The Hartford 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

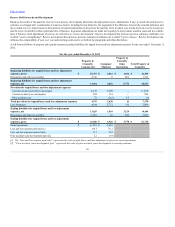

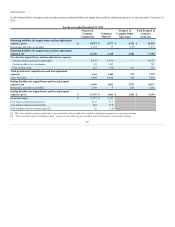

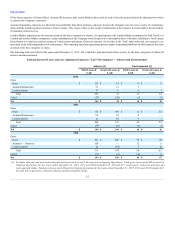

In the fourth quarters of 2012, 2011 and 2010, the Company completed evaluations of certain of its non-asbestos and environmental reserves, including its

assumed reinsurance liabilities. In 2012 and 2011, the Company recognized no prior year development. In 2010, the Company recognized unfavorable prior

year development of $11.

During the second quarter of 2012 and the third quarters of 2011 and 2010, the Company completed its annual ground up environmental reserve evaluations.

In each of these evaluations, the Company reviewed all of its open direct domestic insurance accounts exposed to environmental liability as well as assumed

reinsurance accounts and its London Market exposures for both direct and assumed reinsurance. The Company found estimates for some individual account

exposures increased based upon unfavorable litigation results and increased clean-up or expense costs, with the vast majority of this deterioration emanating

from a limited number of insureds. The net effect of these account-specific changes as well as quarterly actuarial evaluations of new account emergence and

historical loss and expense paid experience resulted in $10, $19 and $62 increases in net environmental liabilities in 2012, 2011 and 2010, respectively. In

addition to the quarterly actuarial evaluations, the Company currently expects to continue to perform an evaluation of its environmental liabilities annually.

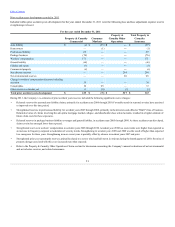

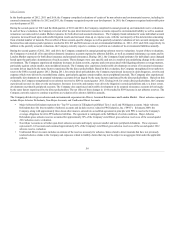

During the second quarter of 2012, 2011 and 2010, the Company completed its annual ground-up asbestos reserve evaluations. As part of these evaluations,

the Company reviewed all of its open direct domestic insurance accounts exposed to asbestos liability, as well as assumed reinsurance accounts and its

London Market exposures for both direct insurance and assumed reinsurance. During 2012, the Company found estimates for individual cases changed

based upon the particular circumstances of such accounts. These changes were case specific and not as a result of any underlying change in the current

environment. The Company experienced moderate increases in claim severity, expense and costs associated with litigating asbestos coverage matters,

particularly against certain smaller, more peripheral insureds. The Company also experienced unfavorable development on certain of its assumed reinsurance

accounts driven largely by the same factors experienced by the direct policyholders. Based on this evaluation, the Company strengthened its net asbestos

reserves by $48 in second quarter 2012. During 2011, for certain direct policyholders, the Company experienced increases in claim frequency, severity and

expense which were driven by mesothelioma claims, particularly against certain smaller, more peripheral insureds. The Company also experienced

unfavorable development on its assumed reinsurance accounts driven largely by the same factors experienced by the direct policyholders. Based on this

evaluation, the Company strengthened its net asbestos reserves by $290 in second quarter 2011. During 2010, for certain direct policyholders, the Company

experienced increases in claim severity and expense. Increases in severity and expense were driven by litigation in certain jurisdictions and, to a lesser extent,

development on primarily peripheral accounts. The Company also experienced unfavorable development on its assumed reinsurance accounts driven largely

by the same factors experienced by the direct policyholders. The net effect of these changes in 2010 resulted in $169 increase in net asbestos reserves. The

Company currently expects to continue to perform an evaluation of its asbestos liabilities annually.

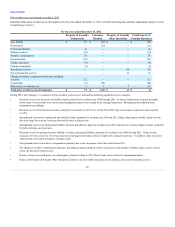

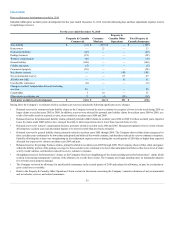

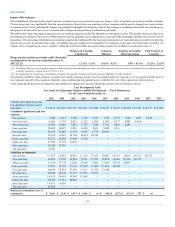

The Company divides its gross asbestos and environmental exposures into Direct, Assumed Reinsurance and London Market. Direct asbestos exposures

include Major Asbestos Defendants, Non-Major Accounts, and Unallocated Direct Accounts.

•Major Asbestos Defendants represent the “Top 70” accounts in Tillinghast's published Tiers 1 and 2 and Wellington accounts. Major Asbestos

Defendants have the fewest number of asbestos accounts and include reserves related to PPG Industries, Inc. (“PPG”). In January 2009, the

Company, along with approximately three dozen other insurers, entered into a modified agreement in principle with PPG to resolve the Company's

coverage obligations for all its PPG asbestos liabilities. The agreement is contingent on the fulfillment of certain conditions. Major Asbestos

Defendants gross asbestos reserves accounted for approximately 30% of the Company's total Direct gross asbestos reserves as of the second quarter

2012 asbestos reserve evaluation.

•Non-Major Accounts are all other open direct asbestos accounts and largely represent smaller and more peripheral defendants. These exposures

represented 1,143 accounts and contained approximately 41% of the Company's total Direct gross asbestos reserves as of the second quarter 2012

asbestos reserve evaluation.

•Unallocated Direct Accounts includes an estimate of the reserves necessary for asbestos claims related to direct insureds that have not previously

tendered asbestos claims to the Company and exposures related to liability claims that may not be subject to an aggregate limit under the applicable

policies.

56