Safeway 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

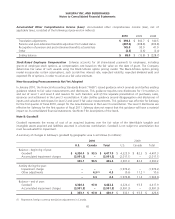

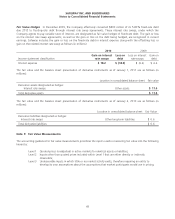

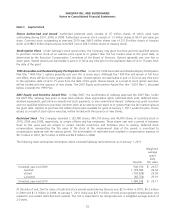

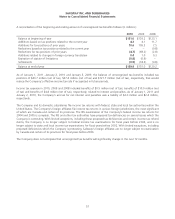

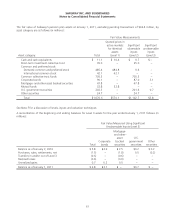

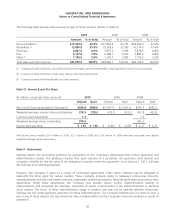

Total share-based compensation expenses recognized as a component of operating and administrative expense is as

follows (in millions):

2010 2009 2008

Share-based compensation expense $ 55.5 $ 61.7 $ 64.3

Income tax benefit (20.8) (22.6) (23.5)

Share-based compensation expense recognized in

earnings, net of tax $ 34.7 $ 39.1 $ 40.8

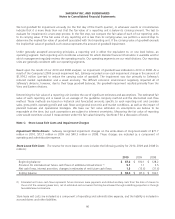

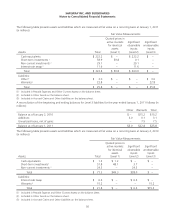

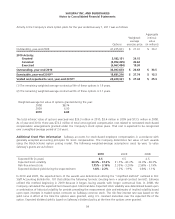

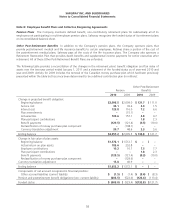

Note J: Taxes on Income

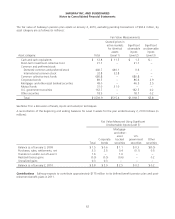

The components of income (loss) before income tax expense are as follows (in millions):

2010 2009 2008

Domestic $ 549.6 $(1,315.6) $1,241.2

Foreign 331.6 362.3 263.4

$ 881.2 $ (953.3) $1,504.6

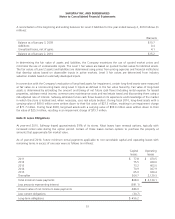

The components of income tax expense are as follows (in millions):

2010 2009 2008

Current:

Federal $ 180.2 $ 137.1 $ 251.1

State 43.9 34.3 40.2

Foreign 97.8 114.9 76.3

321.9 286.3 367.6

Deferred:

Federal (20.7) (111.4) 142.7

State (5.2) (25.6) 24.8

Foreign (5.4) (5.1) 4.2

(31.3) (142.1) 171.7

$ 290.6 $ 144.2 $ 539.3

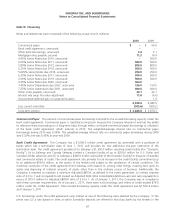

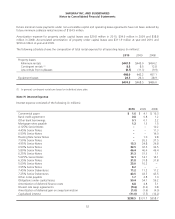

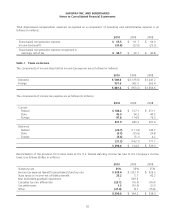

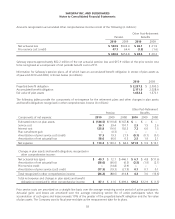

Reconciliation of the provision for income taxes at the U.S. federal statutory income tax rate to the Company’s income

taxes is as follows (dollars in millions):

2010 2009 2008

Statutory rate 35% 35% 35%

Income tax expense (benefit) using federal statutory rate $ 308.4 $ (333.7) $ 526.6

State taxes on income net of federal benefit 25.2 5.7 42.2

Non deductible goodwill impairment –549.5 –

Canadian tax rate differential (23.1) (16.0) (10.4)

Tax settlements 1.5 (70.0) (3.3)

Other (21.4) 8.7 (15.8)

$ 290.6 $ 144.2 $ 539.3

55