Audi 2013 Annual Report Download - page 252

Download and view the complete annual report

Please find page 252 of the 2013 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTES TO THE BALANCE SHEET

CONSOLIDATED FINANCIAL STATEMENTS

249

B

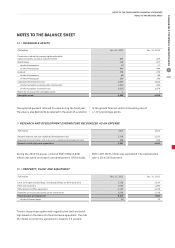

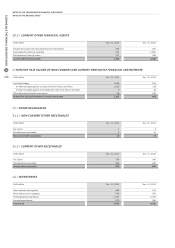

Inventories amounting to EUR 36,559 (35,467) million were

recorded as cost of goods sold at the same time that the reve-

nue from them was realized. EUR 912 (1,092) million of the

total inventories was capitalized at the net realizable value. The

impairment resulting from the measurement of inventories on

the basis of sales markets amounted to EUR 55 (76) million. No

reversals of impairment losses were performed in the fiscal year.

Of the finished goods inventory, a portion of the company car

fleet valued at EUR 219 (260) million has been pledged as col-

lateral for commitments toward employees, under the partial

retirement block model. The other reported inventories are not

subject to any significant restrictions on ownership or disposal.

Leased vehicles with an operating lease term of up to one year

were reported under inventories in the amount of EUR 670

(594) million. In the 2014 fiscal year, payments in the amount

of EUR 44 million are expected from non-cancelable leasing

relationships.

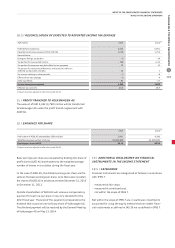

23 /

TRADE RECEIVABLES

Trade receivables of EUR 3,176 (2,251) million will be realized

within the next twelve months. Impairment losses on trade

receivables are detailed under Note 37.2, “Credit risks.”

24 /

EFFECTIVE INCOME TAX ASSETS

Entitlements to income tax rebates, predominantly for foreign

Group companies, are reported under this item.

25 /

SECURITIES AND CASH FUNDS

Securities include fixed or variable-interest securities and

equities in the amount of EUR 2,400 (1,807) million.

Cash funds essentially comprise credit balances with banks

and affiliated companies amounting to EUR 13,332 (11,170)

million. The credit balances with banks amounting to EUR 709

(482) million are held at various banks in different currencies.

Balances with affiliated companies include daily and short-term

investments with only marginal risk of fluctuations in value and

amount to EUR 12,622 (10,688) million.

26 /

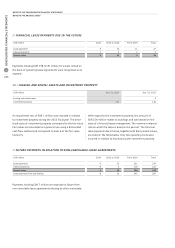

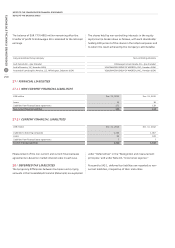

EQUITY

Information on the composition and development of equity is

provided on pages 220 and 221 in the Statement of Changes

in Equity.

The share capital of AUDI AG is unchanged, at

EUR 110,080,000. One share represents a notional share of

EUR 2.56 of the subscribed capital. This capital is divided into

43,000,000 no-par bearer shares.

The capital reserve contains premiums paid in connection with

the issuance of shares in the Company. During the year under

review, the capital reserve of AUDI AG rose to EUR 1,895 million

as a result of a contribution in the amount of EUR 6,979 million

by Volkswagen AG.

Retained earnings comprise accumulated gains and the revalu-

ations from pension plans.

Other reserves include changes in value of cash flow hedges,

available-for-sale investments, investments measured using

the equity method, and currency translation differences.

The risks and rewards under contracts for foreign exchange

futures and foreign exchange options, and under commodity

price and interest hedging transactions serving as hedges for

future cash flows are deferred in the reserve for cash flow

hedges with no effect on profit or loss. When the cash flow

hedges become due, the results from the settlement of the

hedging contracts are reported under the operating profit.

Unrealized gains and losses from the measurement at fair value

of financial assets available for sale are recognized in the reserve

for the market-price measurement of securities. Upon disposal

of the securities, share price gains and losses realized are

reported under the financial result.

Currency translation differences that do not affect profit or loss

and, on a pro rata basis, cash flow hedges with no effect on

profit or loss as well as the effects from the revaluation of pen-

sion schemes of companies valued at equity are included in the

reserve for investments accounted for using the equity method.