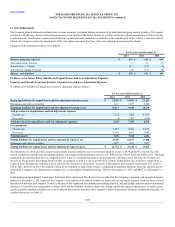

The Hartford 2012 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

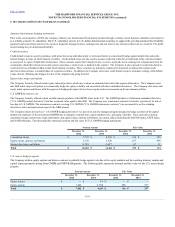

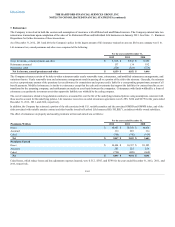

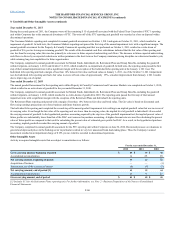

Reinsurance recoverables include balances due from reinsurance companies for paid and unpaid losses and loss adjustment expenses and are presented net of

an allowance for uncollectible reinsurance. The reinsurance recoverables balance includes an estimate of the amount of gross losses and loss adjustment

expense reserves that may be ceded under the terms of the reinsurance agreements, including incurred but not reported unpaid losses. The Company’s estimate

of losses and loss adjustment expense reserves ceded to reinsurers is based on assumptions that are consistent with those used in establishing the gross

reserves for business ceded to the reinsurance contracts. The Company calculates its ceded reinsurance projection based on the terms of any applicable

facultative and treaty reinsurance, including an estimate of how incurred but not reported losses will ultimately be ceded by reinsurance agreements.

Accordingly, the Company’s estimate of reinsurance recoverables is subject to similar risks and uncertainties as the estimate of the gross reserve for unpaid

losses and loss adjustment expenses.

The allowance for uncollectible reinsurance was $ 268 and $290, as of December 31, 2012 and 2011, respectively. The allowance for uncollectible

reinsurance reflects management’s best estimate of reinsurance cessions that may be uncollectible in the future due to reinsurers’ unwillingness or inability to

pay. The Company analyzes recent developments in commutation activity between reinsurers and cedants, recent trends in arbitration and litigation outcomes

in disputes between reinsurers and cedants and the overall credit quality of the Company’s reinsurers. Based on this analysis, the Company may adjust the

allowance for uncollectible reinsurance or charge off reinsurer balances that are determined to be uncollectible. Where its contracts permit, the Company

secures future claim obligations with various forms of collateral, including irrevocable letters of credit, secured trusts, funds held accounts and group-wide

offsets.

Due to the inherent uncertainties as to collection and the length of time before reinsurance recoverables become due, it is possible that future adjustments to the

Company’s reinsurance recoverables, net of the allowance, could be required, which could have a material adverse effect on the Company’s consolidated

results of operations or cash flows in a particular quarter or annual period.

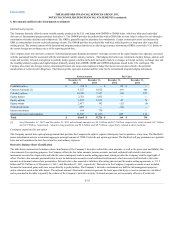

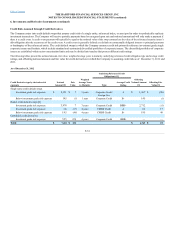

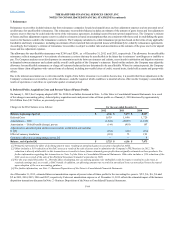

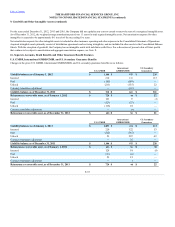

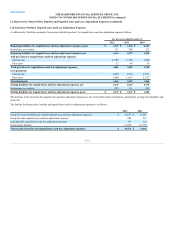

On January 1, 2012, the Company adopted ASU No. 2010-26 as further discussed in Note 1 of the Notes to Consolidated Financial Statements. As a result

of this change in accounting policy, deferred policy acquisition costs and present value of future profits as of January 1, 2010 decreased by approximately

$2.6 billion from $10.7 billion, as previously reported.

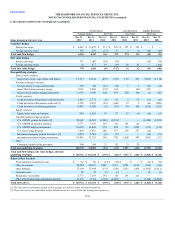

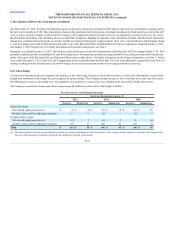

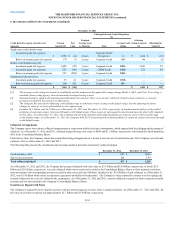

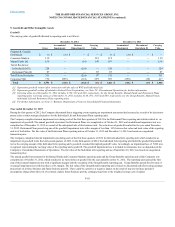

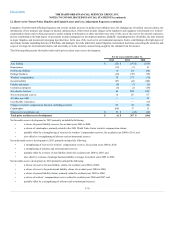

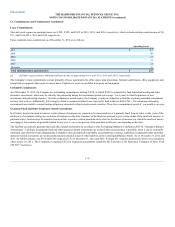

Changes in the DAC balance are as follows:

Deferred Costs 1,639 1,696 1,729

Amortization — DAC (1,844) (2,025) (1,816)

Amortization — Unlock benefit (charge), pre-tax (144)(419)107

Adjustments to unrealized gains and losses on securities available-for-sale and other

[1] [2] (364)(240)(874)

Effect of currency translation (118) 71 191

Cumulative effect of accounting change, pre-tax [3] — — 9

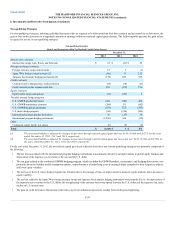

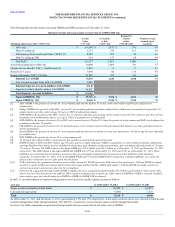

[1] Primarily represents the effect of declining interest rates, resulting in unrealized gains on securities classified in AOCI.

[2] Other includes a $16 reduction of the DAC asset as a result of the sale of assets used to administer the Company's PPLI business in 2012. The

reduction is directly attributable to this transaction as it results in lower future estimated gross profits than originally estimated on these products. For

further information regarding this transaction see Note 2 of the Notes to Consolidated Financial Statements. Other also includes a $34 reduction of the

DAC asset as a result of the sale of the Hartford Investment Canada Corporation in 2010.

[3] For the year ended December 31, 2010 the effect of adopting new accounting guidance for embedded credit derivatives resulted in a decrease to

retained earnings and, as a result, a DAC benefit. In addition, an offsetting amount was recorded in unrealized losses as unrealized losses decreased

upon adoption of the new accounting guidance.

[4] For further information, see Note 2 - Business Dispositions of the Notes to Consolidated Financial Statements.

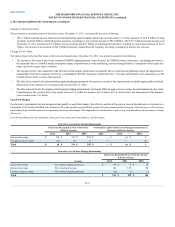

As of December 31, 2012, estimated future net amortization expense of present value of future profits for the succeeding five years is $22, $6, $6, $6 and

$5 in 2013, 2014, 2015, 2016 and 2017, respectively. Future net amortization expense as of December 31, 2012 reflects the estimated impact of the business

disposition transactions discussed in Note 2 - Business Dispositions of the Notes to Consolidated Financial Statements.

F-64