Safeway 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

its assumptions are appropriate, significant differences in actual results or significant changes in the Company’s

assumptions may materially affect Safeway’s pension and other postretirement obligations and its future expense.

Safeway bases the discount rate on current investment yields on high quality fixed-income investments. The discount rate

assumption used to determine the year-end projected benefit obligation is increased or decreased to be consistent with

the change in yield rates for high quality fixed-income investments for the expected period to maturity of the pension

benefits. The discount rate used to determine 2010 pension expense was 6.1%. A lower discount rate increases the

present value of benefit obligations and increases pension expense. Expected return on pension plan assets is based on

historical experience of the Company’s portfolio and the review of projected returns by asset class on broad, publicly

traded equity and fixed-income indices, as well as target asset allocation. Safeway’s target asset allocation mix is designed

to meet the Company’s long-term pension requirements. For 2010, the Company’s assumed rate of return was 8.5% on

U.S. pension assets and 7.0% on Canadian pension assets. Over the 10-year period ended January 1, 2011, the average

rate of return was approximately 4% for U.S. and 5% for Canadian pension assets. The deteriorating conditions in the

global financial markets during 2008 led to a substantial reduction in the 10-year average rate of return on pension

assets. We expect that the markets will eventually recover to our assumed long-term rate of return.

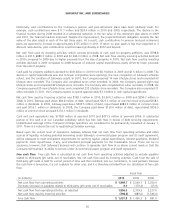

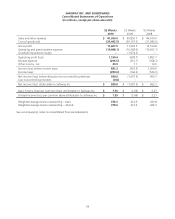

The following table summarizes actual allocations for Safeway’s plans at year-end:

Plan assets

Asset category Target 2010 2009

Equity 65% 67.6% 68.9%

Fixed income 35 31.1 30.3

Cash and other – 1.3 0.8

Total 100% 100.0% 100.0%

The investment policy with regard to Safeway’s pension plans also emphasizes the following key objectives: (1) maintain a

diversified portfolio among asset classes and investment styles; (2) maintain an acceptable level of risk in pursuit of long-

term economic benefit; (3) maximize the opportunity for value-added returns from active investment management while

establishing investment guidelines and monitoring procedures for each investment manager to ensure the characteristics

of the portfolio are consistent with the original investment mandate; and (4) maintain adequate controls over

administrative costs.

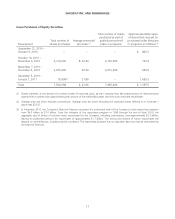

Sensitivity to changes in the major assumptions for Safeway’s pension plans are as follows (dollars in millions):

United States Canada

Percentage

point

change

Projected benefit

obligation

decrease

(increase)

Expense

decrease

(increase)

Projected benefit

obligation

decrease

(increase)

Expense

decrease

(increase)

Expected return on assets +/-1.0 pt – $12.1/(12.1) – $3.1/(3.1)

Discount rate +/-1.0 pt $220.3/(275.6) $24.9/(30.8) $55.8/(64.2) $3.2/(3.5)

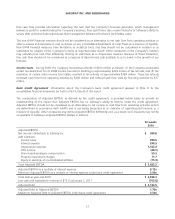

Cash contributions to the Company’s pension and post-retirement benefit plans are expected to total approximately $175

million in 2011 and totaled $17.7 million in 2010, $24.4 million in 2009 and $42.5 million in 2008.

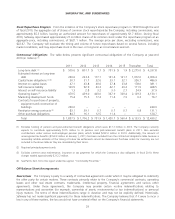

Goodwill Goodwill represents the excess of cost of an acquired business over the fair value of the identifiable tangible

and intangible assets acquired and liabilities assumed in a business combination. Goodwill is not subject to amortization

but must be evaluated for impairment.

We test goodwill for impairment annually (on the first day of the fourth quarter), or whenever events or circumstances

indicate that it is more likely than not that the fair value of a reporting unit is below its carrying amount. The test to

24