Safeway 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

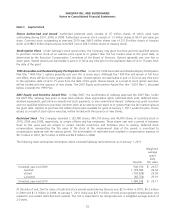

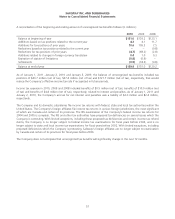

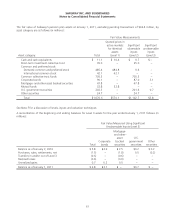

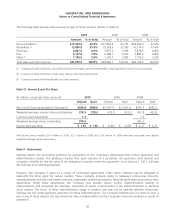

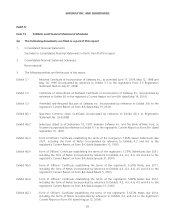

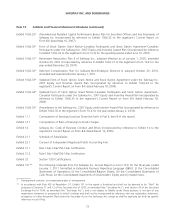

Estimated Future Benefit Payments The following benefit payments, which reflect expected future service as

appropriate, are expected to be paid (in millions):

Pension

benefits

Other

benefits

2011 $ 121.1 $ 8.9

2012 127.2 9.2

2013 132.4 9.6

2014 137.3 9.9

2015 140.9 10.2

2016 – 2020 766.2 57.0

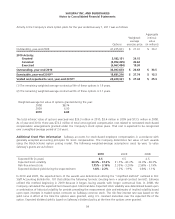

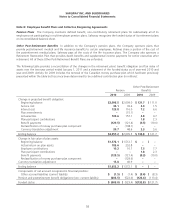

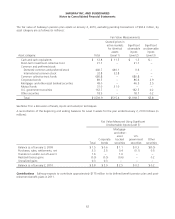

Multi-Employer Pension Plans Safeway participates in various multi-employer retirement plans, covering substantially

all Company employees not covered under the Company’s non-contributory retirement plans. These multi-employer

retirement plans are generally defined benefit plans and are pursuant to agreements between the Company and various

unions. In many cases, specific benefit levels are not negotiated with contributing employers or in some cases even

known by contributing employers. Contributions of $292.3 million in 2010, $278.1 million in 2009 and $286.9 million in

2008 were made and charged to expense.

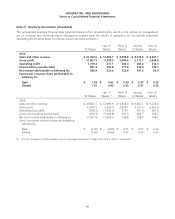

Note L: Investment in Unconsolidated Affiliates

At year-end 2010, 2009 and 2008, Safeway’s investment in unconsolidated affiliates includes a 49% ownership interest

in Casa Ley, which operated 168 food and general merchandise stores in Western Mexico at year-end 2010.

Equity in earnings from Safeway’s unconsolidated affiliates, which is included in other income, was income of $15.3

million in 2010, income of $8.5 million in 2009 and a loss of $2.5 million in 2008.

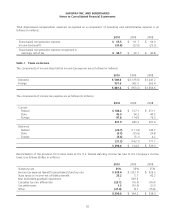

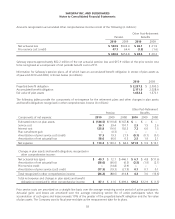

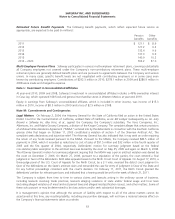

Note M: Commitments and Contingencies

Legal Matters On February 2, 2004, the Attorney General for the State of California filed an action in the United States

District Court for the Central District of California, entitled State of California, ex rel. Bill Lockyer (subsequently ex. rel. Jerry

Brown) v. Safeway Inc. dba Vons, et al., against the Company; the Company’s subsidiary, The Vons Companies, Inc.;

Albertsons, Inc. and Ralphs Grocery Company, a division of the Kroger Company. The complaint alleges that certain provisions

of a Mutual Strike Assistance Agreement (“MSAA”) entered into by the defendants in connection with the Southern California

grocery strike that began on October 11, 2003 constituted a violation of section 1 of the Sherman Antitrust Act. The

complaint seeks declaratory and injunctive relief. The Attorney General has also indicated that it may seek an order requiring

the return of any funds received pursuant to the MSAA. Pursuant to the MSAA, the Company received $83.5 million of

payments in 2004, which it recorded as reductions to cost of sales of $51.5 million and $32 million in the fourth quarter of

2003 and the first quarter of 2004, respectively. Defendants’ motion for summary judgment based on the federal

non-statutory labor exemption to the antitrust laws was denied by the court on May 25, 2005 and again on March 6, 2008.

The Attorney General’s motion for summary judgment arguing that the MSAA was a per se antitrust violation was denied by

the court on December 7, 2006. On March 27, 2008, pursuant to a stipulation of the parties, the court entered a final

judgment in favor of the defendants. Both sides appealed issues to the Ninth Circuit Court of Appeals. On August 17, 2010, a

three-judge panel of the U.S. Court of Appeals for the Ninth Circuit, by a 2-1 vote, reversed the district court judgment in

favor of the defendants on the State’s antitrust claim and remanded the case for entry of judgment in favor of the State and

for any further proceedings consistent with the court’s decision. On February 11, 2011, the Ninth Circuit granted the

defendants’ petition for rehearing en banc and indicated that a hearing would be set for the week of March 21, 2011.

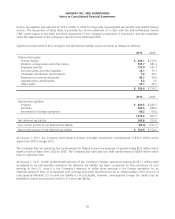

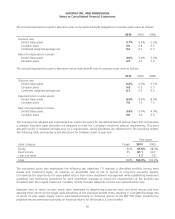

The Company is subject from time to time to various claims and lawsuits arising in the ordinary course of business,

including lawsuits involving trade practices, lawsuits alleging violations of state and/or federal wage and hour laws

(including alleged violations of meal and rest period laws and alleged misclassification issues), and other matters. Some of

these suits purport or may be determined to be class actions and/or seek substantial damages.

It is management’s opinion that although the amount of liability with respect to all of the above matters cannot be

ascertained at this time, any resulting liability, including any punitive damages, will not have a material adverse effect on

the Company’s financial statements taken as a whole.

63