Safeway 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

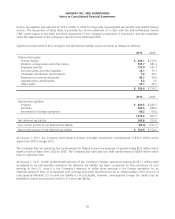

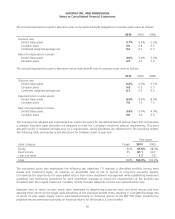

Income tax expense was reduced by $74.9 million in 2009 for previously unrecognized tax benefits and related interest

income. The recognition of these items is primarily due to the settlement of a claim with the Internal Revenue Service

(“IRS”) with respect to the 2002 and 2003 impairment of the Company’s investment in Dominick’s, and the completion

of the IRS examination of the Company’s tax returns for 2004 and 2005.

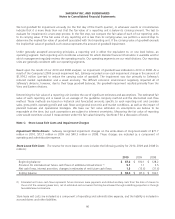

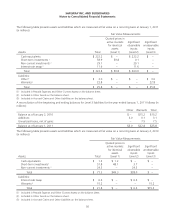

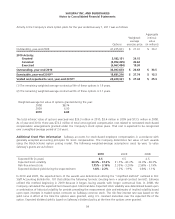

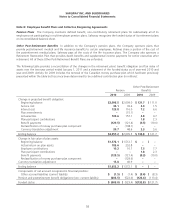

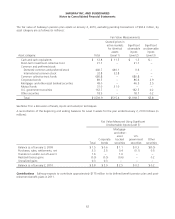

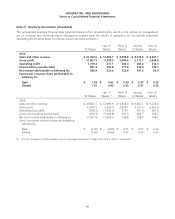

Significant components of the Company’s net deferred tax liability at year end were as follows (in millions):

2010 2009

Deferred tax assets:

Pension liability $ 244.1 $ 213.6

Workers’ compensation and other claims 187.7 181.4

Employee benefits 175.0 147.1

Accrued claims and other liabilities 74.1 73.1

Charitable contribution carryforwards 7.4 34.7

Reserves not currently deductible 43.7 34.9

Operating loss carryforwards 2.3 2.6

Other assets 32.1 26.7

$ 766.4 $ 714.1

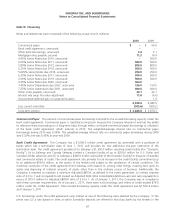

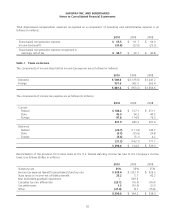

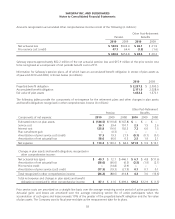

2010 2009

Deferred tax liabilities:

Property $ 649.5 $ 626.3

Inventory 306.5 286.9

Investments in foreign operations 60.2 54.5

1,016.2 967.7

Net deferred tax liability 249.8 253.6

Less current portion of net deferred tax liability (96.3) (103.1)

Noncurrent portion of net deferred tax liability $ 153.5 $ 150.5

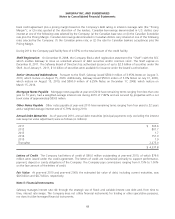

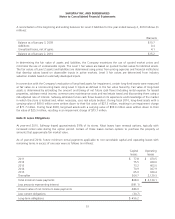

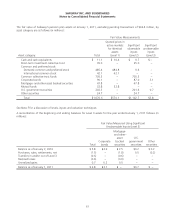

At January 1, 2011, the Company had federal and state charitable contribution carryforwards of $32.6 million which

expire from 2012 through 2015.

The Company had net operating loss carryforwards for federal income tax purposes of approximately $6.5 million which

expire at various dates from 2022 to 2026. The Company also had state tax credit carryforwards of $28.8 million which

have no expiration date.

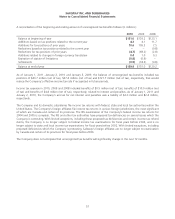

At January 1, 2011, certain undistributed earnings of the Company’s foreign operations totaling $2,051.1 million were

considered to be permanently reinvested. No deferred tax liability has been recognized for the remittance of such

earnings to the U.S., since it is the Company’s intention to utilize those earnings in the foreign operations for an

indefinite period of time, or to repatriate such earnings only when tax-efficient to do so. Determination of the amount of

unrecognized deferred U.S. income tax liability is not practicable; however, unrecognized foreign tax credits may be

available to reduce some portion of the U.S. income tax liability.

56