The Hartford 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

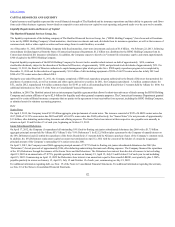

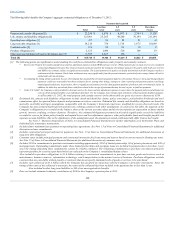

Capital resources and liquidity represent the overall financial strength of The Hartford and its insurance operations and their ability to generate cash flows

from each of their business segments, borrow funds at competitive rates and raise new capital to meet operating and growth needs over the next twelve months.

Liquidity Requirements and Sources of Capital

The liquidity requirements of the holding company of The Hartford Financial Services Group, Inc. (“HFSG Holding Company”) have been and will continue

to be met by HFSG Holding Company’s fixed maturities, short-term investments and cash, dividends from its insurance operations, as well as the issuance of

common stock, debt or other capital securities and borrowings from its credit facilities, as needed.

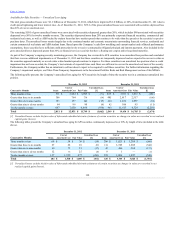

As of December 31, 2012, HFSG Holding Company held fixed maturities, short-term investments and cash of $1.4 billion. On February 22, 2013, following

extraordinary dividend approval from the State of Connecticut Insurance Department, $1.2 billion was distributed to the HFSG Holding Company from its

Connecticut domiciled life insurance subsidiaries. In addition, the Company expects to dissolve its Vermont life reinsurance captive and return approximately

$300 of capital to the HFSG Holding Company.

Expected liquidity requirements of the HFSG Holding Company for the next twelve months include interest on debt of approximately $430, common

stockholder dividends, subject to the discretion of the Board of Directors, of approximately $180, and preferred stock dividends of approximately $21. On

January 31, 2013, the Board of Directors authorized a capital management plan which provides for a $500 equity repurchase program to be completed by

December 31, 2014 and for the reduction of approximately $1.0 billion of debt including repayment of $320 of 4.625% senior notes due in July 2013 and

$200 of 4.75% senior notes due in March 2014.

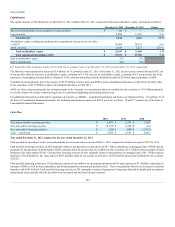

During the year ended December 31, 2012, the Company completed a $500 stock repurchase program authorized by the Board of Directors that permitted for

purchases of common stock, as well as warrants and other equity derivative securities. In 2011, the Company repurchased 3.2 million common shares for

$51, and in 2012, repurchased 8.0 million common shares for $149, as well as all outstanding Series B and Series C warrants held by Allianz for $300. For

additional information see Note 16 of the Notes to Consolidated Financial Statements.

In addition, in 2010 The Hartford entered into an intercompany liquidity agreement that allows for short-term advances of funds among the HFSG Holding

Company and certain affiliates of up to $2.0 billion for liquidity and other general corporate purposes. The Connecticut Insurance Department granted

approval for certain affiliated insurance companies that are parties to the agreement to treat receivables from a parent, including the HFSG Holding Company,

as admitted assets for statutory accounting purposes.

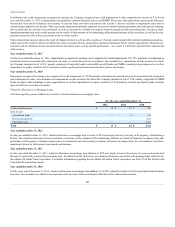

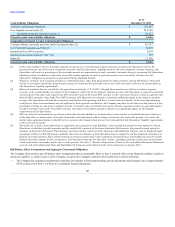

Debt

Senior Notes

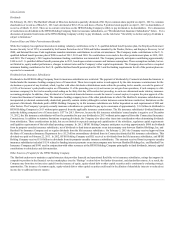

On April 5, 2012, the Company issued $1.55 billion aggregate principal amount of senior notes. The issuance consisted of $325 of 4.000% senior notes due

2017, $800 of 5.125% senior notes due 2022 and $425 of 6.625% senior notes due 2042 (collectively, the “Senior Notes”) for net proceeds of approximately

$1.5 billion, after deducting underwriting discounts and offering expenses. The Senior Notes bear interest at their respective rate, payable semi-annually in

arrears on April 15 and October 15 of each year, beginning on October 15, 2012.

Junior Subordinated Debentures

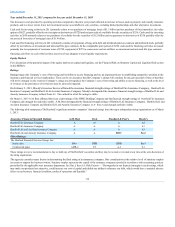

On April 17, 2012, the Company (i) repurchased all outstanding 10% fixed-to-floating rate junior subordinated debentures due 2068 with a $1.75 billion

aggregate principal amount held by Allianz SE (“Allianz”) (the “10% Debentures”) for $2.125 billion (plus a payment by the Company of unpaid interest on

the 10% Debentures) and (ii) settled the repurchase of the Series B and Series C warrants held by Allianz to purchase shares of the Company’s common stock.

In addition, the 10% Debentures replacement capital covenant was terminated on April 12, 2012 with the consent of the holders of a majority in aggregate

principal amount of the Company’s outstanding 6.1% senior notes due 2041.

On April 5, 2012, the Company issued $600 aggregate principal amount of 7.875% fixed-to-floating rate junior subordinated debentures due 2042 (the

“Debentures”) for net proceeds of approximately $586, after deducting underwriting discounts and offering expenses. The Company financed the repurchase

of the 10% Debentures through the issuance of the Senior Notes and the Debentures. The Debentures bear interest from the date of issuance to but excluding

April 15, 2022 at an annual rate of 7.875%, payable quarterly in arrears on January 15, April 15, July 15 and October 15 of each year to and including

April 15, 2022. Commencing on April 15, 2022 the Debentures bear interest at an annual rate equal to three-month LIBOR, reset quarterly, plus 5.596%,

payable quarterly in arrears on January 15, April 15, July 15 and October 15 of each year, commencing on July 15, 2022.

For additional information regarding debt, see Note 15 of the Notes to Consolidated Financial Statements. For additional information regarding the warrants,

see Note 16 of the Notes to Consolidated Financial Statements.

122