Safeway 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

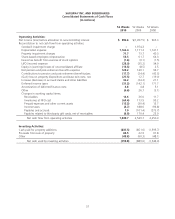

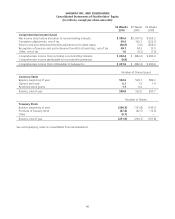

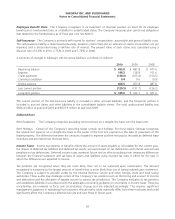

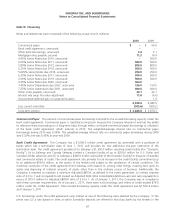

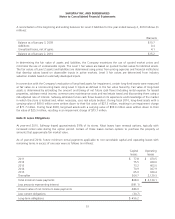

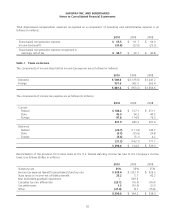

Accumulated Other Comprehensive Income (Loss) Accumulated other comprehensive income (loss), net of

applicable taxes, consisted of the following at year-end (in millions):

2010 2009 2008

Translation adjustments $ 393.3 $ 302.7 $ 140.5

Pension and post-retirement benefits adjustment to funded status (447.8) (408.8) (406.8)

Recognition of pension and post-retirement benefits actuarial loss 145.0 95.9 41.0

Other (2.5) (3.6) (3.4)

Ending balance $ 88.0 $ (13.8) $ (228.7)

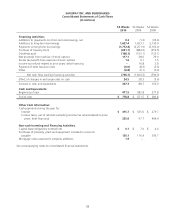

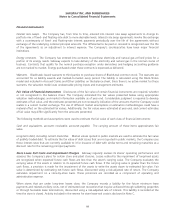

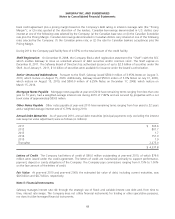

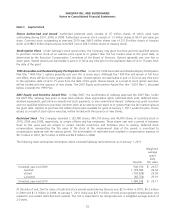

Stock-Based Employee Compensation Safeway accounts for all share-based payments to employees, including

grants of employee stock options, as compensation cost based on the fair value on the date of grant. The Company

determines fair value of such awards using the Black-Scholes option pricing model. The Black-Scholes option pricing

model incorporates certain assumptions, such as risk-free interest rate, expected volatility, expected dividend yield and

expected life of options, in order to arrive at a fair value estimate.

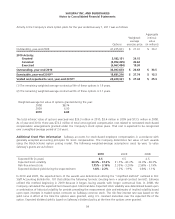

New Accounting Pronouncements Not Yet Adopted

In January 2010, the Financial Accounting Standards Board (“FASB”) issued guidance which amends and clarifies existing

guidance related to fair value measurements and disclosures. This guidance requires new disclosures for (1) transfers in

and out of Level 1 and Level 2 and reasons for such transfers; and (2) the separate presentation of purchases, sales,

issuances and settlement in the Level 3 reconciliation. It also clarifies guidance around disaggregation and disclosures of

inputs and valuation techniques for Level 2 and Level 3 fair value measurements. This guidance was effective for Safeway

for the first quarter of fiscal 2010, except for the new disclosures in the Level 3 reconciliation. The Level 3 disclosures are

effective for Safeway for the first quarter of fiscal 2011. Safeway does not expect that this guidance will have a material

impact on its consolidated financial statements. See Note F for descriptions of the levels.

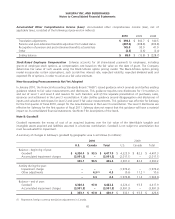

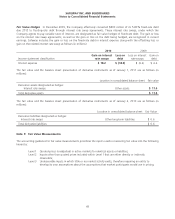

Note B: Goodwill

Goodwill represents the excess of cost of an acquired business over the fair value of the identifiable tangible and

intangible assets acquired and liabilities assumed in a business combination. Goodwill is not subject to amortization but

must be evaluated for impairment.

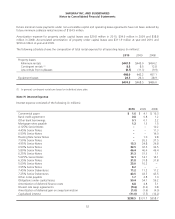

A summary of changes in Safeway’s goodwill by geographic area is as follows (in millions):

2010 2009

U.S. Canada Total U.S. Canada Total

Balance – beginning of year:

Goodwill $ 4,324.4 $ 93.5 $ 4,417.9 $ 4,325.0 $ 82.3 $ 4,407.3

Accumulated impairment charges (3,991.3) – (3,991.3) (2,017.1) – (2,017.1)

333.1 93.5 426.6 2,307.9 82.3 2,390.2

Activity during the year:

Impairment charge –– –(1,974.2) – (1,974.2)

Other adjustments – 4.3 (1) 4.3 (0.6) 11.2 (1) 10.6

– 4.3 4.3 (1,974.8) 11.2 (1,963.6)

Balance – end of year:

Goodwill 4,324.4 97.8 4,422.2 4,324.4 93.5 4,417.9

Accumulated impairment charges (3,991.3) – (3,991.3) (3,991.3) – (3,991.3)

$ 333.1 $ 97.8 $ 430.9 $ 333.1 $ 93.5 $ 426.6

(1) Represents foreign currency translation adjustments in Canada.

45