The Hartford 2012 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

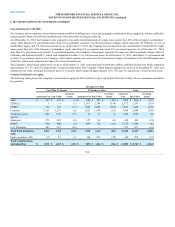

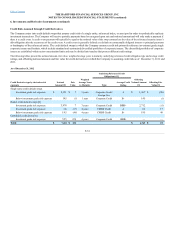

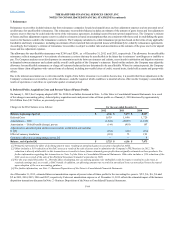

International program

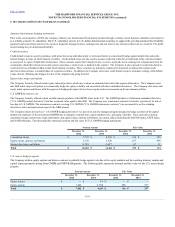

The Company formerly offered certain variable annuity products in the U.K. and Japan with GMWB or GMAB riders, which are bifurcated embedded

derivatives (“International program product derivatives”). The GMWB provides the policyholder with a GRB if the account value is reduced to zero through a

combination of market declines and withdrawals. The GRB is generally equal to premiums less withdrawals. Certain contract provisions can increase the

GRB at contractholder election or after the passage of time. The GMAB provides the policyholder with their initial deposit in a lump sum after a specified

waiting period. The notional amount of the International program product derivatives are the foreign currency denominated GRBs converted to U.S. dollars at

the current foreign spot exchange rate as of the reporting period date.

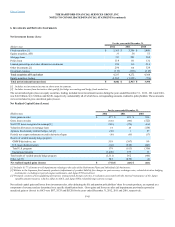

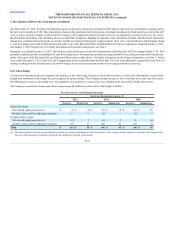

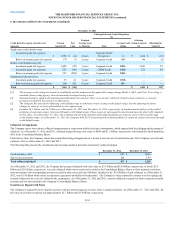

The Company enters into derivative contracts (“International program hedging instruments”) to hedge a portion of the capital market risk exposures associated

with the guaranteed benefits associated with the international variable annuity contracts. The hedging derivatives are comprised of equity futures, options, and

swaps and currency forwards and options to partially hedge against a decline in the debt and equity markets or changes in foreign currency exchange rates and

the resulting statutory surplus and capital impact primarily arising from GMDB, GMIB and GMWB obligations issued in the U.K. and Japan. The

Company also enters into foreign currency denominated interest rate swaps and swaptions to hedge the interest rate exposure related to the potential

annuitization of certain benefit obligations. The following table represents notional and fair value for the international program hedging instruments.

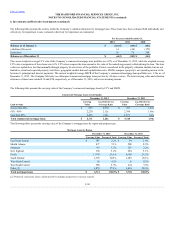

Credit derivatives $350 $ — $ 28 $ —

Currency forwards [1] 9,327 8,622 (87)446

Currency options 10,342 7,357 (24) 127

Equity futures 2,332 3,835 — —

Equity options 3,952 1,565 47 74

Equity swaps 2,617 392 (12)(8)

Customized swaps 899 —(11) —

Interest rate futures 634 739 — —

Interest rate swaps and swaptions 32,632 11,216 228 111

[1] As of December 31, 2012 and December 31, 2011 net notional amounts are $0.1 billion and $7.2 billion, respectively, which include $4.7 billion

and $7.9 billion, respectively, related to long positions and $4.6 billion and $0.7 billion, respectively, related to short positions.

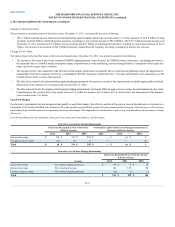

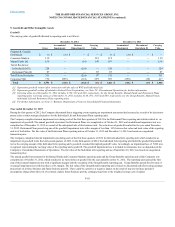

Contingent capital facility put option

The Company entered into a put option agreement that provides the Company the right to require a third-party trust to purchase, at any time, The Hartford’s

junior subordinated notes in a maximum aggregate principal amount of $500. Under the put option agreement, The Hartford will pay premiums on a periodic

basis and will reimburse the trust for certain fees and ordinary expenses.

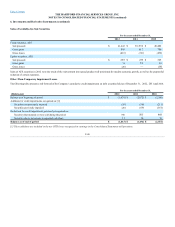

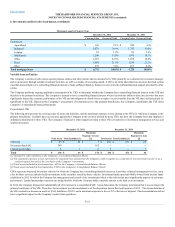

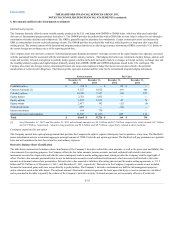

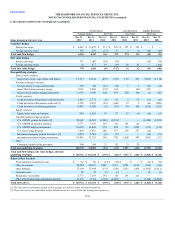

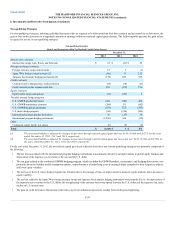

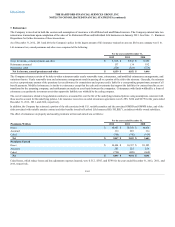

The table below summarizes the balance sheet classification of the Company’s derivative related fair value amounts, as well as the gross asset and liability fair

value amounts. For reporting purposes, the Company offsets the fair value amounts, income accruals, and cash collateral held related to derivative

instruments executed in a legal entity and with the same counterparty under a master netting agreement, which provides the Company with the legal right of

offset. The fair value amounts presented below do not include income accruals or cash collateral held amounts, which are netted with derivative fair value

amounts to determine balance sheet presentation. Derivative fair value reported as liabilities after taking into account the master netting agreements, is $1.5

billion and $3.2 billion as of December 31, 2012, and December 31, 2011, respectively. Derivatives in the Company’s separate accounts are not included

because the associated gains and losses accrue directly to policyholders. The Company’s derivative instruments are held for risk management purposes,

unless otherwise noted in the table below. The notional amount of derivative contracts represents the basis upon which pay or receive amounts are calculated

and is presented in the table to quantify the volume of the Company’s derivative activity. Notional amounts are not necessarily reflective of credit risk.

F-55