The Hartford 2012 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Recognition and Presentation of Other-Than-Temporary Impairments

The Company deems debt securities and certain equity securities with debt-like characteristics (collectively “debt securities”) to be other-than-temporarily

impaired (“impaired”) if a security meets the following conditions: a) the Company intends to sell or it is more likely than not that the Company will be

required to sell the security before a recovery in value, or b) the Company does not expect to recover the entire amortized cost basis of the security. If the

Company intends to sell or it is more likely than not that the Company will be required to sell the security before a recovery in value, a charge is recorded in

net realized capital losses equal to the difference between the fair value and amortized cost basis of the security. For those impaired debt securities which do not

meet the first condition and for which the Company does not expect to recover the entire amortized cost basis, the difference between the security’s amortized

cost basis and the fair value is separated into the portion representing a credit other-than-temporary impairment (“impairment”), which is recorded in net

realized capital losses, and the remaining impairment, which is recorded in OCI. Generally, the Company determines a security’s credit impairment as the

difference between its amortized cost basis and its best estimate of expected future cash flows discounted at the security’s effective yield prior to impairment.

The remaining non-credit impairment, which is recorded in OCI, is the difference between the security’s fair value and the Company’s best estimate of

expected future cash flows discounted at the security’s effective yield prior to the impairment, which typically represents current market liquidity and risk

premiums. The previous amortized cost basis less the impairment recognized in net realized capital losses becomes the security’s new cost basis. The

Company accretes the new cost basis to the estimated future cash flows over the expected remaining life of the security by prospectively adjusting the

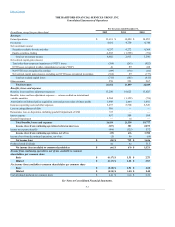

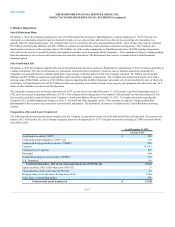

security’s yield, if necessary. The following table presents the change in non-credit impairments recognized in OCI as disclosed in the Company’s

Consolidated Statements of Comprehensive Income (Loss).

OTTI losses recognized in OCI $(40) $ (89) $ (418)

Changes in fair value and/or sales 147 112 647

Tax and deferred acquisition costs (55)(14)(113)

The Company’s evaluation of whether a credit impairment exists for debt securities includes but is not limited to, the following factors: (a) changes in the

financial condition of the security’s underlying collateral, (b) whether the issuer is current on contractually obligated interest and principal payments,

(c) changes in the financial condition, credit rating and near-term prospects of the issuer, (d) the extent to which the fair value has been less than the amortized

cost of the security and (e) the payment structure of the security. The Company’s best estimate of expected future cash flows used to determine the credit loss

amount is a quantitative and qualitative process that incorporates information received from third-party sources along with certain internal assumptions and

judgments regarding the future performance of the security. The Company’s best estimate of future cash flows involves assumptions including, but not

limited to, various performance indicators, such as historical and projected default and recovery rates, credit ratings, current and projected delinquency rates,

and loan-to-value ("LTV") ratios. In addition, for structured securities, the Company considers factors including, but not limited to, average cumulative

collateral loss rates that vary by vintage year, commercial and residential property value declines that vary by property type and location and commercial real

estate delinquency levels. These assumptions require the use of significant management judgment and include the probability of issuer default and estimates

regarding timing and amount of expected recoveries which may include estimating the underlying collateral value. In addition, projections of expected future

debt security cash flows may change based upon new information regarding the performance of the issuer and/or underlying collateral such as changes in the

projections of the underlying property value estimates.

For equity securities where the decline in the fair value is deemed to be other-than-temporary, a charge is recorded in net realized capital losses equal to the

difference between the fair value and cost basis of the security. The previous cost basis less the impairment becomes the security’s new cost basis. The

Company asserts its intent and ability to retain those equity securities deemed to be temporarily impaired until the price recovers. Once identified, these

securities are systematically restricted from trading unless approved by investment and accounting professionals. The investment and accounting

professionals will only authorize the sale of these securities based on predefined criteria that relate to events that could not have been reasonably foreseen.

Examples of the criteria include, but are not limited to, the deterioration in the issuer’s financial condition, security price declines, a change in regulatory

requirements or a major business combination or major disposition.

The primary factors considered in evaluating whether an impairment exists for an equity security include, but are not limited to: (a) the length of time and

extent to which the fair value has been less than the cost of the security, (b) changes in the financial condition, credit rating and near-term prospects of the

issuer, (c) whether the issuer is current on preferred stock dividends and (d) the intent and ability of the Company to retain the investment for a period of time

sufficient to allow for recovery.

F-12