Berkshire Hathaway 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

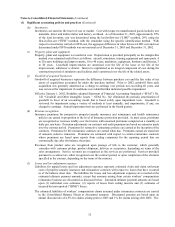

Notes to Consolidated Financial Statements (Continued)

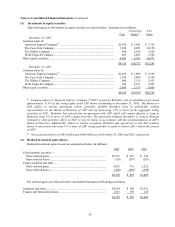

(1) Significant accounting policies and practices (Continued)

(h) Inventories

Inventories are stated at the lower of cost or market. Cost with respect to manufactured goods includes raw

materials, direct and indirect labor and factory overhead. As of December 31, 2003, approximately 59%

of the total inventory cost was determined using the last-in-first-out (“LIFO”) method, 28% using the

first-in-first-out (“FIFO”) method, with the remainder using the specific identification method. With

respect to inventories carried at LIFO cost, the aggregate difference in value between LIFO cost and cost

determined under FIFO methods was not material as of December 31, 2003 and December 31, 2002.

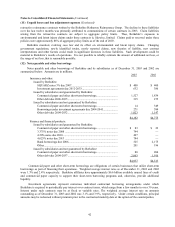

(i) Property, plant and equipment

Property, plant and equipment is recorded at cost. Depreciation is provided principally on the straight-line

method over estimated useful lives as follows: aircraft, simulators, training equipment and spare parts, 4

to 20 years; buildings and improvements, 10 to 40 years; machinery, equipment, furniture and fixtures, 3

to 20 years. Leasehold improvements are amortized over the life of the lease or the life of the

improvement, whichever is shorter. Interest is capitalized as an integral component of cost during the

construction period of simulators and facilities and is amortized over the life of the related assets.

(j) Goodwill of acquired businesses

Goodwill of acquired businesses represents the difference between purchase cost and the fair value of net

assets of acquisitions accounted for under the purchase method. Prior to 2002, goodwill from each

acquisition was generally amortized as a charge to earnings over periods not exceeding 40 years, and

was reviewed for impairment if conditions were identified that indicated possible impairment.

Effective January 1, 2002, Berkshire adopted Statement of Financial Accounting Standards (“SFAS”) No.

142 “Goodwill and Other Intangible Assets.” SFAS No. 142 eliminated the periodic amortization of

goodwill in favor of an accounting model that is based solely upon impairment tests. Goodwill is

reviewed for impairment using a variety of methods at least annually, and impairments, if any, are

charged to earnings. Annual impairment tests are performed in the fourth quarter.

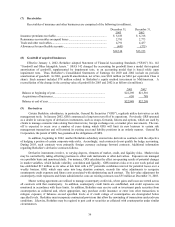

(k) Revenue recognition

Insurance premiums for prospective property/casualty insurance and reinsurance and health reinsurance

policies are earned in proportion to the level of insurance protection provided. In most cases, premiums

are recognized as revenues ratably over their terms with unearned premiums computed on a monthly or

daily pro rata basis. Premium adjustments on contracts and audit premiums are based on estimates made

over the contract period. Premiums for retroactive reinsurance policies are earned at the inception of the

contracts. Premiums for life reinsurance contracts are earned when due. Premiums earned are stated net

of amounts ceded to reinsurers. Premiums are estimated with respect to certain reinsurance contracts

where premiums are based upon reports from ceding companies for the reporting period that are

contractually due after the balance sheet date.

Revenues from product sales are recognized upon passage of title to the customer, which generally

coincides with customer pickup, product shipment, delivery or acceptance, depending on terms of the

sales arrangement. Service revenues are recognized as the services are performed. Services provided

pursuant to a contract are either recognized over the contract period, or upon completion of the elements

specified in the contract, depending on the terms of the contract.

(l) Losses and loss adjustment expenses

Liabilities for unpaid losses and loss adjustment expenses represent estimated claim and claim settlement

costs of property/casualty insurance and reinsurance contracts with respect to losses that have occurred

as of the balance sheet date. The liabilities for losses and loss adjustment expenses are recorded at the

estimated ultimate payment amounts, except that amounts arising from certain workers’ compensation

reinsurance business are discounted as discussed below. Estimated ultimate payment amounts are based

upon (1) individual case estimates, (2) reports of losses from ceding insurers and (3) estimates of

incurred but not reported (“IBNR”) losses.

The estimated liabilities of workers’ compensation claims assumed under reinsurance contracts are carried

in the Consolidated Balance Sheets at discounted amounts. Discounted amounts are based upon an

annual discount rate of 4.5% for claims arising prior to 2003 and 1% for claims arising after 2002. The