The Hartford 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Interest rate risk is the risk of financial loss due to adverse changes in the value of assets and liabilities arising from movements in interest rates. Interest rate

risk encompasses exposures with respect to changes in the level of interest rates, the shape of the term structure of rates and the volatility of interest rates.

Interest rate risk does not include exposure to changes in credit spreads. The Company has exposure to interest rates arising from its fixed maturity securities,

interest sensitive liabilities and discount rate assumptions associated with the Company’s pension and other post retirement benefit obligations.

An increase in interest rates from current levels is generally a favorable development for the Company. Interest rate increases are expected to provide additional

net investment income, reduce the cost of the variable annuity hedging program, limit the potential risk of margin erosion due to minimum guaranteed crediting

rates in certain Talcott Resolution products and, if sustained, could reduce the Company’s prospective pension expense. Conversely, if long-term interest rates

rise dramatically within a six to twelve month time period, certain Talcott Resolution businesses may be exposed to disintermediation risk. Disintermediation

risk refers to the risk that policyholders will surrender their contracts in a rising interest rate environment requiring the Company to liquidate assets in an

unrealized loss position. In conjunction with the interest rate risk measurement and management techniques, certain of Talcott Resolution's fixed income

product offerings have market value adjustment provisions at contract surrender. An increase in interest rates may also impact the Company’s tax planning

strategies and in particular its ability to utilize tax benefits to offset certain previously recognized realized capital losses.

A decline in interest rates results in certain mortgage-backed and municipal securities being more susceptible to paydowns and prepayments or calls. During

such periods, the Company generally will not be able to reinvest the proceeds at comparable yields. Lower interest rates will also likely result in lower net

investment income, increased hedging cost associated with variable annuities and, if declines are sustained for a long period of time, it may subject the

Company to reinvestment risks, higher pension costs expense and possibly reduced profit margins associated with guaranteed crediting rates on certain Talcott

Resolution products. Conversely, the fair value of the investment portfolio will increase when interest rates decline and the Company’s interest expense will be

lower on its variable rate debt obligations.

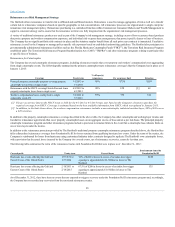

The Company manages its exposure to interest rate risk by constructing investment portfolios that maintain asset allocation limits and asset/liability duration

matching targets which may include the use of derivatives. The Company analyzes interest rate risk using various models including parametric models and

cash flow simulation under various market scenarios of the liabilities and their supporting investment portfolios, which may include derivative instruments.

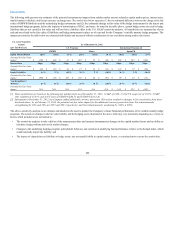

Measures the Company uses to quantify its exposure to interest rate risk inherent in its invested assets and interest rate sensitive liabilities include duration,

convexity and key rate duration. Duration is the price sensitivity of a financial instrument or series of cash flows to a parallel change in the underlying yield

curve used to value the financial instrument or series of cash flows. For example, a duration of 5 means the price of the security will change by approximately

5% for a 100 basis point change in interest rates. Convexity is used to approximate how the duration of a security changes as interest rates change in a parallel

manner. Key rate duration analysis measures the price sensitivity of a security or series of cash flows to each point along the yield curve and enables the

Company to estimate the price change of a security assuming non-parallel interest rate movements.

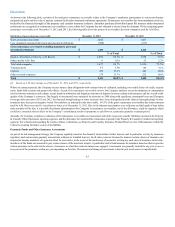

To calculate duration, convexity, and key rate durations, projections of asset and liability cash flows are discounted to a present value using interest rate

assumptions. These cash flows are then revalued at alternative interest rate levels to determine the percentage change in fair value due to an incremental change

in the entire yield curve for duration and convexity, or a particular point on the yield curve for key rate duration. Cash flows from corporate obligations are

assumed to be consistent with the contractual payment streams on a yield to worst basis. Yield to worst is a basis that represents the lowest potential yield that

can be received without the issuer actually defaulting. The primary assumptions used in calculating cash flow projections include expected asset payment

streams taking into account prepayment speeds, issuer call options and contract holder behavior. Mortgage-backed and asset-backed securities are modeled

based on estimates of the rate of future prepayments of principal over the remaining life of the securities. These estimates are developed by incorporating

collateral surveillance and anticipated future market dynamics. Actual prepayment experience may vary from these estimates.

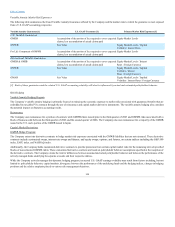

The Company is also exposed to interest rate risk based upon the discount rate assumption associated with the Company’s pension and other postretirement

benefit obligations. The discount rate assumption is based upon an interest rate yield curve comprised of bonds rated Aa with maturities primarily between

zero and thirty years. For further discussion of interest rate risk associated with the benefit obligations, see the Critical Accounting Estimates Section of the

MD&A under Pension and Other Postretirement Benefit Obligations and Note 18 of the Notes to Consolidated Financial Statements. In addition, management

evaluates performance of certain Talcott Resolution products based on net investment spread which is, in part, influenced by changes in interest rates. For

further discussion, see the Talcott Resolution section of the MD&A.

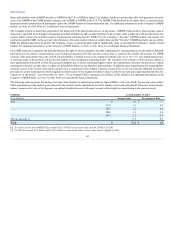

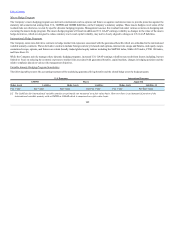

The investments and liabilities primarily associated with interest rate risk are included in the following discussion. Certain product liabilities, including those

containing GMWB, GMIB, GMAB, or GMDB, expose the Company to interest rate risk but also have significant equity risk. These liabilities are discussed

as part of the Equity Risk section below.

98