Audi 2013 Annual Report Download - page 262

Download and view the complete annual report

Please find page 262 of the 2013 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297

|

|

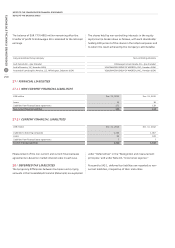

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ADDITIONAL DISCLOSURES

CONSOLIDATED FINANCIAL STATEMENTS

259

B

ADDITIONAL DISCLOSURES

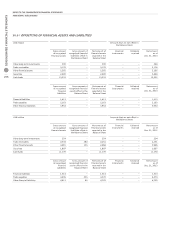

35 /

CAPITAL MANAGEMENT

The primary goal of capital management within the Audi Group

is to assure financial flexibility in order to achieve business and

growth targets, and to enable continuous, steady growth in the

value of the Company. In particular, management is focused

on achieving the minimum return demanded by the capital

market on the invested assets. The capital structure is steered

specifically with this in mind, and the economic environment is

kept under constant observation. The targets, methods and

procedures for optimizing capital management remained

unchanged at December 31, 2013. For this purpose, the devel-

opment of key cost and value factors are analyzed regularly;

appropriate optimization measures are then defined and their

implementation is monitored on an ongoing basis. To ensure

that resources are deployed as efficiently as possible, and to

measure success in this regard, the Audi Group has been using

the return on investment as an indicator based on capital

expenditure for several years now.

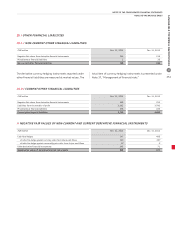

//

DEVELOPMENT OF CAPITAL

EUR million

Dec. 31, 2013 Dec. 31, 2012 1)

Equity 18,565 15,092

as % of total capital 41.1 37.4

Financial liabilities from profit transfer 4,595 5,103

of which current financial liabilities 1,228 1,168

of which non-current financial liabilities 186 145

of which liabilities from the transfer of profit 3,182 3,790

as % of total capital 10.2 12.6

Balance sheet total 45,156 40,401

1) Figures have been adjusted to reflect the revised IAS 19.

Around 99.55 percent of the subscribed capital is held by

Volkswagen AG, with which a control and profit transfer

agreement exists.

In the 2013 fiscal year, equity rose by 23.0 percent compared

to the prior year. This is primarily due to the allocation to the

retained earnings and a cash injection to the capital reserve by

Volkswagen AG.

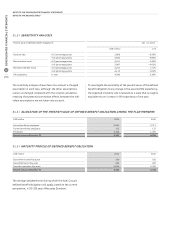

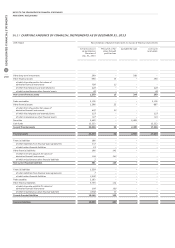

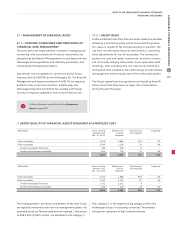

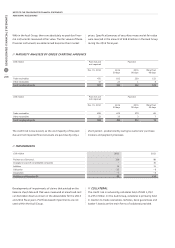

36 /

ADDITIONAL DISCLOSURES ON FINANCIAL

INSTRUMENTS IN THE BALANCE SHEET

36.1 /

FINANCIAL INSTRUMENTS MEASURED

AT FAIR VALUE

Measurement of financial instruments at fair value is based on

a three-level hierarchy and on the proximity of the measurement

factors used to an active market. An active market is one in

which homogeneous products are traded, where willing buyers

and sellers can be found for them at all times, and where their

prices are publicly available.

Level 1 involves the measurement of financial instruments,

such as securities, listed on active markets.

Level 2 involves the measurement of financial instruments such

as derivatives based on market-related, acknowledged financial

valuation models, where the measurement factors, such as

exchange rates or interest rates, can be observed directly or

indirectly on active markets.

In the Audi Group, level 3 mainly covers residual value hedging

arrangements with the retail trade. The input factors for mea-

suring the future development of used car prices cannot be

observed on active markets; they are forecast by various inde-

pendent institutions. The residual value hedging model is

explained in Note 37.4, “Market risks.”

Furthermore, non-current commodity futures are also measured

according to level 3, as the key parameters for their measure-

ment cannot be observed on active markets owing to the long-

term nature of the contracts, but are extrapolated. During the

previous year, rights to acquire shares in companies were also

assigned to fair value level 3, at which input factors that are

not derived from active markets can be used for measurement.