Berkshire Hathaway 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

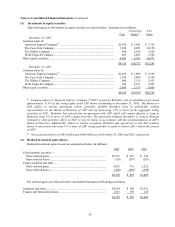

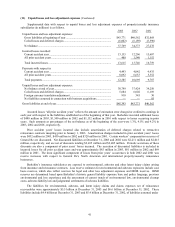

(17) Pension plans (Continued)

Pension plan assets are generally invested with the long-term objective of earning sufficient amounts to cover

expected benefit obligations, while assuming a prudent level of risk. There are no target allocation investment

percentages with respect to individual or categories of investments. Allocations may change rapidly as a result of

changing market conditions and investment opportunities. The expected rates of return on plan assets reflect Berkshire’ s

subjective assessment of expected invested asset returns over a period of several years, given the current low interest

rate environment and current equity security valuations, in general. Actual experience will differ from the assumed

rates, in particular over quarterly or annual periods as a result of market volatility and changes in the mix of assets.

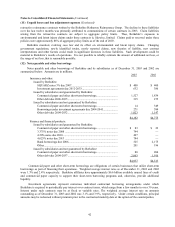

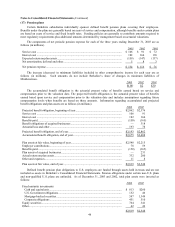

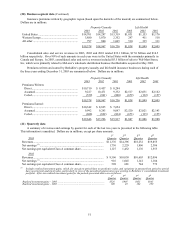

The funded status of the plans as of December 31, 2003 and 2002 is as follows (in millions).

2003 2002

Excess of projected benefit obligations over plan assets.................................................. $374 $314

Unrecognized net actuarial gains and other...................................................................... 134 108

Accrued benefit cost liability............................................................................................ $508 $422

The total net deficit status for plans (including unfunded plans) with accumulated benefit obligations in excess of

plan assets was $378 million and $320 million as of December 31, 2003 and 2002, respectively. Expected contributions

to plans during 2004 are estimated to be $72 million.

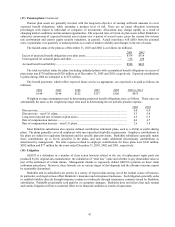

The benefit payments, which reflect expected future service as appropriate, are expected to be paid as follows (in

millions).

2004 2005 2006 2007 2008 2009 to 2013

$144 $144 $152 $157 $166 $955

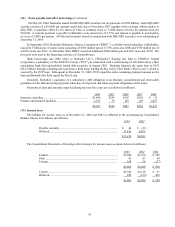

Weighted average assumptions used in determining projected benefit obligations were as follows. These rates are

substantially the same as the weighted average rates used in determining the net periodic pension expense.

2003 2002

Discount rate............................................................................................................................ 6.0 6.4

Discount rate – non-U.S. plans................................................................................................ 5.3 5.9

Long-term expected rate of return on plan assets .................................................................... 6.5 6.5

Rate of compensation increase ................................................................................................ 4.6 4.7

Rate of compensation increase – non-U.S. plans..................................................................... 2.6 3.8

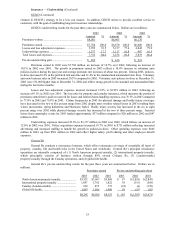

Most Berkshire subsidiaries also sponsor defined contribution retirement plans, such as a 401(k) or profit sharing

plans. The plans generally cover all employees who meet specified eligibility requirements. Employee contributions to

the plans are subject to regulatory limitations and the specific plan provisions. Berkshire subsidiaries generally match

these contributions up to levels specified in the plans, and may make additional discretionary contributions as

determined by management. The total expenses related to employer contributions for these plans were $242 million,

$202 million and $77 million for the years ended December 31, 2003, 2002 and 2001, respectively.

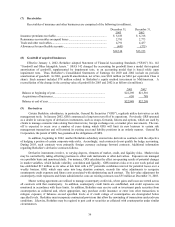

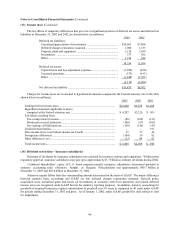

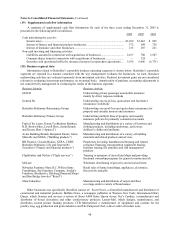

(18) Litigation

GEICO is a defendant in a number of class action lawsuits related to the use of replacement repair parts not

produced by the original auto manufacturer, the calculation of “total loss” value and whether to pay diminished value as

part of the settlement of certain claims. Management intends to vigorously defend GEICO’ s position on these claim

settlement procedures. However, these lawsuits are in various stages of development and the ultimate outcome cannot

be reasonably determined.

Berkshire and its subsidiaries are parties in a variety of legal actions arising out of the normal course of business.

In particular, such legal actions affect Berkshire’ s insurance and reinsurance businesses. Such litigation generally seeks

to establish liability directly through insurance contracts or indirectly through reinsurance contracts issued by Berkshire

subsidiaries. Plaintiffs occasionally seek punitive or exemplary damages. Berkshire does not believe that such normal

and routine litigation will have a material effect on its financial condition or results of operations.