Audi 2013 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2013 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECONOMIC REPORT

BUSINESS AND UNDERLYING SITUATION

MANAGEMENT REPORT

156

A

BUSINESS AND

UNDERLYING SITUATION

/

GLOBAL ECONOMIC SITUATION

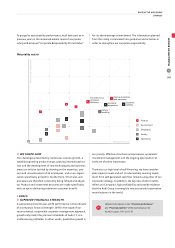

Growth in the global economy picked up speed over 2013, but

at 2.5 (2.6) percent the rate of increase was slightly below that

of the previous year due to the subdued economic performance

of the first half. From a low starting level, the economic situa-

tion in industrialized nations improved somewhat, despite

continuing structural challenges. On the other hand, most

emerging economies again achieved above-average growth

rates. Though many central banks adhered to expansionary

monetary policies, average inflation for the year remained at a

moderate level overall.

In Western Europe, economic development stagnated mainly as

a result of the sovereign debt crises and the continuing struc-

tural problems. In the previous year, gross domestic product had

even dipped by 0.3 percent. Despite signs of a slight recovery,

most countries on the southern fringe of Western Europe again

saw negative rates of growth. In contrast, the economic devel-

opment in the remaining Western European countries was

predominantly positive. Meanwhile, tension in the labor market

in Western Europe showed no signs of easing. The unemploy-

ment rate rose to 11.3 (10.7) percent and thus remained above

the long-term average. In Greece, Spain, Portugal and Cyprus,

the unemployment rate was significantly higher.

Economic growth in Germany was down on the previous year

at 0.5 (0.9) percent. The domestic economy showed upward

tendencies thanks to the continuing favorable trend in the

labor market and positive consumer confidence. At the same

time, the still-moderate performance of the global economy

held back international trade by the export-focused German

economy.

Economic development in Central and Eastern Europe exhibited

a slowdown over the past year. The principal cause was the

more subdued development of the Russian economy, which

expanded by a mere 1.6 (3.4) percent.

In the United States, gross domestic product was up just slightly

by 1.9 (2.8) percent despite more buoyant consumer confidence

and the improved labor market. Growth was inhibited by the

tax increases and state spending cuts which took effect at the

start of the year.

The Latin America region, on the other hand, saw the pace of

economic development quicken slightly. Gross domestic prod-

uct in Argentina and Brazil increased by 4.9 (1.9) percent and

2.3 (1.0) percent respectively, though structural deficits and

high inflation continued to weigh on development in both

countries.

Asia’s emerging economies again enjoyed the most dynamic

rates of expansion in 2013. China exceeded the state target of

7.5 percent to achieve a growth rate of 7.7 (7.7) for gross

domestic product. China was therefore the powerhouse of the

global economy once again. In India, economic growth of

5.0 (5.1) percent was influenced by high inflation and a chal-

lenging economic environment.

Japan’s gross domestic product climbed 1.7 (1.4) percent on

the back of economic stimulus measures and the substantial

devaluation of the yen.

/

INTERNATIONAL CAR MARKET

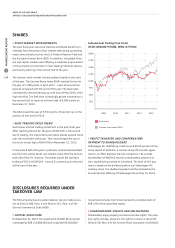

Global demand for cars grew at a rate of 5.0 percent in 2013

to 70.1 (66.7) million passenger cars – a new all-time record –

despite the global economy’s merely moderate growth. The

development was driven by the Asia-Pacific and North America

regions, while Latin America remained flat at the previous

year’s high level and European sales regions again contracted.

ECONOMIC REPORT

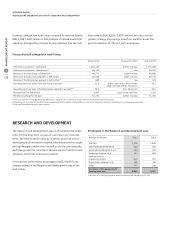

The Audi Group held its ground in 2013 in a challenging market environment

and increased deliveries of the core brand Audi by 8.3 percent to 1,575,480

cars. As a result, the strategic goal of delivering over 1.5 million vehicles to

customers worldwide was easily exceeded two years earlier than planned.