The Hartford 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

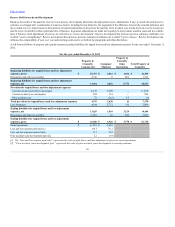

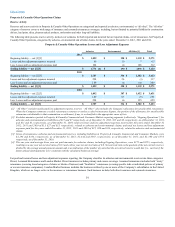

Reserve Activity

Reserves and reserve activity in Property & Casualty Other Operations are categorized and reported as asbestos, environmental, or “all other”. The “all other”

category of reserves covers a wide range of insurance and assumed reinsurance coverages, including, but not limited to, potential liability for construction

defects, lead paint, silica, pharmaceutical products, molestation and other long-tail liabilities.

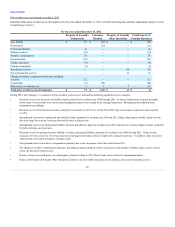

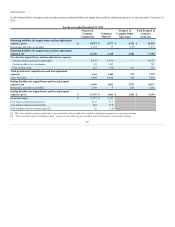

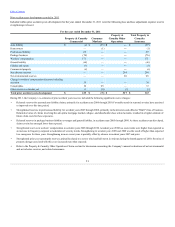

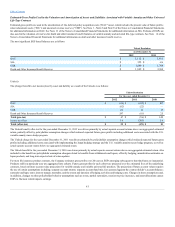

The following table presents reserve activity, inclusive of estimates for both reported and incurred but not reported claims, net of reinsurance, for Property &

Casualty Other Operations, categorized by asbestos, environmental and all other claims, for the years ended December 31, 2012, 2011 and 2010.

Beginning liability — net [2] [3]

Losses and loss adjustment expenses incurred 48 10 765

Less: Losses and loss adjustment expenses paid 164 40 108 312

Beginning liability — net [2] [3]

Losses and loss adjustment expenses incurred 294 26 (3)317

Less: Losses and loss adjustment expenses paid 189 40 140 369

Beginning liability — net [2] [3]

Losses and loss adjustment expenses incurred 189 67 (5) 251

Less: Losses and loss adjustment expenses paid 294 40 125 459

[1] “All Other” includes unallocated loss adjustment expense reserves. “All Other” also includes the Company’s allowance for uncollectible reinsurance.

When the Company commutes a ceded reinsurance contract or settles a ceded reinsurance dispute, the portion of the allowance for uncollectible

reinsurance attributable to that commutation or settlement, if any, is reclassified to the appropriate cause of loss.

[2] Excludes amounts reported in Property & Casualty Commercial and Consumer Markets reporting segments (collectively “Ongoing Operations”) for

asbestos and environmental net liabilities of $15 and $7 respectively, as of December 31, 2012, $15 and $8, respectively, as of December 31, 2011,

and $11 and $5, respectively, as of December 31, 2010; total net losses and loss adjustment expenses incurred for the years ended December 31,

2012, 2011 and 2010 of $13, $27 and $15, respectively, related to asbestos and environmental claims; and total net losses and loss adjustment

expenses paid for the years ended December 31, 2012, 2011 and 2010 of $15, $20 and $14, respectively, related to asbestos and environmental

claims.

[3] Gross of reinsurance, asbestos and environmental reserves, including liabilities in Property & Casualty Commercial and Consumer Markets, were

$2,294 and $334, respectively, as of December 31, 2012; $2,442 and $367, respectively, as of December 31, 2011; and $2,308 and $378,

respectively, as of December 31, 2010.

[4] The one year and average three year net paid amounts for asbestos claims, including Ongoing Operations, were $175 and $225, respectively,

resulting in a one year net survival ratio of 10.3 and a three year net survival ratio of 8.0. Net survival ratio is the quotient of the net carried reserves

divided by the average annual payment amount and is an indication of the number of years that the net carried reserve would last (i.e., survive) if the

future annual claim payments were consistent with the calculated historical average.

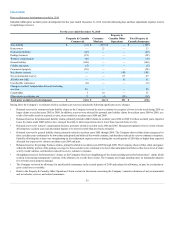

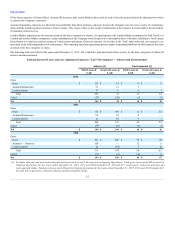

For paid and incurred losses and loss adjustment expenses reporting, the Company classifies its asbestos and environmental reserves into three categories:

Direct, Assumed Reinsurance and London Market. Direct insurance includes primary and excess coverage. Assumed reinsurance includes both “treaty”

reinsurance (covering broad categories of claims or blocks of business) and “facultative” reinsurance (covering specific risks or individual policies of primary

or excess insurance companies). London Market business includes the business written by one or more of the Company’s subsidiaries in the United

Kingdom, which are no longer active in the insurance or reinsurance business. Such business includes both direct insurance and assumed reinsurance.

54