Audi 2013 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2013 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

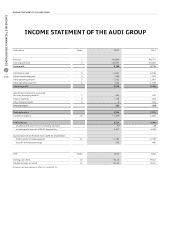

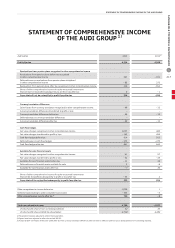

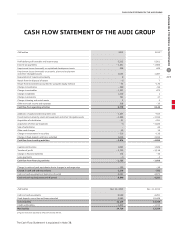

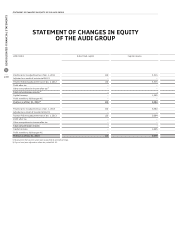

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

GENERAL INFORMATION

CONSOLIDATED FINANCIAL STATEMENTS

226

B

GENERAL INFORMATION

AUDI AG has the legal form of a German stock corporation

(Aktiengesellschaft). Its registered office is at Ettinger Strasse,

Ingolstadt, and the Company is recorded in the Commercial

Register of Ingolstadt under HR B 1.

Around 99.55 percent of the subscribed capital of AUDI AG is

held by Volkswagen AG, with which a control and profit transfer

agreement exists. The Consolidated Financial Statements of

AUDI AG are included in the Consolidated Financial Statements

of Volkswagen AG, which are held on file at the Local Court of

Wolfsburg. The purpose of the Company is the development,

production and sale of motor vehicles, other vehicles and

engines of all kinds, together with their accessories, as well as

machinery, tools and other technical articles.

/

ACCOUNTING PRINCIPLES

AUDI AG prepares its Consolidated Financial Statements on

the basis of the International Financial Reporting Standards

(IFRS) and the interpretations of the International Financial

Reporting Standards Interpretations Committee (IFRS IC). All

pronouncements of the International Accounting Standards

Board (IASB), whose application is mandatory in the European

Union (EU), have been observed. The prior-year figures have

been calculated according to the same principles.

The Income Statement is prepared according to the interna-

tionally practiced cost of sales method.

AUDI AG prepares its Consolidated Financial Statements in

euros (EUR). All figures have been rounded in accordance with

standard commercial practice, with the result that minor dis-

crepancies may occur when adding these amounts.

The Consolidated Financial Statements provide a true and fair

view of the net worth, financial position and financial perfor-

mance of the Audi Group.

The requirements of Section 315a of the German Commercial

Code (HGB) regarding the preparation of Consolidated Financial

Statements in accordance with IFRS, as endorsed by the EU,

are met.

All requirements that must be applied under German commer-

cial law are additionally observed in preparing the Consolidated

Financial Statements. In addition, the requirements of the

German Corporate Governance Code have been adhered to.

The Board of Management prepared the Consolidated Financial

Statements on February 6, 2014. This date marks the end of

the adjusting events period.

//

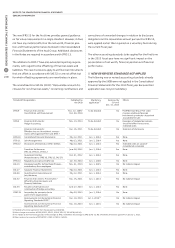

EFFECTS OF NEW OR REVISED STANDARDS

The Audi Group has implemented all of the accounting stand-

ards whose application became mandatory with effect from

the 2013 fiscal year.

The IASB’s revision of IAS 1 has resulted in changes in the way

that the Statement of Comprehensive Income is presented.

The items that come under other comprehensive income now

need to be differentiated according to whether they may prompt

reclassification into profit or loss at a later date when specific

conditions are met, or whether the possibility of such a reclas-

sification is excluded. The corresponding tax effects are also to

be assigned to these two groups. The Statement of Compre-

hensive Income and the Statement of Changes in Equity for

the Audi Group have been adjusted correspondingly. In the

Statement of Changes in Equity, the retained earnings now

comprise the accumulated profits along with the actuarial

gains and losses from pension obligations. The remaining

items are classified as “Other reserves.”

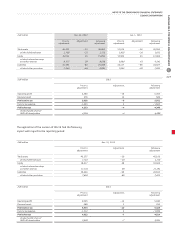

The revision of IAS 19 led to an adjustment in the way employee

benefits are accounted for. The effects on the Consolidated

Financial Statements are as follows:

>Bonus contributions for partial retirement agreements are

to be accrued in the periods of service pro rata in the block

model applied in the Audi Group.

>A past service cost for pension obligations is to be recognized

immediately in profit or loss.

>Pension obligations and plan assets are discounted at a

uniform interest rate (net interest approach).

Because of the retrospective application of the revision of IAS 19,

the comparative information has been adjusted accordingly.

Taking the change in reporting pursuant to IAS 1 into account,

this had the following effects: