Audi 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECONOMIC REPORT

BUSINESS AND UNDERLYING SITUATION

MANAGEMENT REPORT

157

A

In Western Europe, the number of new cars registered fell by a

further 1.9 percent compared with the already low prior-year

figure. Despite a steadying of demand as the year progressed,

the overall market volume of 11.5 (11.7) million units was the

lowest for 20 years. Among Western Europe’s volume markets,

France and Italy suffered marked falls in sales of 5.6 and

7.1 percent respectively, whereas state incentives in Spain

prevented a renewed contraction in the number of passenger

cars sold. Increasing economic momentum led to strong con-

sumer demand in the United Kingdom car market, bolstering

new registrations by 10.7 percent. In Germany, on the other

hand, overall market demand receded by 4.2 percent to

3.0 (3.1) million units despite more stable conditions in the

second half of the year.

In Central and Eastern Europe, demand for cars fell mainly due

to lower new registrations in Russia. Subsidies for car buyers

from the Russian government failed to stave off a downturn in

sales, which decreased by 5.7 percent to 2.6 (2.7) million pas-

senger cars. On top of declining economic momentum, special

levies on imported vehicles held back demand last year.

The U.S. car market, by contrast, was characterized by an above-

average pace of growth. Above all favorable credit terms,

improved consumer confidence and a continuing high level

of replacement demand helped new registrations climb to

15.6 (14.5) million units – a rise of 7.7 percent or 1.1 million

passenger cars and light commercial vehicles.

In Latin America, the Brazilian car market reached 2.8 (2.9)

million units, the 3.1 percent fall meaning it only narrowly

missed the previous year’s record level. High demand in 2012

had reflected the widespread impact of tax breaks for newly

registered cars. The market in Argentina performed better,

with 8.9 percent more cars registered as new than in the pre-

vious year. At 640 (587) thousand units, this even beat the

previous record from 2011.

The Asia-Pacific region was again the main driver of the world-

wide car market in 2013, with new car registrations reaching

28.0 (25.8) million units. The Chinese car market proved espe-

cially dynamic. On the back of the robust general economic

situation, it expanded by 17.0 percent to 15.8 (13.5) million

new registrations. In India on the other hand, still-high financ-

ing costs and escalating fuel prices caused sales of new vehicles

to slip by 6.7 percent to 2.4 (2.5) million units. The car market

in Japan remained stable, at an unchanged 4.6 (4.6) million

passenger cars.

/

INTERNATIONAL MOTORCYCLE MARKET

Worldwide demand for motorcycles in the displacement seg-

ment above 500 cc showed little consistency in the year under

review. International registrations of new motorcycles in the

established markets slipped marginally by 0.5 percent. In Spain

and Italy, the persistently difficult overall economic situation

prompted downturns in demand of 14.0 and 11.3 percent

respectively. In France too, registrations of new motorcycles

were down 9.1 percent. By contrast, sales of motorcycles in the

United Kingdom and Germany remained stable. Those markets

delivered slight growth of 1.1 and 1.8 percent respectively.

The motorcycle markets in the United States and Japan gained

ground against a backdrop of economic stability. Overall market

demand grew slightly by 1.9 percent in the United States and

by 3.6 percent in Japan.

/

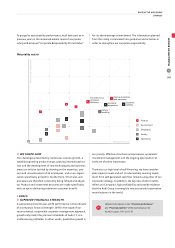

MANAGEMENT’S OVERALL ASSESSMENT

1) 2)

The Audi Group again performed very successfully in 2013

despite only moderate global economic growth. With

1,575,480 (1,455,123) Audi models delivered worldwide, we

achieved our strategic target of 1.5 million vehicles two years

earlier than planned. The substantial rise in deliveries of

8.3 percent is attributable not simply to higher overall demand

for cars, but above all to our attractive model portfolio and its

steady expansion. Deliveries of motorcycles of the Ducati brand

likewise increased in 2013 compared with the period January

through December 2012. Hand in hand with the positive devel-

opment in deliveries, revenue for the Audi Group increased to

EUR 49,880 (48,771) million. The Motorcycles segment saw

its revenue fall from the 2012 level to EUR 573 (606) million,

mainly as a result of lower other income. As part of our long-

term approach to corporate management, the Audi Group again

benefited from continuously optimized processes and cost

structures along the entire value chain in 2013. In view of the

cost-intensive input needed for new products and technologies,

the expansion of our international production structures and

the still-challenging environment in many markets, operating

profit for the Audi Group of EUR 5,030 (5,365) million did not

quite match the previous year’s high level. The operating return

on sales reached 10.1 percent and was therefore slightly above

our strategic target corridor of 8 to 10 percent. Its performance

in 2013 keeps the Audi Group among the most profitable vehicle

manufacturers in the world. Taking account of additional de-

preciation in view of the revaluation of assets and liabilities for

purchase price allocation, the Motorcycles segment achieved

an operating return on sales of 5.7 percent. Adjusted for these

extraordinary items, the operating return on sales for the

Motorcycles segment came to 10.2 percent. Thanks to its high

1) Prior-year figures have been adjusted to reflect the revised IAS 19.

2) The prior-year (pro forma) figures for the Motorcycles segment refer to the full-year 2012 for ease of comparison with the forecast.