Berkshire Hathaway 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

2003 ANNUAL REPORT

TABLE OF CONTENTS

Business Activities.................................................... Inside Front Cover

Corporate Performance vs. the S&P 500 ................................................ 2

Chairman’ s Letter* ................................................................................. 3

Selected Financial Data For The

Past Five Years .................................................................................. 24

Acquisition Criteria ................................................................................25

Independent Auditors’ Report ................................................................25

Consolidated Financial Statements.........................................................26

Management’ s Discussion ......................................................................52

Owner’ s Manual .....................................................................................69

Common Stock Data............................................................................... 75

Operating Companies ............................................................................. 76

Directors and Officers of the Company.........................Inside Back Cover

*Copyright © 2004 By Warren E. Buffett

All Rights Reserved

Table of contents

-

Page 1

...25 Independent Auditors' Report ...25 Consolidated Financial Statements ...26 Management' s Discussion ...52 Owner' s Manual ...69 Common Stock Data...75 Operating Companies ...76 Directors and Officers of the Company ...Inside Back Cover *Copyright © 2004 By Warren E. Buffett All Rights Reserved -

Page 2

... investing strategies (BH Finance), commercial and consumer lending (Berkshire Hathaway Credit Corporation and Clayton Homes), transportation equipment and furniture leasing (XTRA and CORT) and risk management activities (General Re Securities). In addition, Berkshire' s other non-insurance business... -

Page 3

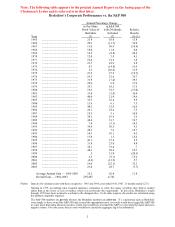

...1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market rather than at the lower of cost or market, which was previously the requirement. In this table, Berkshire's results through... -

Page 4

... INC. To the Shareholders of Berkshire Hathaway Inc.: Our gain in net worth during 2003 was $13.6 billion, which increased the per-share book value of both our Class A and Class B stock by 21%. Over the last 39 years (that is, since present management took over) per-share book value has grown from... -

Page 5

... a decade ago. (Investment managers often profit far more from piling up assets than from handling those assets well. So when one tells you that increased funds won' t hurt his investment performance, step back: His nose is about to grow.) The shortage of attractively-priced stocks in which we can... -

Page 6

... than our purchase last year of Clayton Homes. The unlikely source was a group of finance students from the University of Tennessee, and their teacher, Dr. Al Auxier. For the past five years, Al has brought his class to Omaha, where the group tours Nebraska Furniture Mart and Borsheim' s, eats at... -

Page 7

... and a B share. Al got an A share. If you meet some of the new Tennessee shareholders at our annual meeting, give them your thanks. And ask them if they' ve read any good books lately In early spring, Byron Trott, a Managing Director of Goldman Sachs, told me that Wal-Mart wished to sell its McLane... -

Page 8

...clearly winning. Today, many large corporations - run by CEOs whose fiddle-playing talents make your Chairman look like he is all thumbs - pay nothing close to the stated federal tax rate of 35%. In 1985, Berkshire paid $132 million in federal income taxes, and all corporations paid $61 billion. The... -

Page 9

...tangible assets - the directors experienced a "counter-revelation" and immediately signed on with the new manager and accepted its fee schedule. In effect, the directors decided that whoever would pay the most for the old management company was the party that should manage the shareholders' money in... -

Page 10

.... We urge fund directors to continue the job. Like directors throughout Corporate America, these fiduciaries must now decide whether their job is to work for owners or for managers. Berkshire Governance True independence - meaning the willingness to challenge a forceful CEO when something is... -

Page 11

... that the ultimate scorecard on its performance will be determined by the record of my successor. He or she will need to maintain Berkshire' s culture, allocate capital and keep a group of America' s best managers happy in their jobs. This isn' t the toughest task in the world - the train is already... -

Page 12

... immediately paying claims, since it sometimes takes years for losses to be reported (think asbestos), negotiated and settled. Float is wonderful - if it doesn' t come at a high price. The cost of float is determined by underwriting results, meaning how losses and expenses paid compare with premiums... -

Page 13

... will. • Regular readers of our annual reports know of Ajit Jain' s incredible contributions to Berkshire' s prosperity over the past 18 years. He continued to pour it on in 2003. With a staff of only 23, Ajit runs one of the world' s largest reinsurance operations, specializing in mammoth and... -

Page 14

... me to the company. Because MidAmerican is subject to the Public Utility Holding Company Act ("PUHCA"), Berkshire' s voting interest is limited to 9.9%. Walter has the controlling vote. Our limited voting interest forces us to account for MidAmerican in our financial statements in an abbreviated... -

Page 15

... interest, Berkshire is compensated fairly for putting up the funds needed for purchases, while our partners are spared dilution of their equity interests. MidAmerican also owns a significant non-utility business, Home Services of America, the second largest real estate broker in the country. Unlike... -

Page 16

...could not effectively be measured or limited. Moreover, we knew that any major problems the operation might experience would likely correlate with troubles in the financial or insurance world that would affect Berkshire elsewhere. In other words, if the derivatives business were ever to need shoring... -

Page 17

... for Ajit Jain' s life and annuity business in this section. That' s because this business, in large part, involves arbitraging money. Our annuities range from a retail product sold directly on the Internet to structured settlements that require us to make payments for 70 years or more to people... -

Page 18

... balance sheet and earnings statement consolidating the entire group. Balance Sheet 12/31/03 (in $ millions) Assets Cash and equivalents ...Accounts and notes receivable ...Inventory ...Other current assets ...Total current assets ...Goodwill and other intangibles...Fixed assets ...Other assets... -

Page 19

..., $59 million. Both R.C. Willey and Nebraska Furniture Mart ("NFM") opened hugely successful stores last year, Willey in Las Vegas and NFM in Kansas City, Kansas. Indeed, we believe the Kansas City store is the country' s largest-volume home-furnishings store. (Our Omaha operation, while located on... -

Page 20

... aircraft early in the year. Specifically, we bought back fractions from withdrawing owners at prevailing prices, and these fell in value before we were able to remarket them. Prices are now stable. The European loss is painful. But any company that forsakes Europe, as all of our competitors have... -

Page 21

... Bank Corporation ...Moody' s Corporation ...PetroChina Company Limited ...The Washington Post Company ...Wells Fargo & Company...Others ...Total Common Stocks ... 11.8 8.2 9.5 8.2 3.1 5.6 16.1 1.3 18.1 3.3 We bought some Wells Fargo shares last year. Otherwise, among our six largest holdings, we... -

Page 22

... well-reported and well-written. Additionally, Jason Zweig last year did a first-class job in revising The Intelligent Investor, my favorite book on investing. Designated Gifts Program From 1981 through 2002, Berkshire administered a program whereby shareholders could direct Berkshire to make gifts... -

Page 23

... signed up American Express (800-799-6634) to give you special help. They do a terrific job for us each year, and I thank them for it. In our usual fashion, we will run vans from the larger hotels to the meeting. Afterwards, the vans will make trips back to the hotels and to Nebraska Furniture Mart... -

Page 24

... Furniture Mart, located on a 77-acre site on 72nd Street between Dodge and Pacific, we will again be having "Berkshire Weekend" pricing, which means we will be offering our shareholders a discount that is customarily given only to employees. We initiated this special pricing at NFM seven years... -

Page 25

BERKSHIRE HATHAWAY INC. and Subsidiaries Selected Financial Data for the Past Five Years (dollars in millions except per share data) 2003 Revenues: Insurance premiums earned ...Sales and service revenues...Interest, dividend and other investment income ...Interest and other revenues of finance and ... -

Page 26

... about new ventures, turnarounds, or auction-like sales: "When the phone don' t ring, you' ll know it' s me." _____ INDEPENDENT AUDITORS' REPORT To the Board of Directors and Shareholders Berkshire Hathaway Inc. We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc... -

Page 27

...acquired businesses...Deferred charges reinsurance assumed ...Other...Investments in MidAmerican Energy Holdings Company ...Finance and Financial Products: Cash and cash equivalents...Investments in fixed maturity securities: Available-for-sale ...Other ...Trading account assets ...Loans and finance... -

Page 28

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (dollars in millions except per share amounts) Year Ended December 31, 2003 2002 2001 Revenues: Insurance and Other: Insurance premiums earned...Sales and service revenues ...Interest, dividend and other investment income ... -

Page 29

... reinsurance assumed ...Unearned premiums ...Receivables ...Accounts payable, accruals and other liabilities ...Finance businesses operating activities...Income taxes ...Other...Net cash flows from operating activities ...Cash flows from investing activities: Purchases of securities with fixed... -

Page 30

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY AND COMPREHENSIVE INCOME (dollars in millions) Year Ended December 31, 2003 2002 2001 Class A & B Common Stock Balance at beginning and end of year...$ 8 $ 8 $ 8 Capital in Excess of Par Value ... -

Page 31

... impaired and are included in the Consolidated Statements of Earnings. Berkshire reviews investments classified as held-to-maturity or available-for-sale as of each balance sheet date with respect to investments of an issuer carried at a net unrealized loss. If in management' s (c) (d) 30 -

Page 32

... claim on the investee' s book value. (e) Loans and finance receivables Loans and finance receivables consist of commercial and consumer loans originated or purchased by Berkshire' s finance and financial products businesses. Loans and finance receivables are carried at amortized cost. Derivatives... -

Page 33

... insurers and (3) estimates of incurred but not reported ("IBNR") losses. The estimated liabilities of workers' compensation claims assumed under reinsurance contracts are carried in the Consolidated Balance Sheets at discounted amounts. Discounted amounts are based upon an annual discount rate... -

Page 34

...Financial Accounting Standards Board ("FASB") issued a revision to Statement No. 132, "Employers' Disclosures about Pension Plans and Other Post Retirement Benefits", which requires additional quantitative and qualitative disclosures concerning plan assets and benefit obligations. Certain of the new... -

Page 35

...able and honest management and at sensible prices. Businesses with these characteristics typically have market values that exceed net asset value, thus producing goodwill for accounting purposes. On May 23, 2003, Berkshire acquired McLane Company, Inc. ("McLane"), from Wal-Mart Stores, Inc. for cash... -

Page 36

...Existing MiTek management acquired the remaining 10% interest. MiTek produces steel connector products, design engineering software and ancillary services for the building components market. XTRA Corporation ("XTRA") On September 20, 2001, Berkshire acquired all of the outstanding shares of XTRA for... -

Page 37

Notes to Consolidated Financial Statements (Continued) (3) Investments in MidAmerican Energy Holdings Company (Continued) While the convertible preferred stock does not vote generally with the common stock in the election of directors, the convertible preferred stock gives Berkshire the right to ... -

Page 38

... ...Obligations of foreign governments ...Corporate bonds and redeemable preferred stocks ...Mortgage-backed securities ...Finance and financial products, available-for-sale: Obligations of U.S. Treasury, U.S. government corporations and agencies ...Corporate bonds ...Mortgage-backed securities... -

Page 39

...Value Data with respect to investments in equity securities are shown below. Amounts are in millions. Unrealized Cost Gains(2) December 31, 2003 Common stock of: American Express Company(1) ...$1,470 $ 5,842 The Coca-Cola Company ...1,299 8,851 The Gillette Company ...600 2,926 Wells Fargo & Company... -

Page 40

... rate, foreign exchange rate, or market price movements. The runoff is expected to occur over a number of years during which GRS will limit its new business to certain risk management transactions and will unwind its existing asset and liability positions in an orderly manner. General Re Corporation... -

Page 41

... assets of finance and financial products businesses. In January of 2004, Berkshire received a cash distribution of $30 million from Value Capital. As a limited partner, Berkshire' s exposure to loss is limited to the carrying value of its investment. Beginning in 2004, Berkshire will consolidate... -

Page 42

... from prior years' occurrences in both 2002 and 2001 was reserve increases with respect to General Re' s North American and international property/casualty reinsurance businesses. Berkshire' s insurance subsidiaries are exposed to environmental, asbestos and other latent injury claims arising from... -

Page 43

... liquidity. Investment agreements represent numerous individual contractual borrowing arrangements under which Berkshire is required to periodically pay interest over contract terms, which range from a few months to over 30 years. Interest under such contracts may be at fixed or variable rates. The... -

Page 44

..., which expires in May 2007, to purchase either 0.1116 shares of Class A common stock or 3.3480 shares of Class B common stock for $10,000. A warrant premium is payable to Berkshire at an annual rate of 3.75% and interest is payable to note holders at a rate of 3.00% per annum. All debt and warrants... -

Page 45

... policy acquisition costs, unrealized gains and losses on investments in securities with fixed maturities and related deferred income taxes are recognized under GAAP but not for statutory reporting purposes. In addition, statutory accounting for goodwill of acquired businesses requires amortization... -

Page 46

..., independent pricing services or appraisals by Berkshire' s management were used. Those services and appraisals reflected the estimated present values utilizing current risk adjusted market rates of similar instruments. The carrying values of cash and cash equivalents, accounts receivable and... -

Page 47

..., end of year...$3,193 $2,675 $2,862 $2,408 $2,548 $2,215 78 59 (150) (165) - 231 332 200 11 8 $2,819 $2,548 Defined benefit pension plan obligations to U.S. employees are funded through assets held in trusts and are not included as assets in Berkshire' s Consolidated Financial Statements. Pension... -

Page 48

... of investments. Allocations may change rapidly as a result of changing market conditions and investment opportunities. The expected rates of return on plan assets reflect Berkshire' s subjective assessment of expected invested asset returns over a period of several years, given the current low... -

Page 49

... ("Apparel") Acme Building Brands, Benjamin Moore, Johns Manville and MiTek ("Building products") BH Finance, Clayton Homes, XTRA, CORT, Berkshire Hathaway Life and General Re Securities ("Finance and financial products") FlightSafety and NetJets ("Flight services") McLane Nebraska Furniture Mart... -

Page 50

.... Operating Businesses: Insurance group: Premiums earned: GEICO...General Re ...Berkshire Hathaway Reinsurance Group...Berkshire Hathaway Primary Group...Investment income...Total insurance group...Apparel...Building products ...Finance and financial products...Flight services ...McLane Company... -

Page 51

... acquisitions. Operating Businesses: Insurance group: GEICO...General Re ...Berkshire Hathaway Reinsurance Group...Berkshire Hathaway Primary Group...Total insurance group ...Apparel (1) ...Building products ...Finance and financial products ...Flight services...McLane Company (2) ...Retail ...Shaw... -

Page 52

... billion of sales to Wal-Mart Stores, Inc. which were primarily related to McLane' s wholesale distribution business that Berkshire acquired in May 2003. Premiums written and earned by Berkshire' s property/casualty and life/health insurance businesses during each of the three years ending December... -

Page 53

...the four largest reinsurers in the world, (3) Berkshire Hathaway Reinsurance Group ("BHRG") and (4) Berkshire Hathaway Primary Group. Berkshire' s management views insurance businesses as possessing two distinct operations - underwriting and investing. Accordingly, Berkshire evaluates performance of... -

Page 54

...of business written through 89% owned Cologne Re, (3) London-market property/casualty through the Faraday operations, and (4) global life/health. General Re' s pre-tax underwriting results for the past three years are summarized below. Dollars are in millions. Premiums earned North American property... -

Page 55

... cancellations in excess of new business. Premiums earned in 2001 included $400 million from one retroactive reinsurance contract and a large quota share agreement. No such contracts were written in 2002 or 2003. The North American property/casualty business produced a pre-tax underwriting gain of... -

Page 56

.../casualty operations write quota-share and excess reinsurance on risks around the world, with its largest markets in Continental Europe and the United Kingdom. International property/casualty business is written on a direct reinsurance basis primarily through Cologne Re. Premiums earned in 2003... -

Page 57

... denominated liabilities are largely offset by assets denominated in those currencies. Faraday (London-market) London-market business is written through Faraday Holdings Limited ("Faraday"). Faraday owns the managing agent of Syndicate 435 at Lloyd' s of London and provides capacity and participates... -

Page 58

... During the last two years, BHRG wrote a significant amount of business under traditional multi-line contracts. Such contracts included several quota-share participations in, and contracts with, Lloyd' s syndicates and a quota-share contract written in 2002 with a major U.S. based insurer, which was... -

Page 59

... (Continued) Insurance - Underwriting (Continued) Berkshire Hathaway Reinsurance Group (Continued) share arrangement, BHRG essentially participates proportionately in the premiums and claims of the business written by the ceding company. BHRG was willing to enter into these new contracts because... -

Page 60

... and lease furniture (XTRA and CORT) and offer for sale annuities and similar type products (Berkshire Hathaway Life). This group also includes General Re Securities ("GRS"), a dealer in derivative contracts. These businesses generally issue debt or interest bearing obligations to finance asset... -

Page 61

... ownership field. McLane On May 23, 2003, Berkshire acquired McLane Company, Inc. from Wal-Mart Stores, Inc. Results of McLane' s business operations are included in Berkshire' s consolidated results beginning on that date. McLane' s revenues were $13,743 million and pre-tax earnings totaled... -

Page 62

...of businesses acquired in 2002 from their respective acquisition dates (Larson-Juhl-February 8, 2002, The Pampered Chef and CTB International-both October 31, 2002). Equity in earnings of MidAmerican Energy Holdings Company Earnings from MidAmerican represent Berkshire' s share of MidAmerican' s net... -

Page 63

... which expire in May 2007. A warrant premium is payable to Berkshire at an annual rate of 3.75% and interest is payable to note holders at a rate of 3.00%. Each warrant provides the holder the right to purchase either 0.1116 shares of Class A or 3.348 shares of Class B stock for $10,000. In addition... -

Page 64

..., the amounts currently recorded in the financial statements may prove, with the benefit of hindsight, to be inaccurate. The balance sheet items most significantly affected by these estimates are property and casualty insurance and reinsurance related liabilities. Berkshire records liabilities for... -

Page 65

... of net premiums earned current year...* ** Net of reinsurance recoverable and deferred charges reinsurance assumed. Includes amortization of deferred charges and includes accretion of discounts on General Re workers' compensation reserves (See Note 11 to the Consolidated Financial Statements). 64 -

Page 66

... these assets are carried at fair values based upon current market quotations and, when not available, based upon fair value pricing models. Certain fixed maturity securities Berkshire owns are not actively traded in the markets. Further, Berkshire' s finance businesses maintain significant balances... -

Page 67

... average levels of shareholder capital to provide a margin of safety against short term equity price volatility. The carrying values of investments subject to equity price risks are based on quoted market prices or management' s estimates of fair value as of the balance sheet dates. Market prices... -

Page 68

... contracts provide that Berkshire receive certain foreign currencies and pay U.S. dollars at specified exchange rates and at specified future dates. Management entered into these contracts as an overall economic hedge of Berkshire' s net assets and business activities. The value of these contracts... -

Page 69

... financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible future Company actions, which may be provided by management are also forward-looking statements as defined by the Act. Forward-looking statements are based on current... -

Page 70

...effect, our shareholders behave in respect to their Berkshire stock much as Berkshire itself behaves in respect to companies in which it has an investment. As owners of, say, Coca-Cola or Gillette shares, we think of Berkshire as being a non-managing partner in two extraordinary businesses, in which... -

Page 71

... of marketable common stocks by our insurance subsidiaries. The price and availability of businesses and the need for insurance capital determine any given year' s capital allocation. In the last three years we have made eleven acquisitions. Though there will be dry years, we expect to make a number... -

Page 72

... "float," the funds of others that our insurance business holds because it receives premiums before needing to pay out losses. Both of these funding sources have grown rapidly and now total about $45 billion. Better yet, this funding to date has often been cost-free. Deferred tax liabilities bear no... -

Page 73

... existing shareholders' money: Owners unfairly lose if their managers deliberately sell assets for 80¢ that in fact are worth $1. We didn' t commit that kind of crime in our offering of Class B shares and we never will. (We did not, however, say at the time of the sale that our stock was overvalued... -

Page 74

... regularly report our per-share book value, an easily calculable number, though one of limited use. The limitations do not arise from our holdings of marketable securities, which are carried on our books at their current prices. Rather the inadequacies of book value have to do with the companies we... -

Page 75

... to the point of abdication: Though Berkshire has about 172,000 employees, only 16 of these are at headquarters. Charlie and I mainly attend to capital allocation and the care and feeding of our key managers. Most of these managers are happiest when they are left alone to run their businesses, and... -

Page 76

... owners. Price Range of Common Stock Berkshire' s Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List... -

Page 77

...Kirby (1) Larson-Juhl McLane Company Meriam Instrument (1) MidAmerican Energy Company (2) MidAmerican Energy Holdings Company MiTek Inc. National Indemnity Companies Nebraska Furniture Mart NetJets Northern Natural Gas (2) Northern and Yorkshire Electric (2) Northland (1) The Pampered Chef Precision... -

Page 78

... of Allen and Company Incorporated, an investment banking firm. REBECCA K. AMICK, Director of Internal Auditing JERRY W. HUFTON, Director of Taxes THOMAS S. MURPHY, Former Chairman of the Board and CEO of Capital Cities/ABC. MARK D. MILLARD, Director of Financial Assets RONALD L. OLSON, Partner...