Audi 2013 Annual Report Download - page 276

Download and view the complete annual report

Please find page 276 of the 2013 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ADDITIONAL DISCLOSURES

CONSOLIDATED FINANCIAL STATEMENTS

273

B

//

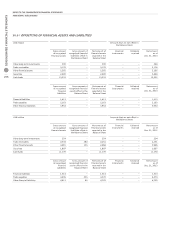

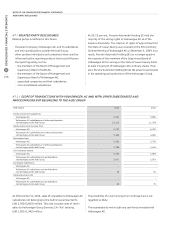

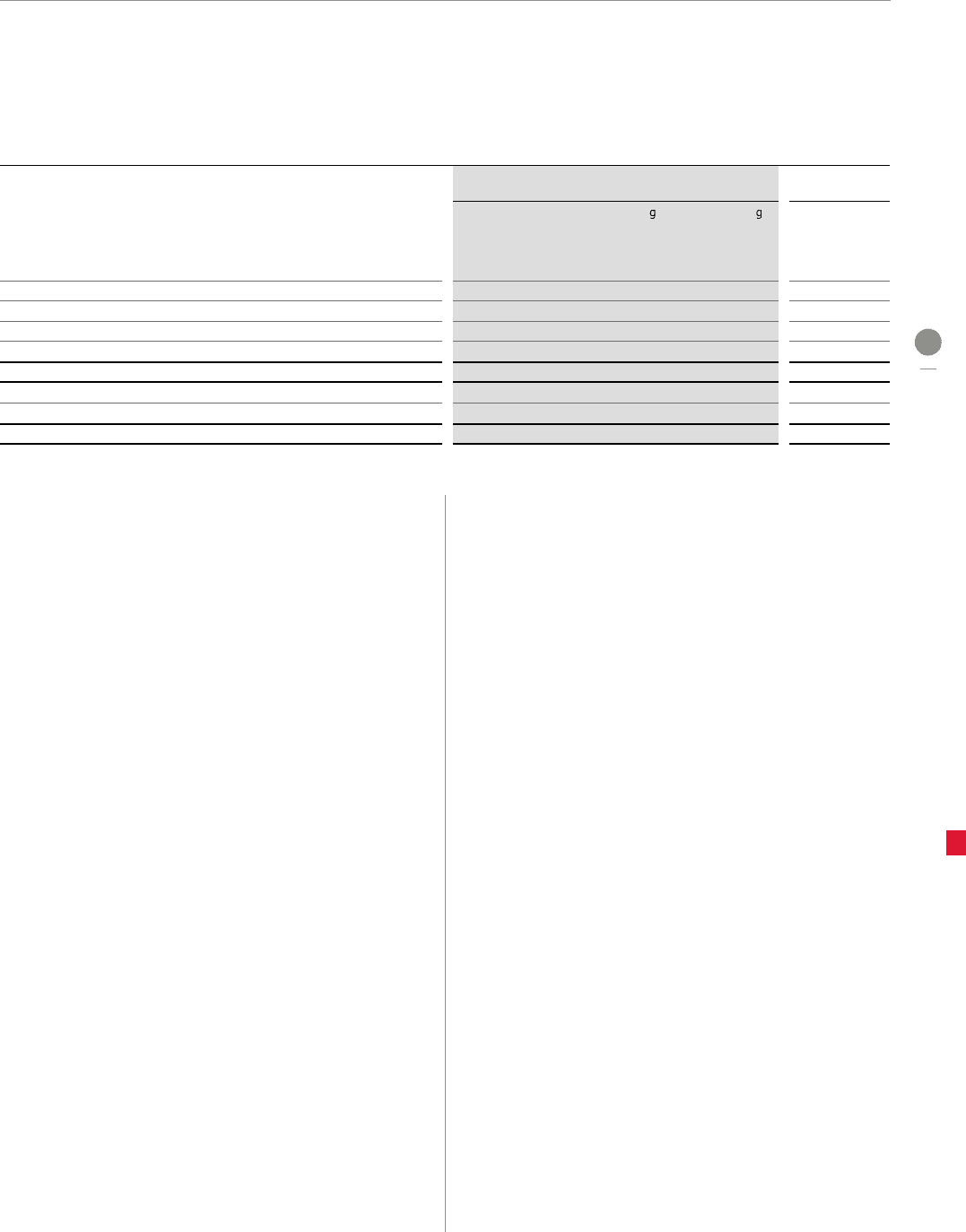

NOMINAL VOLUME OF DERIVATIVE FINANCIAL INSTRUMENTS

EUR million

Nominal volumes

Dec. 31, 2013 Remainin

term

up to 1 year

Remainin

term 1 to

5 years

Dec. 31, 2012

Contracts for foreign exchange futures 21,964 10,901 11,063 25,876

Contracts for foreign exchange options 618 149 469 –

Commodity futures 228 84 144 269

Currency swaps 2 2 – –

Cash flow hedges 22,812 11,135 11,677 26,144

Contracts for foreign exchange futures 623 391 232 698

Commodity futures 491 280 211 620

Other derivatives 1,114 672 443 1,318

The nominal volumes of the presented cash flow hedges for

hedging currency risks and commodity price risks represent the

total of all buying and selling prices on which the transactions

are based.

Due to the reduction in the planned figures, existing cash flow

hedge relationships with a nominal value of EUR 20 million were

reversed. EUR 1 million from the cash flow hedge reserve was

included under the financial result with a positive effect.

The derivative financial instruments used exhibit a maximum

hedging term of five years.

38 /

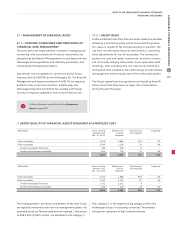

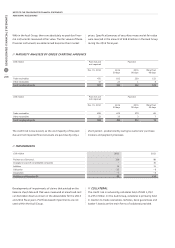

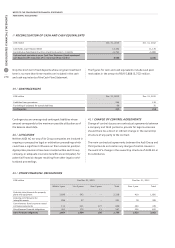

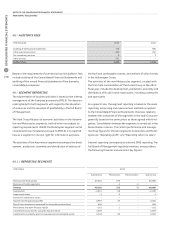

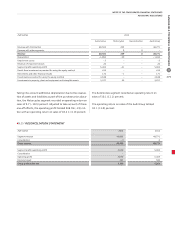

CASH FLOW STATEMENT

The Cash Flow Statement details the payment streams for both

the 2013 fiscal year and the previous year, categorized accord-

ing to cash outflow and inflow, investing and financing activi-

ties. The effects of changes in foreign exchange rates on cash

flows are presented separately.

Cash flow from operating activities includes all cash flows in

connection with ordinary activities and is presented using the

indirect calculation method. Starting from the profit before

profit transfer and income tax, all income and expenses with

no impact on cash flow (mainly write-downs) are excluded.

Cash flow from operating activities in 2013 included payments

for interest received amounting to EUR 46 (154) million and

for interest paid amounting to EUR 31 (53) million. In 2013 ,

the Audi Group received dividends and profit transfers totaling

EUR 430 (290) million. The “Income tax payments” item sub-

stantially comprises payments made to Volkswagen AG on the

basis of the single-entity relationship for tax purposes in

Germany, as well as payments to foreign tax authorities.

The item “Other non-cash income and expenses” primarily

includes non-cash income and expenses from the measure-

ment of derivative financial instruments.

Cash flow from investing activities includes capitalized devel-

opment costs as well as additions to other intangible assets,

property, plant and equipment, long-term financial invest-

ments and non-current borrowings. The proceeds from the

disposal of assets, the proceeds from the disposal of participa-

tions, and the change in securities and fixed deposits are simi-

larly reported in cash flow from investing activities.

Capital increases at non-consolidated subsidiaries resulted in a

total cash flow of EUR 31 (591) million. The previous year’s

figure also included cash outflows in connection with the acqui-

sition of the Ducati Group and the change in cash and cash

equivalents resulting from first-time consolidations. The acqui-

sition of investments in other participations resulted in an

outflow of EUR 5 (3,020) million.

Cash flow from financing activities includes cash used for the

transfer of profit, as well as changes in financial liabilities.

The changes in the Balance Sheet items that are presented in

the Cash Flow Statement cannot be derived directly from the

Balance Sheet because the effects of currency translation and

of changes in the group of consolidated companies do not

affect cash and are therefore not included in the Cash Flow

Statement.