Berkshire Hathaway 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Management’s Discussion (Continued)

Insurance — Underwriting (Continued)

General Re (Continued)

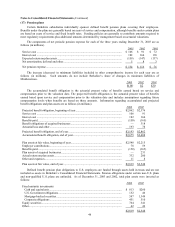

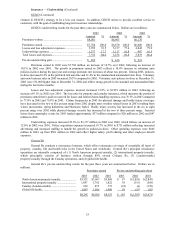

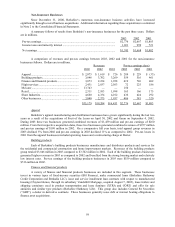

losses in August and European storm Jeanette in October. The underwriting loss of $568 million in 2001 included

$247 million of net losses related to the September 11th terrorist attack and $143 million resulting from other large

individual property losses.

At December 31, 2003, the international property/casualty operations had gross loss reserves of $6.4

billion, ($6.0 billion net of reinsurance) compared to $5.4 billion in gross loss reserves at December 31, 2002 ($5.1

billion net of reinsurance). The increase in reserves during 2003 was primarily due to changes in foreign currency

rates. The overall economic effect of foreign currency changes were mitigated because foreign denominated

liabilities are largely offset by assets denominated in those currencies.

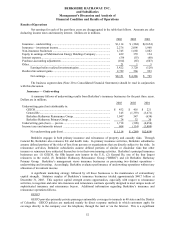

Faraday (London-market)

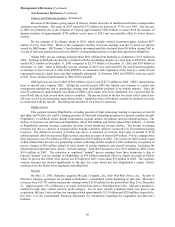

London-market business is written through Faraday Holdings Limited (“Faraday”). Faraday owns the

managing agent of Syndicate 435 at Lloyd’ s of London and provides capacity and participates in the results of

Syndicate 435. Through Faraday, General Re’ s participation in Syndicate 435 was 100% in 2003. Also included in

the London-market segment are Cologne Re’ s UK and Continental Europe broker-market subsidiaries.

Premiums earned in the London-market operations increased $95 million (11.1%) in 2003 as compared to

2002. Premiums earned in 2002 increased $280 million (48.7%) over 2001 amounts. In local currencies, premiums

earned in 2003 were unchanged from 2002 and increased 41.9% in 2002 over 2001. In 2003, premiums earned

from Cologne Re’ s Continental Europe broker-market subsidiary, which was placed in run-off, declined but were

offset by increases in earned premiums in Faraday Syndicate 435. Premiums earned in 2002 increased primarily

due to the increased participation in Faraday Syndicate 435 from 60.6% in 2001 to 96.7% in 2002.

London-market operations produced a pre-tax underwriting loss of $18 million in 2003, compared with

pre-tax underwriting losses of $4 million and $178 million in 2002 and 2001, respectively. The underwriting loss in

2003 included $73 million of reserve increases related to prior years’ loss events. These losses occurred primarily

in casualty lines. In 2003, underwriting gains were earned in property and aviation lines, reflecting more selective

underwriting and a lack of catastrophes and other large losses. Underwriting results in 2002 were adversely

impacted by $80 million of increases in prior years’ casualty loss reserve estimates and $17 million of European

flood losses. Offsetting these amounts were gains in property business. The London-market underwriting loss in

2001 included $66 million of losses from the September 11th terrorist attack as well as relatively high property

losses.

At December 31, 2003, the Faraday operations had gross loss reserves of $1.9 billion, ($1.7 billion net of

reinsurance) compared to $1.7 billion in gross reserves at December 31, 2002 ($1.3 billion net of reinsurance). The

increase in reserves during 2003 was primarily due to changes in foreign currency rates.

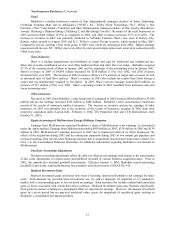

Global life/health

General Re’ s global life/health affiliates reinsure such risks worldwide. Premiums earned in 2003

decreased by $39 million (2.1%) compared with 2002. Premiums earned in 2002 for the global life/health

operations declined $102 million (5.1%) from 2001. Adjusting for the effects of foreign currency exchange,

premiums earned declined 9.6% in 2003, and 6.7% in 2002. The decline in 2003 was primarily due to decreases in

the group and individual health businesses in the U.S. life/health operations.

Underwriting results for the global life/health operations produced a pre-tax underwriting gain of $58

million in 2003, compared with underwriting losses of $55 million and $82 million in 2002 and 2001, respectively.

While both the U.S. and international life/health segments were profitable in 2003, most of the gains were earned in

the international life segment. The underwriting losses for 2002 and 2001 were principally due to increased

reserves on run-off business in the U.S. life/health operations. Underwriting results for 2001 also include $19

million of net losses related to the September 11th terrorist attack.