Audi 2013 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2013 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

RECOGNITION AND MEASUREMENT PRINCIPLES

CONSOLIDATED FINANCIAL STATEMENTS

234

B

Assignment to one of these categories depends on the pur-

pose for which the financial instruments were acquired and is

reviewed at the end of each reporting period.

The Audi Group does not make use of the fair value option, i.e.

choosing to measure certain assets and liabilities at fair value

through profit or loss.

For purchases and sales in the customary manner, recognition

takes place using settlement date accounting (in other words,

on the day on which an asset is delivered).

Initial measurement of financial assets and liabilities is carried

out at fair value.

Subsequent measurement is dependent on the category

assigned in accordance with IAS 39 and is carried out either

at amortized cost or at fair value.

The amortized cost of a financial asset or financial liability, using

the effective interest method, is the amount at which a finan-

cial instrument was measured at initial recognition minus any

principal repayments, impairment losses or uncollectible debts.

In the case of current financial assets and liabilities, the amor-

tized cost basically corresponds to the nominal value or the

repayment value.

Fair value generally corresponds to the market value or trading

price. If no active market exists, fair value is determined using

investment mathematics methods, for example by discounting

future cash flows at the market rate or applying established

option pricing models.

Financial instruments are abandoned if the rights to payments

from the investment have expired or been transferred and the

Audi Group has substantially transferred all risks and rewards

associated with their title.

With regard to factoring in the Audi Group, essentially all risks

and rewards are transferred.

Financial assets and liabilities include both non-derivative and

derivative claims or commitments, as detailed below.

Financial assets and liabilities are only offset if offsetting the

amounts is legally enforceable at the current time and if there

is an actual intention to offset.

//

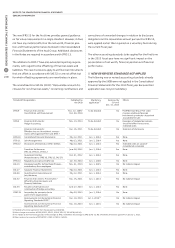

NON-DERIVATIVE FINANCIAL INSTRUMENTS

The “Loans and receivables” and “Financial liabilities measured

at amortized cost” categories include non-derivative financial

instruments measured at amortized cost. These include, in

particular:

>borrowings,

>trade receivables and payables,

>other current assets and liabilities,

>financial liabilities,

>cash and cash equivalents.

Assets and liabilities in foreign currencies are measured at the

relevant closing rates.

In the case of current items, the fair values to be additionally

indicated in the Notes correspond to the amortized cost. For

assets and liabilities with a remaining term of more than one

year, fair values are determined by discounting future cash flows

at market rates. Recognizable credit risks associated with “Loans

and receivables” are accounted for by carrying out specific allow-

ances. These are entered in the amount of the incurred loss for

significant individual receivables using benchmarks applied

uniformly across the Group. Potential impairment is assumed in

the event of various circumstances such as a payment delay of a

specific duration, introduction of coercive measures, the threat

of insolvency or excessive debts, an application for or the open-

ing of insolvency proceedings or the failure of restructuring

measures. Impairment losses on receivables are regularly

posted to separate impairment accounts.

The item “Available-for-sale financial assets” includes non-

derivative financial instruments that are either specifically

allocated to this category or cannot be allocated to any of the

other categories. This includes equity instruments, such as

equities, and debt instruments, such as interest-bearing

securities. As a general rule, financial instruments that fall

into this category are reported at their fair value. In the case

of listed financial instruments – exclusively securities in the

case of the Audi Group – the fair value corresponds to the

market value on the balance sheet date. Fluctuations in value

are accounted for within equity in the reserve for the market

valuation of securities, after taking deferred tax into account.

Unless there is evidence of lasting impairment, the financial

result includes only gains or losses realized through disposal.