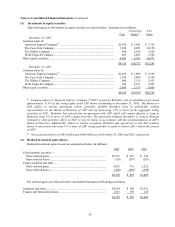

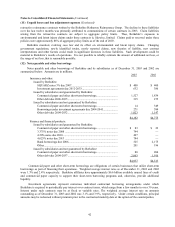

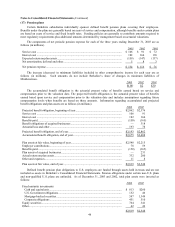

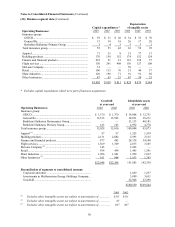

Payments of principal amounts expected during the next five years are as follows (in millions).

2004 2005 2006 2007 2008

Insurance and other.............................................................. $1,606 $255 $118 $556 $ 15

Finance and financial products ............................................ 1,347 79 129 107 1,057

$2,953 $334 $247 $663 $1,072

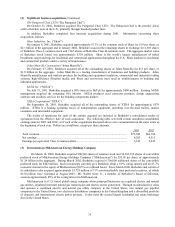

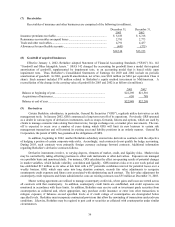

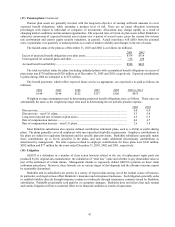

(13) Income taxes

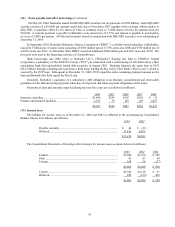

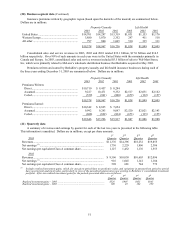

The liability for income taxes as of December 31, 2003 and 2002 as reflected in the accompanying Consolidated

Balance Sheets is as follows (in millions). 2003 2002

Payable currently ................................................................................. $ 44 $ (21)

Deferred ............................................................................................... 11,435 8,072

$11,479 $8,051

The Consolidated Statements of Earnings reflect charges for income taxes as shown below (in millions).

2003 2002 2001

Federal ................................................................................................. $3,490 $1,916 $ 599

State ..................................................................................................... 81 87 68

Foreign ................................................................................................. 234 56 (77)

$3,805 $2,059 $ 590

Current ................................................................................................. $3,346 $2,218 $ 91

Deferred ............................................................................................... 459 (159) 499

$3,805 $2,059 $ 590