Berkshire Hathaway 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

some day, perhaps soon, either PUHCA will be repealed or accounting rules will change. Berkshire’ s

consolidated figures would then take in all of MidAmerican, including the substantial debt it utilizes.

The size of this debt (which is not now, nor will it be, an obligation of Berkshire) is entirely

appropriate. MidAmerican’ s diverse and stable utility operations assure that, even under harsh economic

conditions, aggregate earnings will be ample to very comfortably service all debt.

At yearend, $1.578 billion of MidAmerican’ s most junior debt was payable to Berkshire. This

debt has allowed acquisitions to be financed without our three partners needing to increase their already

substantial investments in MidAmerican. By charging 11% interest, Berkshire is compensated fairly for

putting up the funds needed for purchases, while our partners are spared dilution of their equity interests.

MidAmerican also owns a significant non-utility business, Home Services of America, the second

largest real estate broker in the country. Unlike our utility operations, this business is highly cyclical, but

nevertheless one we view enthusiastically. We have an exceptional manager, Ron Peltier, who, through

both his acquisition and operational skills, is building a brokerage powerhouse.

Last year, Home Services participated in $48.6 billion of transactions, a gain of $11.7 billion from

2002. About 23% of the increase came from four acquisitions made during the year. Through our 16

brokerage firms – all of which retain their local identities – we employ 16,343 brokers in 16 states. Home

Services is almost certain to grow substantially in the next decade as we continue to acquire leading

localized operations.

* * * * * * * * * * * *

Here’ s a tidbit for fans of free enterprise. On March 31, 1990, the day electric utilities in the U.K.

were denationalized, Northern and Yorkshire had 6,800 employees in functions these companies continue

today to perform. Now they employ 2,539. Yet the companies are serving about the same number of

customers as when they were government owned and are distributing more electricity.

This is not, it should be noted, a triumph of deregulation. Prices and earnings continue to be

regulated in a fair manner by the government, just as they should be. It is a victory, however, for those who

believe that profit-motivated managers, even though they recognize that the benefits will largely flow to

customers, will find efficiencies that government never will.

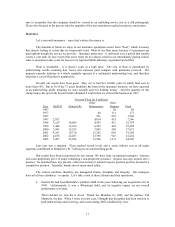

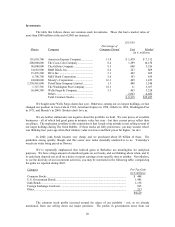

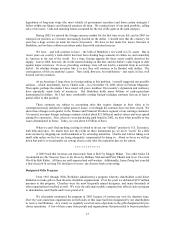

Here are some key figures on MidAmerican’ s operations:

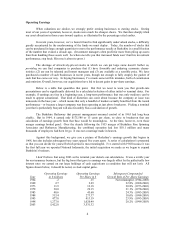

Earnings (in $ millions)

2003 2002

U.K. Utilities ...................................................................................................... $ 289 $ 267

Iowa.................................................................................................................... 269 241

Pipelines ............................................................................................................. 261 104

Home Services.................................................................................................... 113 70

Other (Net) ......................................................................................................... 144 108

Earnings before corporate interest and tax ......................................................... 1,076 790

Corporate Interest, other than to Berkshire......................................................... (225) (192)

Interest Payments to Berkshire........................................................................... (184) (118)

Tax...................................................................................................................... (251) (100)

Net Earnings....................................................................................................... $ 416 $ 380

Earnings Applicable to Berkshire*..................................................................... $ 429 $ 359

Debt Owed to Others.......................................................................................... 10,296 10,286

Debt Owed to Berkshire ..................................................................................... 1,578 1,728

*Includes interest paid to Berkshire (net of related income taxes) of $118 in 2003 and $75 in 2002.